What Is Micro VC Fund?

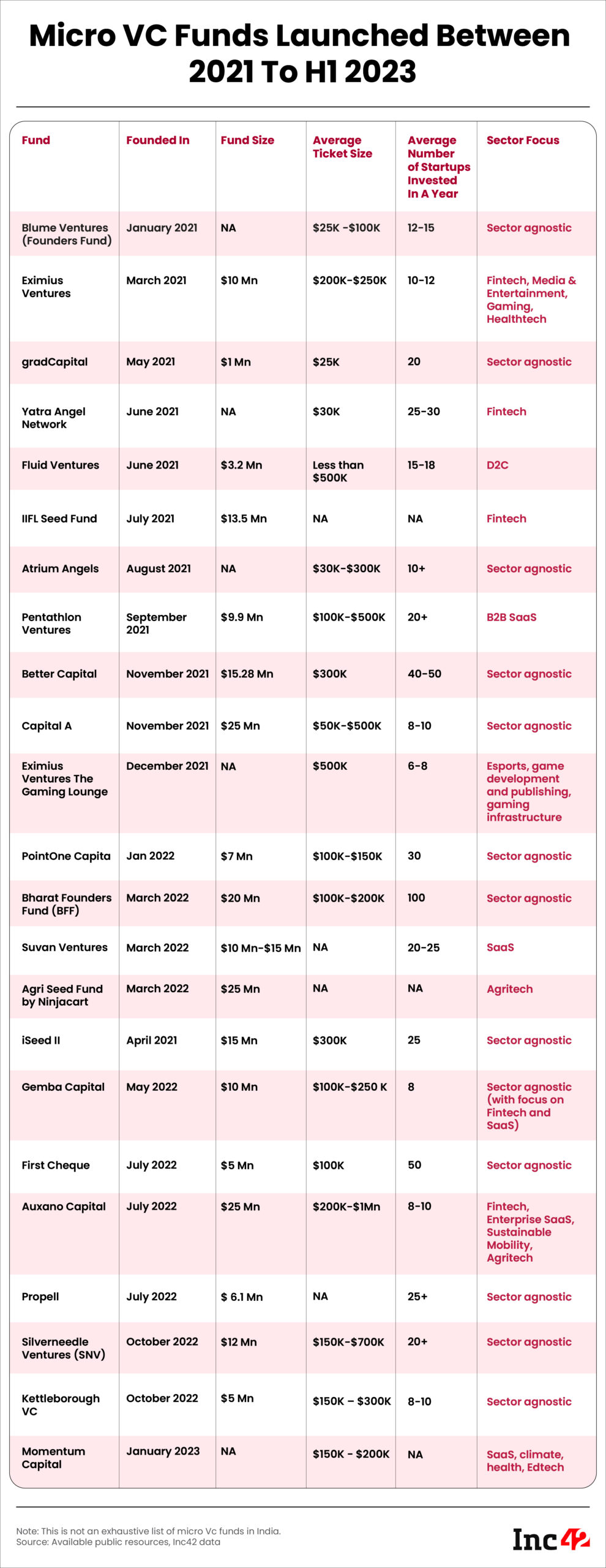

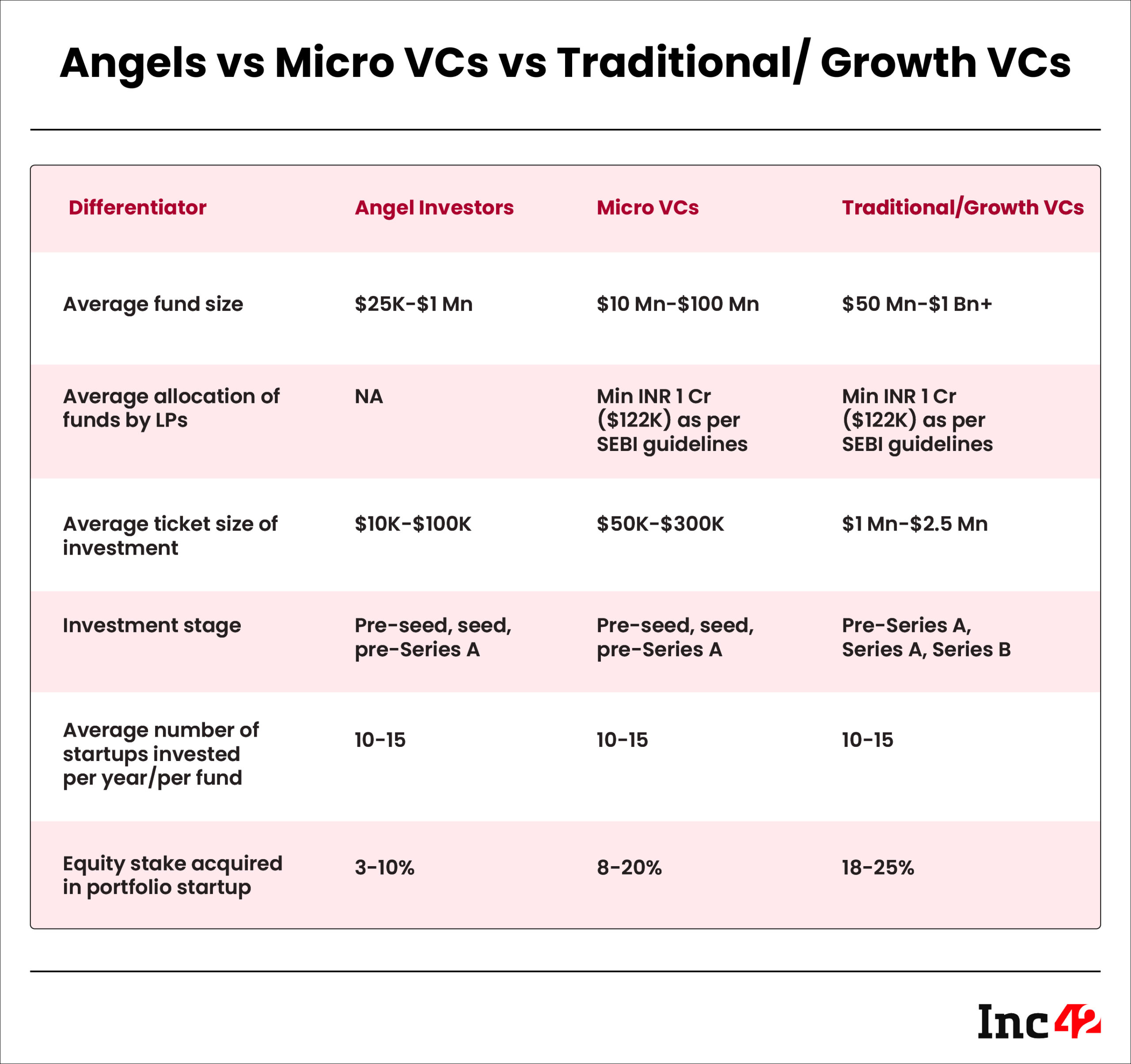

Although angel investors have traditionally dominated early-stage funding, a new crop of venture capital funds (VCs) is now actively engaging in pre-seed and seed funding rounds. These new players, known as micro VC funds, operate with a smaller capital corpus ($10- $100 Mn) as compared to their larger counterparts with a fund size of $50 Mn to $1 Bn.

What Factors Do Micro VC Funds Consider Before Investing?

Micro VC funds look at the following factors while investing:

- Sector: Micro VCs can be both sector agnostic and sector-specific. In India, 100X VC, gradCapital and Better Capital are largely sector-agnostic micro VCs while Eximius Ventures, Yatra Angel Network and Suvan Ventures make sector-focussed investments.

- Funding Stage: Micro VCs invest in startups looking to raise pre-seed to pre-Series A funding. They may participate in follow-on rounds in Series A and above.

- Conditional Funding: Micro VCs generally fund startups at the post-MVP (minimum viable product) stage. They either write their first cheque with follow-on investments or write monthly/quarterly cheques with full involvement in growth strategy.

- Number Of Deals: Micro VCs can invest in 50 to 100 deals every year.

What Are The Advantages Of Raising Capital From A Micro VC Firm?

The advantages of raising funding from micro VCs are:

Specialisation: Unlike typical growth VCs, micro VCs specialise investments (pre-seed to pre-Series A) in early stage companies. As a result, they add more value and momentum than traditional fund houses.

Bridging The Funding Gap: Micro VCs play a crucial role in closing the divide between traditional VCs, who often overlook early-stage opportunities, and not-so-organised angel networks.

For example, let’s consider 100X.VC, which launched its micro VC fund in March 2021. It actively seeks to invest in 75-100 deals per year and provides funding of $16K in exchange for a 15% future equity stake through iSAFE Notes. This is a refreshing change from the lengthy due diligence processes associated with VCs.

