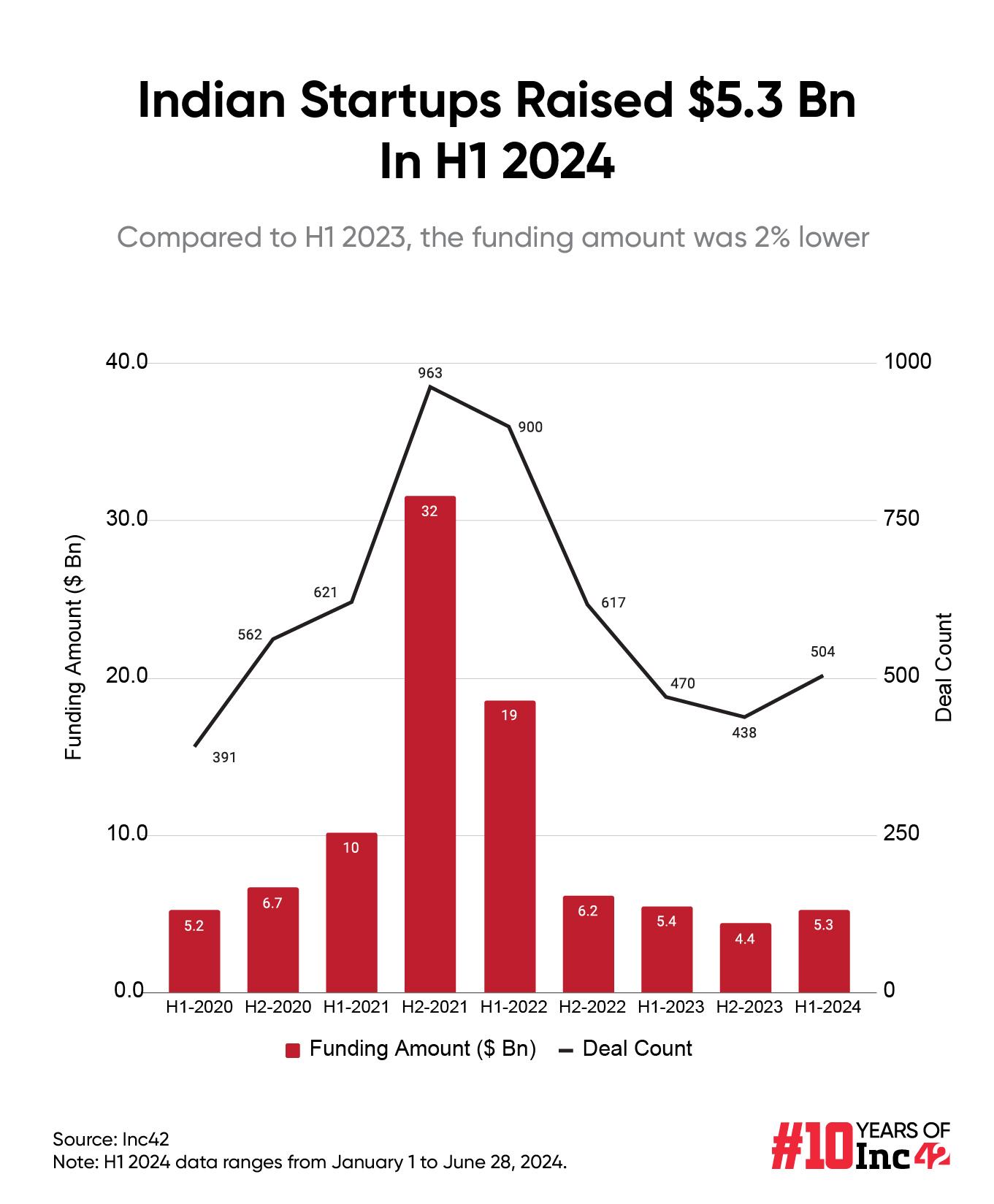

Indian startups cumulatively raised investments worth $5.3 Bn in the first six months (H1) of the calendar year 2024, down a mere 1.8% from H1 2023’s $5.4 Bn.

