What Is Revenue Based Financing?

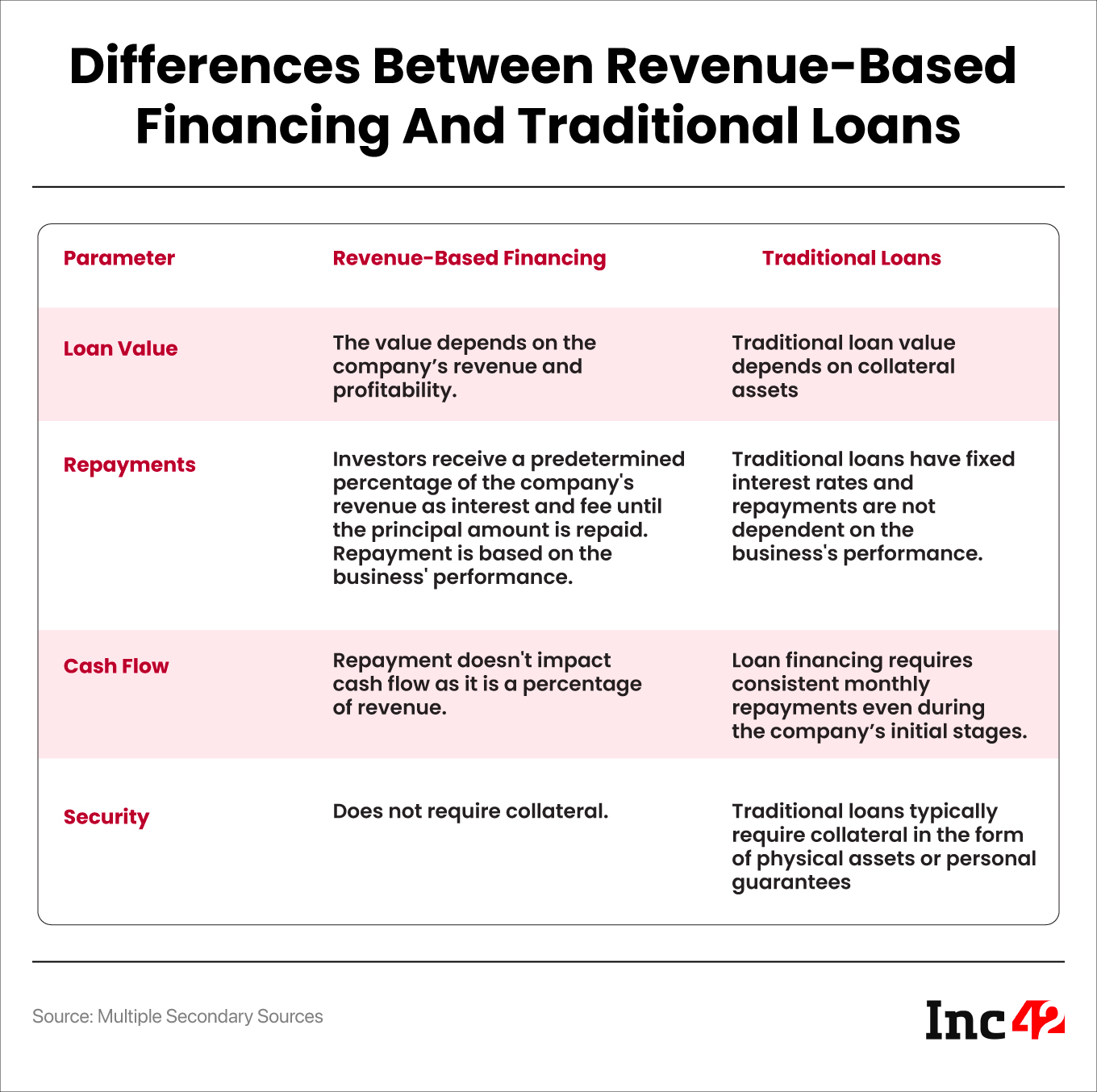

In revenue based financing (RBF), companies raise funding from entities in exchange for a certain percentage of their gross revenue. Under RBF, companies, typically, do not pay collateral against the capital borrowed, unlike in traditional banking.

What Are The Benefits Of Revenue Based Financing For Businesses?

RBF provides the following benefits to businesses:

- Companies are not required to give up an equity share in exchange for capital, unlike in angel investing and venture capital investing. This means they get to retain their ownership of the business.

- Companies don’t have to pay a fixed instalment amount. They make the repayments as per the revenue generated in a respective month. If they make lower revenue, they make a lower payment and if they make higher revenue, they make a higher payment. This reduces the strain on monthly cash flow.

- RBF fullfills businesses’ short-term capital requirements such as inventory fulfilment and marketing. This allows startups to go for multiple funding rounds that can increase their cash flow if they project long-term growth. The repayment duration is ideally between 4 to 18 months, depending on the capital raised.

- SMEs and MSMEs don’t have to worry about repaying the interest costs that usually arise in credit financing. Revenue based financing is fast and accessible in comparison to traditional loans that have lengthy application processes. This is crucial for businesses that require immediate capital to overcome financial challenges.

What Are The Risks Involved In Revenue Based Funding?

The major drawback of revenue based financing is that it is not for pre-revenue businesses. It is usually meant for companies who have been generating revenue for at least six to 12 months.

Also, revenue based financing is mostly available for short-term goals. Businesses looking for capital for a longer term should reach out to venture capital firms and angel investors.

What Businesses Are Best Suited For Revenue Based Financing?

As mentioned earlier, revenue based financing is a suitable option for those who do not want to dilute a part of their ownership while raising funding and small businesses.

