What Is A Syndicate?

In terms of investments, a syndicate functions as a special purpose vehicle (SPV) where multiple investors contribute money to make various investments. The lead investor creates a mini fund, and approved backers of the syndicate then contribute funds to this collective pool.

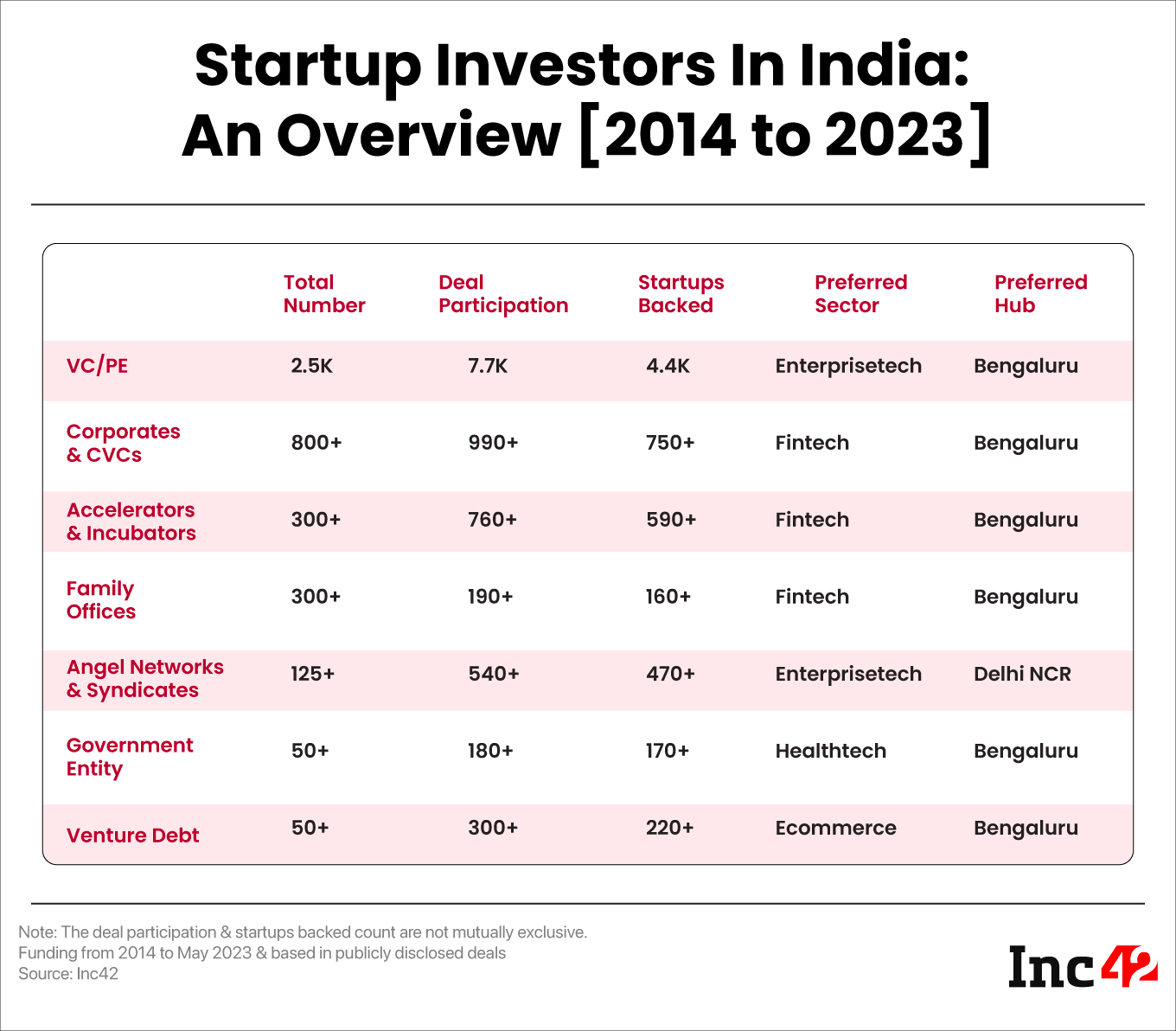

According to Inc42 data, there are over 125 syndicates and angel networks in India currently and this number is expected to go past the 250 mark by 2030. However, it is worth noting that angel networks are formal groups connecting investors and startups, while syndicates involve flexible, deal-specific investment opportunities for angels.