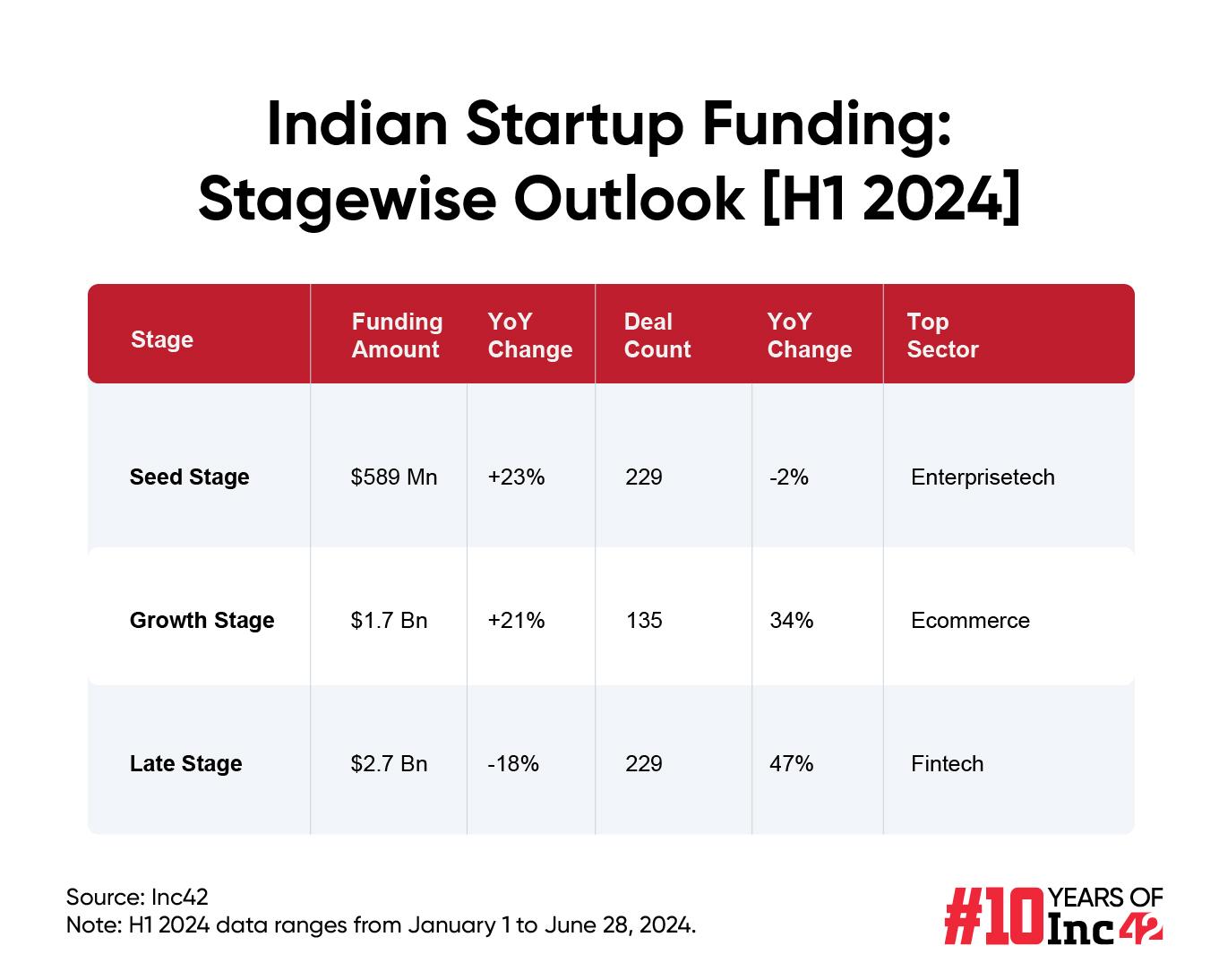

Per the Inc42 H1 2024 report, seed and growth-stage companies drove the funding trend in H1 2024 and late-stage ventures saw investors practising caution.

