Here’s how Flipkart is getting ready for the brave new digital commerce world with its fintech and quick commerce plays

Seventeen years is a long time in any era — for Flipkart

Flipkart and Amazon India created what was believed to be ecommerce for so long, but now things are changing and quick commerce is the belle of the ball. At the same time, ecommerce is also broadening and turning into digital commerce, that pretty much means selling anything and everything online — from electronics to fashion to unbranded products to insurance to travel and even personal loans.

The past year for Flipkart has been about seeing this market in transition. It tried some things to stay relevant, it reportedly looked to acquire startups that could fill the gap, but now Flipkart is going at it alone, launching its fintech product Super.Money in beta and is gunning for the quick commerce vertical next.

So this Sunday, we wanted to see how Flipkart is getting ready for the brave new digital commerce world. But first, here’s a look at the top stories from our newsroom this week:

- Indus Vs Google Play: Indian startups are growing increasingly wary of Google’s stronghold on the app ecosystem, and PhonePe’s made-for-India Indus Appstore is looking to become the alternative. Can PhonePe loosen Google’s grip?

- NODWIN’s Next Focus: Even as it commands 80% market share in the esports market, NODWIN Gaming is eyeing a wider presence in the youth-centric recreational entertainment space and plenty of acquisitions to get there

The New Flipkart

When Flipkart started out in 2007, India’s internet economy was a newborn. It’s only come of age in the past eight to nine years after the 4G revolution made internet access ubiquitous for Indians. So it’s worth noting that for the first half of its existence, Flipkart was pretty much reliant on the consumers from metro cities.

And the truth is that Flipkart has always been chasing the ‘eight ball’ ever since this inflection point. That’s because even the internet revolution has not been as equal as many claim it to be.

Consumers could access Flipkart, but logistics problems needed to be solved. Cash on delivery suffered a disruption with demonetisation. UPI solved this issue to a large extent after 2016, but then marketplaces suffered setbacks in terms of policy decisions and ecommerce rules in 2017 and 2018.

When Walmart acquired Flipkart in 2018, it was seen as a major validation for the business, but things were changing on the ground.

By 2019, D2C brands were rising, and many bemoaned the over-reliance on marketplaces such as Flipkart, leading to alternative channels, native stores and more. This was of course as true for Amazon India as it was for Flipkart.

Covid was the next big disruption to Flipkart and in some ways, it changed ecommerce for good. As all commerce moved online, Flipkart found itself part of this growing and evolving ecommerce ecosystem. As the pandemic ripped through the economy, access to credit was a major gap to be solved. The digital lending boom is a testament to how large this gap was.

From 2021 onwards and increasingly in the past year, the game has moved to quick commerce, and cross-selling, which has once again sparked off a super app race. This is the moment that Flipkart finds itself right now, and it is arguable that it’s definitely moving towards becoming a super app itself.

Flipkart’s Fintech Dreams

The newest piece in the Flipkart universe is Super.Money, which has launched with UPI payments but will see other financial services soon.

The cross-selling strategy is obvious when you see the introductory offers on Super.Money, which include cashback rewards of up to 10% on Flipkart, Myntra and Shopsy.

The other financial products include a credit card offering in partnership with Utkarsh Small Finance Bank, a pre-approved personal loan service called “superCash”, and a fixed deposit offering “superDeposit”, which would also require banking partnerships.

As Inc42 reported earlier this year, Flipkart initiated the fintech app’s development in July 2023 and earmarked an investment of $20 Mn for the project. Back in January, the company rolled out personal loans on the Flipkart app, which will soon be offered through Super.Money.

This after the company launched UPI services to select users in March. In its first month, Flipkart recorded 5 Mn UPI transactions worth INR 197.24 Cr.

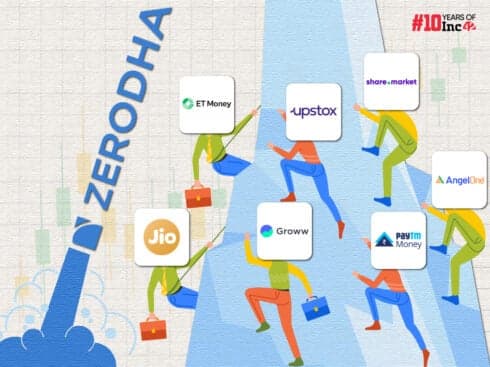

Flipkart’s full-fledged fintech entry comes a year after its demerger with PhonePe, and interestingly, PhonePe will be one of the biggest competitions for Flipkart, along with the likes of Paytm, CRED, Jio Financial Services (JFS) and others.