Expertise: Micro VCs bring valuable expertise to their portfolio companies, assisting them with strategic planning, team development, networking, identifying product-market fit and facilitating sustainable growth for founders.

How Can Startups Find And Approach Micro VC Funds?

The journey of finding micro VCs and closing a deal includes:

- Research: Startups must identify potential micro VC firms based on factors such as their size, sector, focus and location. Once identified, startups should create a list of micro VCs that align with their needs.

- Outreach: Startups can reach out to potential firms through email, social media, or in-person meetings. Leveraging one’s network to find potential leads also helps.

- Pitch: Present your startup to interested micro VC firms, showcasing its value and potential for investment.

- Negotiation: If a micro VC firm expresses interest, negotiate the investment terms, including funding amount, equity, and deal specifics.

- Close: Finalise the deal by signing the investment agreement and receiving the funds.

What Are The Risks Associated With Raising Capital From Micro VC Funds?

Going by its most dominant features in terms of fund size and ticket size, micro VCs closely resemble angel investors rather than traditional VCs. Hence, there is still debate on this model of funding and where it can be placed in the institutional investment spectrum.

However, in an earlier conversation with Inc42, Anirudh Damani of Artha Venture Fund explained the VC vs angel network conundrum, “We must bear various expenses for regulatory compliance as we are in the VC category. But this is not apt considering our investment strategy. We should be put under the angel fund category or one notch higher than that,” he said.

Industry experts have also emphasised another significant challenge: the imperative to enhance the quality of deals through hands-on efforts. While venture capitalists come across various ideas, they observe a dearth of fundamental innovation in crucial sectors like SaaS, deeptech and biotech.

Which Are Some Of The Prominent Micro VCs In India?