Experts also believe that revenue based financing is a good option for ecommerce businesses as they can quickly get capital to stock up their inventory during strong sales periods, like Black Friday Sale or the festive season.

Subscription-based businesses can also avail of revenue based financing as they receive a fixed monthly amount that makes it easy for financers to predict revenue.

How Is The Revenue Shared Between Investors And Businesses?

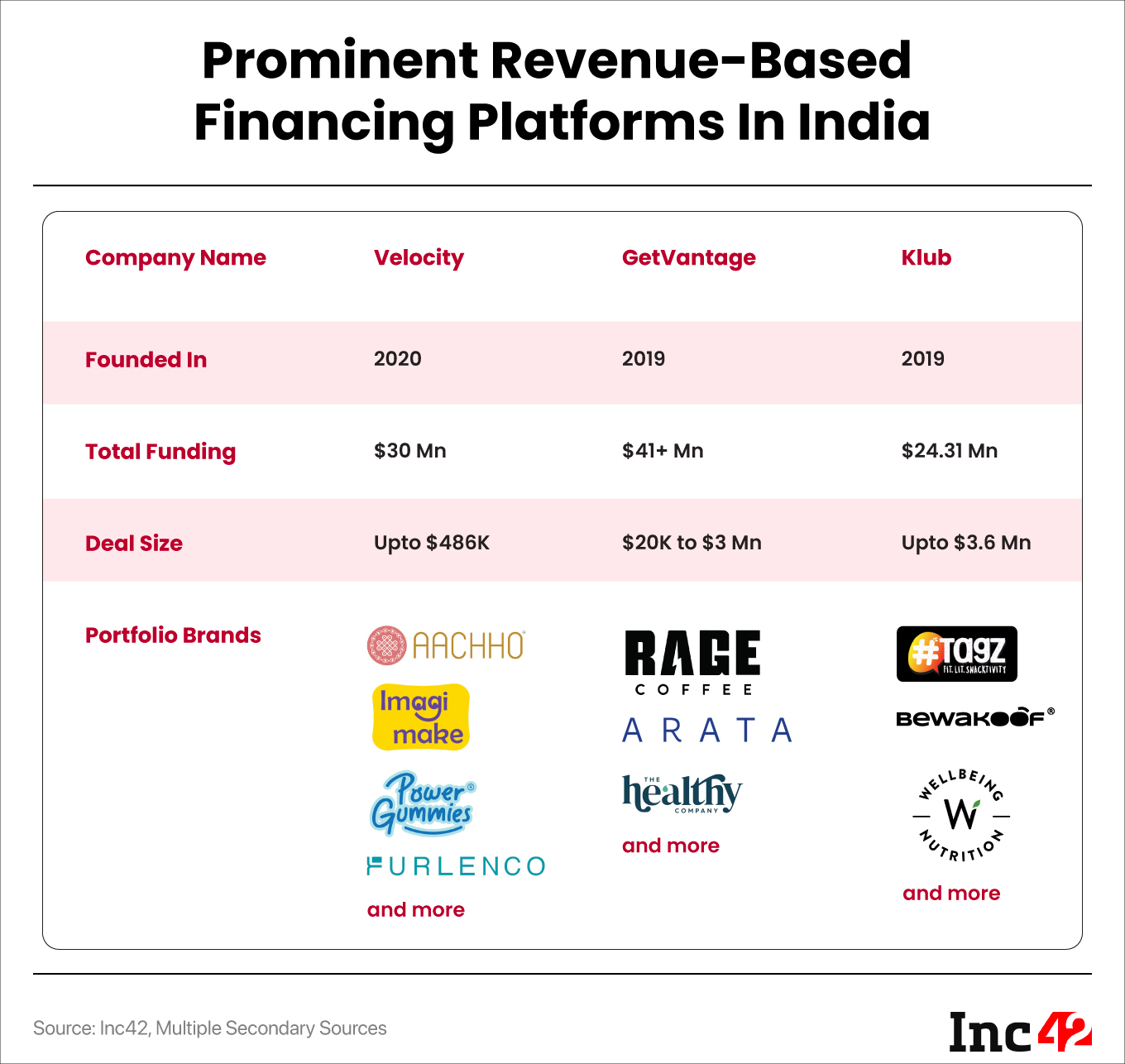

According to the RBF platform Velocity, businesses opting for revenue based funding have to pay the principal amount and a fixed fee, which ranges from 4%-8% of monthly revenue. Businesses have to make a payment of 5%-20% of monthly revenue every month. This percentage is determined by the monthly turnover.

The firm providing revenue based financing will check a business’ income over the previous few months to understand the repayment time period.

For instance, if the agreed percentage is 5% and the monthly sales are INR 1 Cr, the business would pay INR 5 Lakh as interest till they pay the principal amount.

If the monthly sales decrease to INR 80 Lakh, the interest payment would be INR 4 Lakh (5% of INR 80 Lakh).

What Is A Revenue Based Financing Term Sheet?

A revenue based financing term sheet outlines the principal amount, fees and repayment schedule. The term sheet is prepared around a company’s revenue and determines the loan amount, minimum payment and repayment period.

It includes crucial conditions and terms like loan collection period (repayment schedule), remittance (payment rate based on sales), fees (cost of the loan), total fees paid (overall loan cost), early-payment fee (penalty for early repayment) and eligible gross sales (revenue used to determine payment).

Are There Any Tax Implications Associated With Revenue Based Financing?

According to Invest India, revenue based funding is a form of debt, therefore, the interest payment on the investment is ‘tax-deductible’ for businesses.