The launch is one thing, scaling it up will be critical. PhonePe invested billions of dollars in scaling it up, just like Paytm or Google Pay, Amazon Pay or others. While the market is undoubtedly large, competition makes it hard to acquire and retain users.

Quick Commerce Rebuffs

We’ve written about it before — Flipkart is looking to get third time lucky with grocery deliveries and quick commerce, after two relatively unsuccessful attempts over the past few years. But before venturing out on its own, the company looked at its options, as per reports.

First there were talks with IPO-bound Swiggy some time late last year, as reported this week. The talks fizzled out as the two giants failed to come to consensus over a valuation. Besides this, Flipkart is also said to have demanded a majority stake in Swiggy, which proved to be a roadblock to the deal.

Separately, Flipkart reportedly held talks with Reliance-backed Dunzo which was in a severe cash crunch throughout last year, and has scaled back to B2B deliveries only.

Flipkart also held talks with Zepto, which is currently in the quick commerce spotlight thanks to its massive fundraise and high valuations. These talks also failed due to a lack of valuation consensus.

The biggest factor behind Flipkart’s most recent push into quick commerce is the revenue outcome. Ten-minute deliveries are no longer just a fancy proposition, as they were in 2020 and 2021. Cumulatively, Swiggy Instamart, Zepto, Blinkit — the three biggest quick commerce platforms — are on track to report combined revenue north of $1 Bn in FY24, as we had reported earlier.

Flipkart’s next-day grocery delivery business clocked 1.6X year-on-year (YoY) growth in FY24, but the company did not share the revenue numbers for this vertical, which is said to be present in over 200 cities already.

Over the past two years, Flipkart has watched as quick commerce platforms demonstrated massive growth, and indeed even encroached on ecommerce territory in recent months with larger warehouses and plans to deliver large products and electronics, which have been the forte of marketplaces for so long.

Instead of relinquishing the opportunity, Flipkart wants to build it anew. It’s not alone, Reliance Retail and JioMart also have plans to extend their reach into quick commerce, so here again, Flipkart is faced with a massive revenue opportunity but strong competition with a foothold on a segment that will be new for Flipkart.

On The Prowl For Profits

For Flipkart, these two new verticals come at a critical moment. Some might call it a defining moment for the company, which seems strange given that it has been around for nearly two decades. But Flipkart cannot afford to wait too long.

Earlier this month, Flipkart majority owner Walmart said that the company (along with PhonePe) is heading towards profitability. Interestingly, Flipkart brought Google on board as a minority investor as part of the funding round led by the US-based retail giant.

In a statement, Flipkart said, “Google’s proposed investment and its Cloud collaboration will help Flipkart expand its business and advance the modernisation of its digital infrastructure to serve customers across the country.”

This points to Flipkart looking to scale up its various digital commerce verticals across categories. It needs to do a lot to get back into the black after years of losses.

Flipkart’s B2C arm saw a 42% YoY jump in revenue to INR 14,845.8 Cr in FY23, while its loss reduced 9% to INR 4,026.5 Cr. On the other hand, the B2B arm of the company saw its standalone net loss widen to INR 4,845.7 Cr in FY23.

Last year, the company went through a reorganisation and also laid off employees to cut costs. But the new fintech and quick commerce play will be critical for Flipkart in turning the ship around and heading in the direction of profits.

Neither fintech services nor quick commerce are saturated by any means — opportunities exist to disrupt the incumbents and gain a foothold. But execution will be key and both these segments require diligent focus and operational efficiency.

Flipkart has watched Indian ecommerce and digital commerce evolve for the past few years, and now it’s ready to jump in from the sidelines. Can the ecommerce giant find new wings 17 years after it took off?