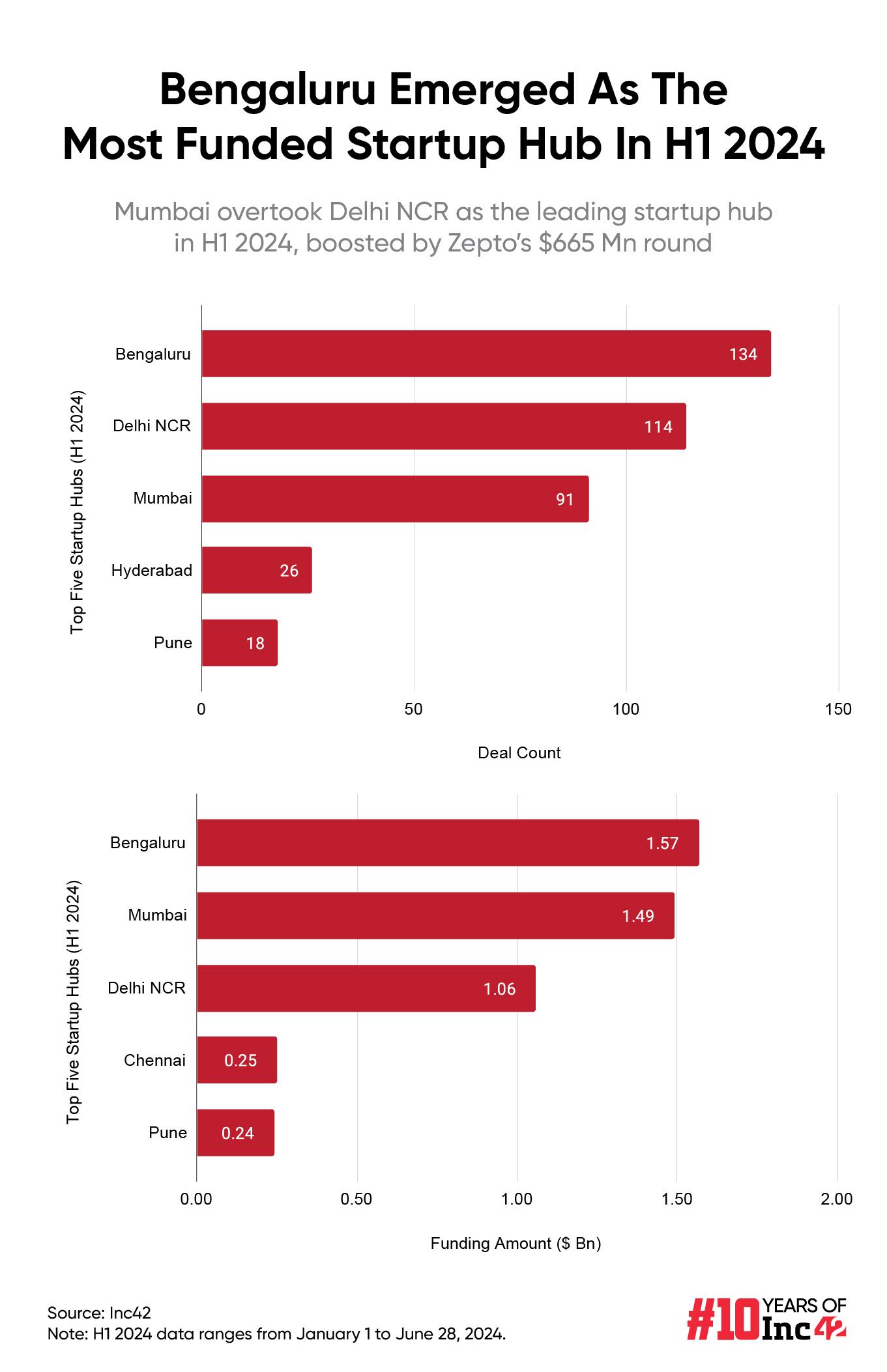

Bengaluru continued its reign as the most-funded startup hub in India, bagging $1.57 Bn across 134 deals. Following the suit was Mumbai with $1.49 Bn raise across 114 deals

Towards the fag end of 2023, most stakeholders of the world’s third-largest startup ecosystem concurred that funding activity will start returning to normalcy in the latter half of 2024. Interestingly, the homegrown startup ecosystem is making a slow but steady headway in that direction.

