Startups are a risky asset class and without a strategic approach to evaluating promising businesses, angel investing can be perilous

Angel School By VCats++ aims to democratise angel investing for a broader audience and lower the entry barriers

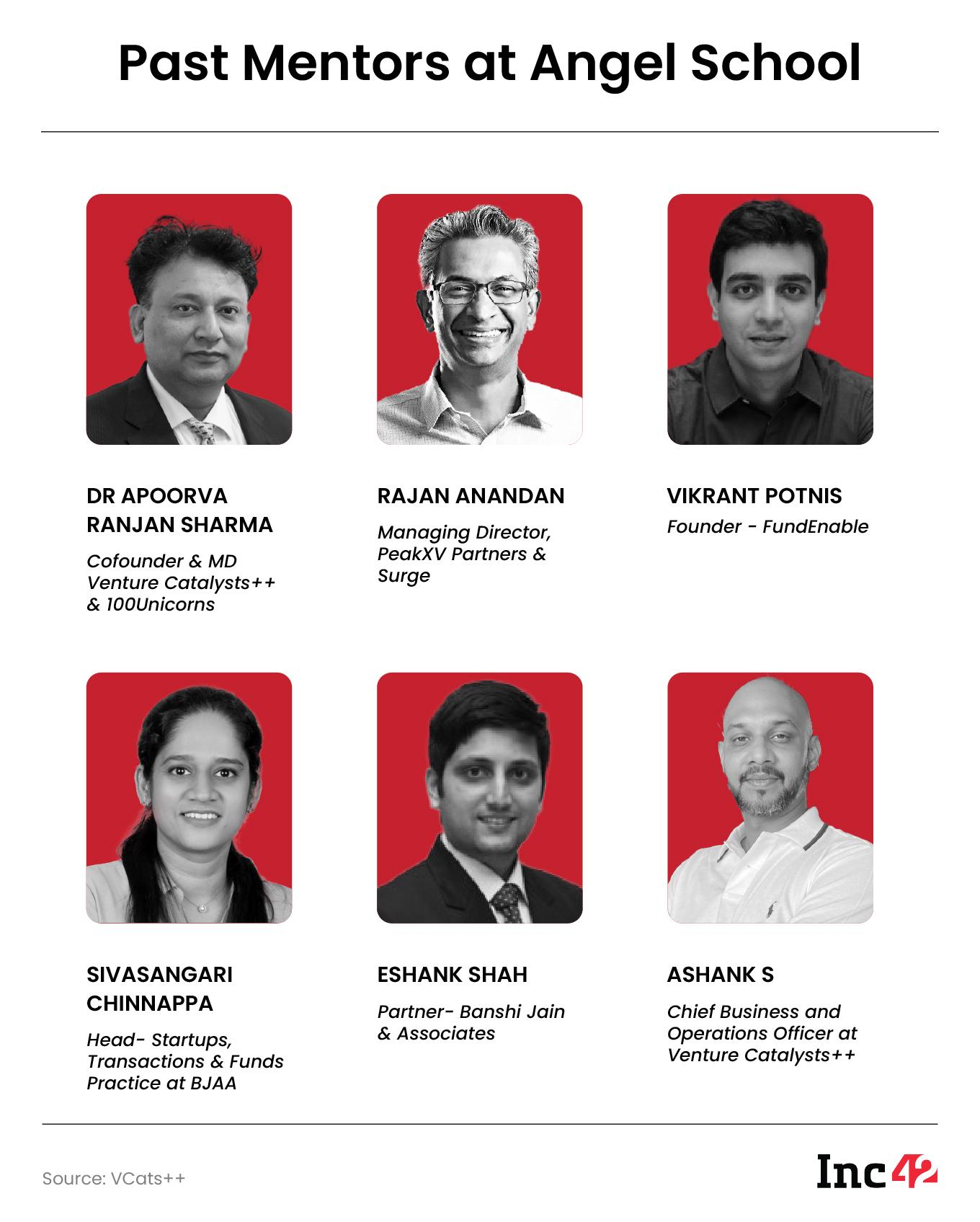

Angel School has previously trained 300+ angel investors and featured investing experts like Dr Apoorva Ranjan Sharma of VCats++ and 100Unicorns, Rajan Anandan of Peak XV Partners and Surge, and Vikrant Potnis of FundEnable

With over 1.2 Lakh startups and a vibrant community of institutional investors, India holds the title of the world’s third-largest startup ecosystem. According to a CII report, India’s startups contributed 10-15% to the country’s GDP growth between 2016 and 2023.