How Does It Work?

It consists of a lead investor and members who contribute capital in proportion to their stake. This structure allows them to participate in larger investments led by the lead, in exchange for a carry.

For example, Mr X, a prominent angel investor, decides to lead a syndicate and the investors agree to invest $150K in his future deals and pay him a carry of 15% (another 5% goes to the syndicate advisors).

Consequently, Mr X makes an investment of $200K in a startup. He personally invests $50K and the remaining $150K is invested by the syndicate members. If the investment is successful, the syndicate members receive the share they contributed to $150K, after which every dollar of the syndicate’s profits are split in 1:4 ratio — 20% goes to Mr X and the advisors, while the remaining 80% is distributed among the members.

Source: AngelList

What Are The Benefits Of Joining A Syndicate?

- Access To Lucrative Investment Opportunities: Allows investors to pool their money together to invest in larger opportunities.

- Diversification: By investing across multiple companies, investors can diversify their portfolios, reduce risks and increase rewards.

- Shared Costs & More Resources: By pooling resources with other investors, members can share the costs such as legal fees, transaction costs, or professional services. This sharing of expenses helps reduce individual financial burdens and makes participating in larger deals more feasible.

- Network Opportunities: Offers networking opportunities and industry connections to novice and emerging investors. Being part of a syndicate allows them to enhance their follow-on and future investments.

What Are The Risks Of Joining A Syndicate?

Some of the risks are:

- Limited Decision Making Power: Members have limited influence on the investment choices made by the lead investor.

- Reliance On Lead Investor’s Expertise: The success of the investment depends on the competence and decision-making abilities of the lead investor.

- High Risk: Investments made carry the risk of losing the invested capital.

- Lack Of Liquidity: Syndicate investments cannot be liquidated, making it difficult to access funds quickly.

- Conflicts Of Interest & Delay In Decision Making: The members of a syndicate may have conflicting investment objectives and preferences.

- Diluted Returns: Distribution of returns among syndicate members can result in diluted profits.

There are some other areas of concern as well. Speaking to Inc42 earlier, Alkesh Agarwal, CEO of Refeel Cartridge and a partner at Seeders, said ‘mushrooming’ of syndicates signals the need for consolidations in order to stay competitive. He also cited the need for improving the due diligence process to create trust among investors.

How Can Someone Join A Syndicate?

The following can help increase your chances of becoming a syndicate member:

- Network & Research: Connect with professionals and research syndicates that align with your investment goals.

- Identify Potential Syndicates: Find syndicates actively seeking members through personal connections, investment platforms, or online syndicate platforms..

- Express Interest & Negotiate Terms: Communicate your desire to join and discuss membership details, including capital contributions and profit-sharing arrangements.

- Complete Documentation: Fulfil any required paperwork, such as membership agreements or subscription documents.

- Contribute Capital: Make the required capital contribution as per the syndicate’s terms.

- Active Participation: Engage in syndicate activities, attend meetings, and contribute your expertise to the group.

Can Individuals Start Their Own Syndicates?

Any seasoned investor can start their own syndicate. However, they must be clear about why they want to start their own syndicate over joining one as a member and reaping its benefits.

Following are some of the reasons because of which an individual can consider starting a syndicate:

- You aspire to start your own fund someday and are looking for a jump start.

- You want to work as a VC.

- You are keen about certain sectors and are looking for shared expertise in making informed decisions.

- You want to invest alongside like-minded investors.

What Are Some Notable Examples Of Syndicates In India?