According to Inc42’s ‘H1 2024 Startup Funding Report’, Indian startups cumulatively raised investments worth $5.3 Bn in the first six months (H1) of the calendar year 2024, down a mere 1.8% from H1 2023’s $5.4 Bn. In contrast, funding numbers declined 10% year-on-year (YoY) in the first half of 2023.

However, in some silver lining, the H1 2024 funding numbers improved sequentially, by more than 20%, from $4.4 Bn in H2 2023. Startup funding declined by nearly 13% sequentially in H1 2023. Notably, H1 2024 witnessed a sequential growth in funding numbers after a two-year lull.

Moving on, the deal count in H1 2024 improved 7% to 504 deals compared to 470 in the year-ago period. Sequentially, the deal volume improved 15%.

Leading the charge from the front were fintech and enterprise tech sectors, which took the lion’s share of funding during the period under review. Region-wise, there were no surprises either — Bengaluru retained its crown as the abode to the most funded Indian startups in H1 2024.

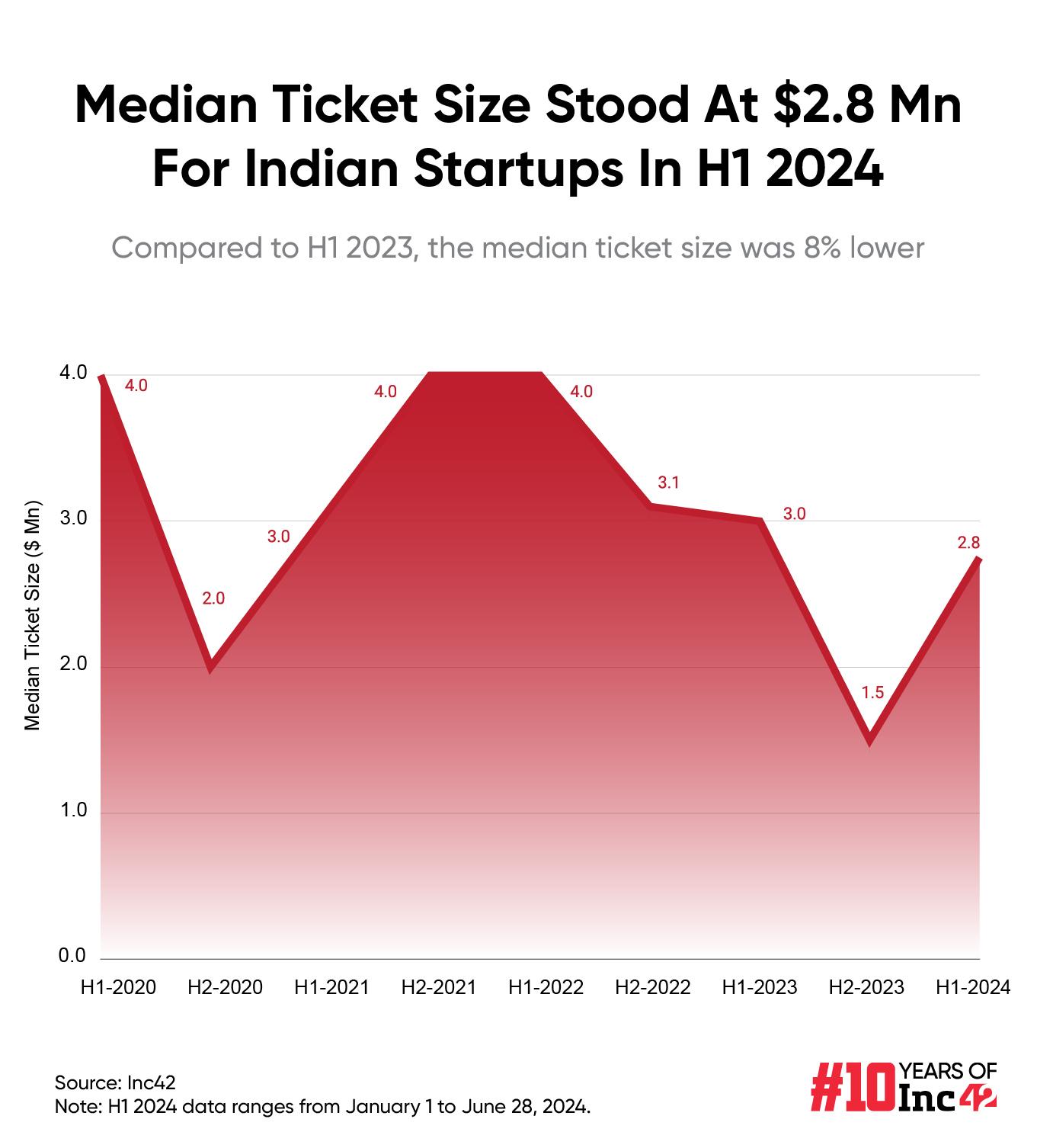

Meanwhile, the median ticket size declined by 8% YoY to $2.8 Mn in the first six months of the ongoing calendar year but zoomed 87% from $1.5 Mn in the second half of 2023.

On the consolidation front, 37 mergers and acquisitions (M&As) took place during the first half of the ongoing calendar year, down from 67 M&As in the year-ago period.

Despite the mixed performance of Indian startups in wooing investors during the first six months of 2024, the almost flat funding numbers could be pointing at VCs’ wait-and-watch strategy before they start to deploy dry powder in droves.

While it may be some time before we see the funding winter finally wane, let’s delve deeper into H1 2024 funding trends.