Sunday Roundup: Tech Stocks, Startup Funding & More

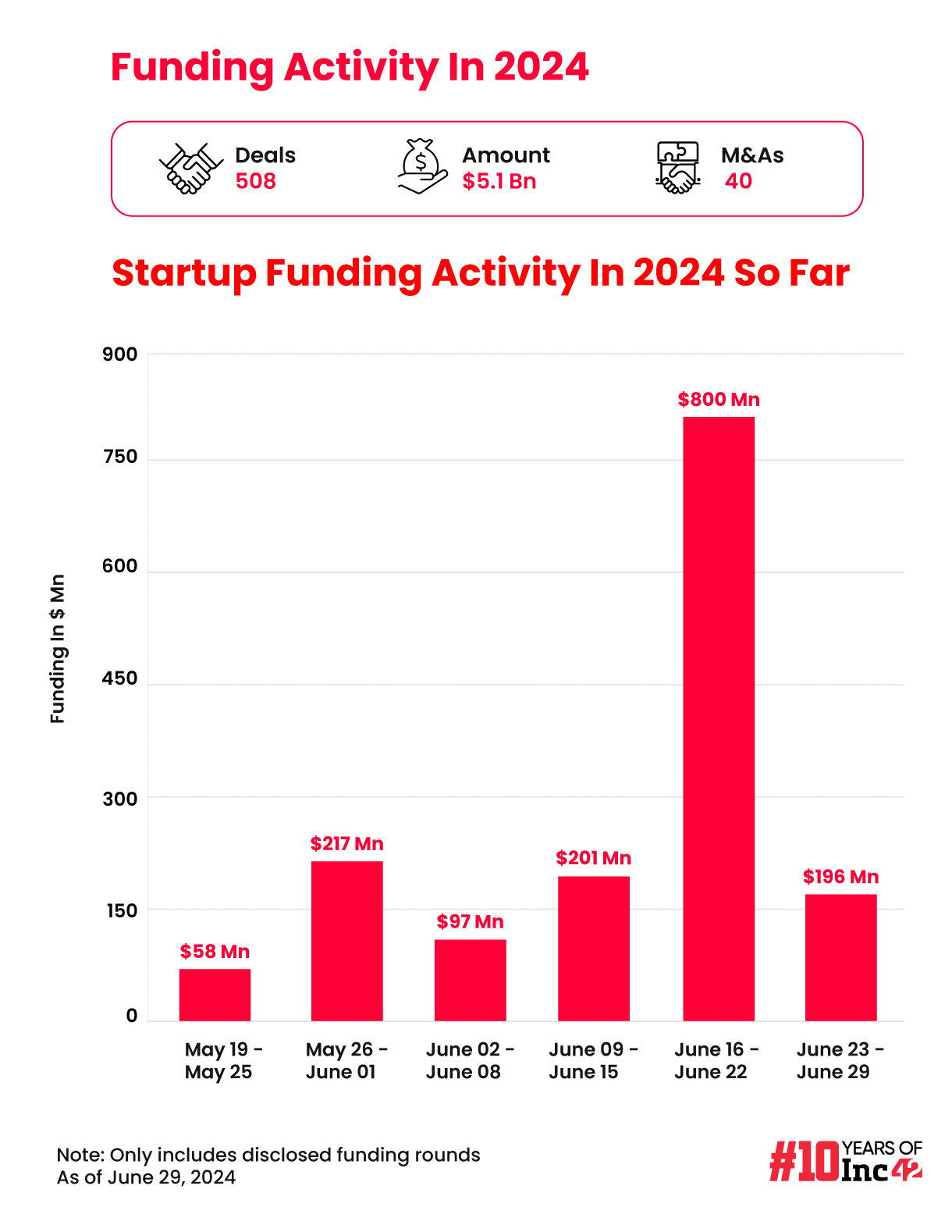

- The weekly startup funding fell to $196 Mn this past week, a 75% decline from the previous week, when the tally was inflated by Zepto’s $665 Mn round

- The Ministry of Corporate Affairs (MCA) had to step in to clear speculation around BYJU’S being cleared of financial fraud and major corporate governance lapses reportedly after a ministry probe

- Zoomcar cofounder Greg Moran has been removed as the CEO of the company after a 12-year tenure as the Nasdaq-listed company faces regulatory scrutiny

- Adding to its product portfolio, Zomato has rolled out a restaurant services hub to plug in operational requirements such as hiring, regulatory requirements, taxation and trademarking

- Bhavish Aggarwal-led Ola is all set to roll out grocery delivery through ONDC on its app after seeing success with the food delivery pilot

Ad-lite browsing experience

Ad-lite browsing experience