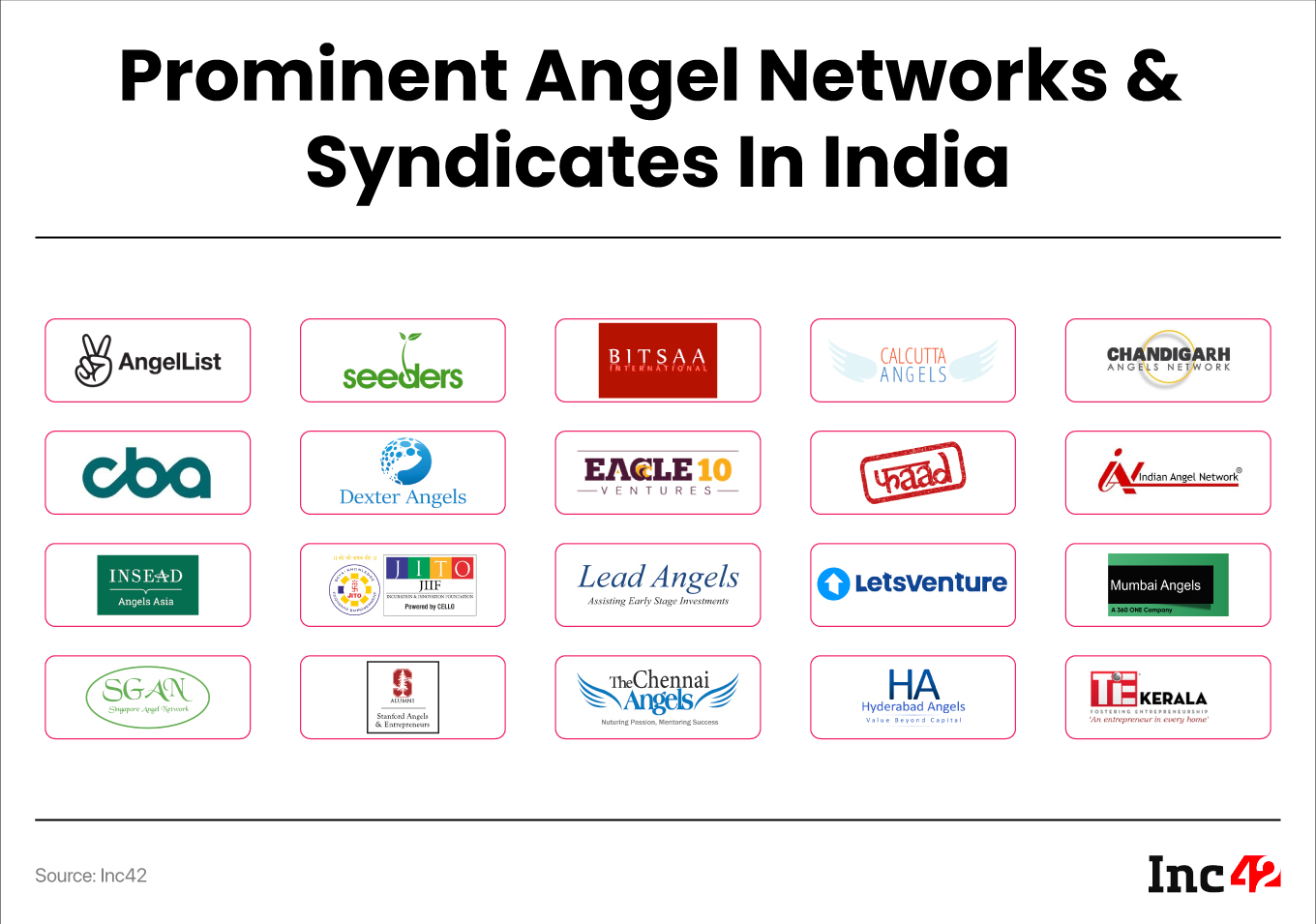

Silicon Valley-headquartered AngelList is one of the most prominent syndicate platforms in India. The global syndicate forayed in India in 2018 and has funded over 500 Indian startups, including BharatPe, Jupiter Money, Teachmint, Plum, and DealShare, since then. Several homegrown syndicates and angel networks have also been launched in the last few years:

What Is A Syndicate Agreement?

A syndicate agreement defines how much money a member will receive from his/her investment and what percentage of ownership he/she will get in a company.

What Happens If A Syndicate Fails?

Investments made through syndicates carry the risk of complete capital loss.