Fintech & SaaS Startups Bagged The Maximum Funding

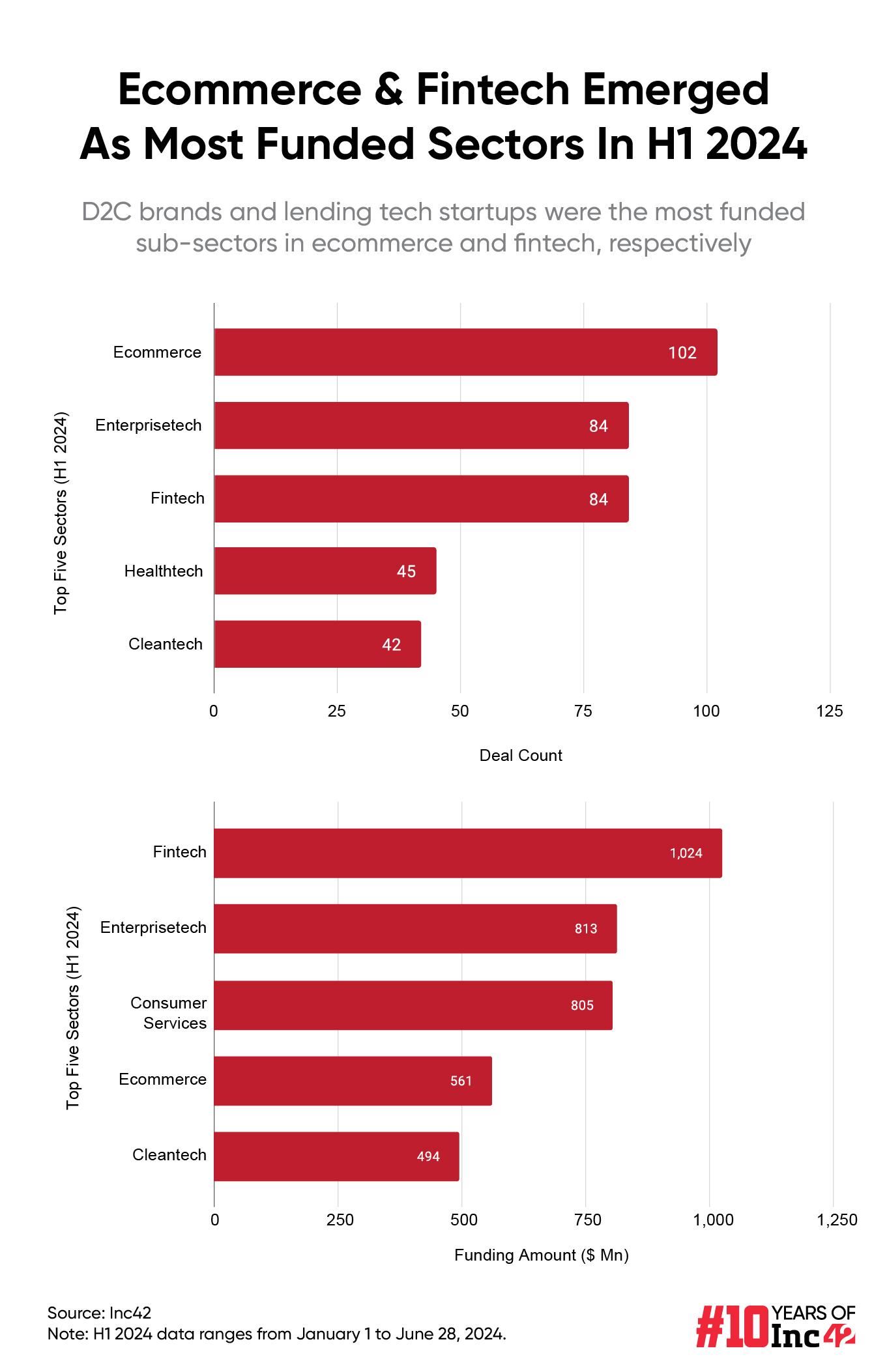

A sector-wise breakdown of the funding numbers revealed that the fintech and enterprise tech sectors bagged the most funds in the first six months.

On the back of Perfios’ $80 Mn unicorn round, the fintech sector accounted for a cumulative funding of $1.02 Bn across 84 deals.

Hot on the heels were enterprise tech startups, which raked in $813 Mn across the same number of deals. Increased investments in artificial intelligence (AI) startups drove the uptick in SaaS funding during the first half of 2024, led by the likes of names such as Unikon.ai, GreyLabs AI, and Vodex.

What was also interesting is that the ecommerce space saw the most number of deals (102) in H1 2024. Moreover, consumer services sector managed to raise $805 Mn during the period under review, with quick commerce unicorn Zepto accounting for more than 82% ($665 Mn) of the total sectoral funding.

Late Stage Funding Staggers But Seed & Growth Stage Amaze

Per the Inc42 H1 2024 report, seed and growth-stage companies drove the funding trend in H1 2024 and late-stage ventures saw investors practising caution.

Interestingly, the advent of AI helped the Indian seed-stage startup funding receive a booster shot, catapulting it 23% YoY to $589 Mn across 229 deals in H1 2024. Within this space, the enterprise tech sector emerged as the strongest.

Similar traces of investor interest were also present in growth-stage startup funding, with H1 2024 clocking a 21% YoY jump in funding to $1.7 Bn across 135 deals.