Angel investors, who support startups in their early stages of growth, play a critical role in the growth of the startup ecosystem. They not only provide crucial capital to startups but also champion unconventional and disruptive ideas.

Angel investing also offers rewards beyond just financial returns. Through mentorship and guidance, investors can share the satisfaction of nurturing revolutionary solutions. Their involvement, particularly in the crucial pre-seed and seed funding stages, empowers startups with valuable wisdom and expertise, enabling them to flourish.

With the number of high-net-worth individuals (HNIs) on the rise in the country, angel investing presents a compelling avenue for portfolio diversification. However, it’s crucial to remember that startups are a risky asset class. Without a strategic approach to evaluating promising businesses, angel investing can be perilous.

Hence, to equip aspiring angel investors and HNIs with the secrets of strategic angel investing, Venture Catalysts++ (VCats++), India’s first multi-stage VC firm, is back with the fifth edition of its online programme ‘Angel School’, to be held on June 22 and 23.

Commenting on the latest edition, VCats++ and 100Unicorns cofounder Dr. Apoorva Ranjan Sharma said, “We aim to democratise angel investing for a broader audience. Traditionally, angel investing has been an exclusive domain, often limited to well-connected individuals.”

He added that by offering a condensed weekend course, VCats++ aims to lower the barrier to entry and provide essential knowledge and tools.

The course is also designed to attract new investors who are interested in venture capital but lack formal education or experience.

Unlocking Investment Potential: Riding India’s Growth Wave

Over its previous iterations, Angel School has successfully trained over 300 angel investors, equipping them with the essential know-how for navigating the world of angel investing.

The programme has featured renowned investors and experts like Dr. Sharma; Peak XV Partners and Surge managing director Rajan Anandan; FundEnable founder Vikrant Potnis; Sivasangari Chinnappa, head of startups, transactions and funds practise at Banshi Jain and Associates (BJAA); and VCats++ chief business and operations officer Ashank S.

In its latest edition, Angel School will intensify its focus on enabling HNIs to leverage India’s remarkable growth trajectory by unlocking their investment potential. Over the course of two days, Angel School by VCats++ will empower participants with the knowledge required to capitalise on the potential of startups and enhance their wealth creation journey.

“By educating more individuals on angel investing, Angel School aims to increase the flow of capital to startups. This will not only help individual investors grow their wealth but also stimulate innovation and economic growth by providing startups with the necessary funding to develop and scale their businesses,” said Dr Sharma.

Apply NowAngel School Curriculum

This year’s programme will once again feature leading angel investors, VCs, and funding experts. They will delve into crucial topics in angel investing:

- Introduction To Angel Investment: Attendees will gain a comprehensive understanding of angel investment, capital allocation strategies, the startup lifecycle, and the differences between private and public markets.

- Building An Investment Thesis: Speakers will delve into the factors that investors should consider before investing in a venture and how they can create a winning investment thesis.

- Demystifying Deal Structures: Participants will gain insights into the intricacies of deal structuring, valuation, term sheets and exit & liquidation strategies.

In addition to mentor-led sessions, attendees will also participate in insightful panel discussions on navigating the due diligence process and the essential dos and don’ts of building a robust startup portfolio.

Attendees of Angel School will also get investment opportunities, a chance to become a member of VCats++, and exposure to exclusive pitch events which will help them build a diverse investment portfolio and gain exposure to high-potential startups.

“They can gain access to a robust network of top angel investors, founders and industry experts. This network is invaluable for sourcing investment opportunities, collaborating on deals, and sharing knowledge and experiences,” said Dr Sharma.

Seed Investments Show Resilience Despite Funding Winter

While the funding winter has undoubtedly dampened overall investment activity in recent years, seed investments have largely remained resilient, witnessing only temporary dips. According to Inc42 data, seed stage investments surged to $808 Mn in 2023 from $43 Mn in 2014, clocking a CAGR of 34%.

This jump signifies a robust increase in angel investing activity. Even in the first quarter of 2024, Indian startups secured $179 Mn across 70 seed funding deals. Programmes like Angel School aim to prepare angel investors so that they can face the highs and lows of investing with resilience and contribute to India’s startup growth story.

Apply Now

Ad-lite browsing experience

Ad-lite browsing experience