However, with only five mega deals (over $100 Mn) in the first half of the year, late stage funding fell to a seven-year low. Late-stage startups could only secure $2.7 Bn, enduring an 18% YoY decline. However, the deal count zoomed 47% YoY to 72 in H1 CY24.

Bengaluru Hub For India’s Most-Funded Startups

Bengaluru continued its reign as the most-funded startup hub in India in the first half of 2024, bagging $1.57 Bn across 134 deals.

Following its lead was Mumbai, which piped Delhi to clinch the second spot on the top-funded startup hub list in H1 CY24. Helped by Zepto’s unicorn round, new-age tech ventures based out of the country’s financial capital raised over $1.5 Bn across 114 deals.

Meanwhile, Delhi NCR had to make do with the third spot on the podium $1.06 Bn raised across 91 startup deals in H1 2024.

The Inc42 report also notes that the first six months of the ongoing calendar year saw the participation of more than 915 “unique” investor participation in funding deals. The number signifies the growing allure for Indian entrepreneurs from a constantly growing horde of backers, beyond the usual VCs and PEs.

Come that as it may, unlike the VC capital-fuelled era of 2020 and 2021, investors today remain sharply focussed on supporting profitable and sustainable ventures. It is this mantra that has become the buzzword for Indian startups and the H1 2024 numbers could also be seen as a testament to the same.

[Edited by Shishir Prasher]

Ad-lite browsing experience

Ad-lite browsing experience