What Is An ESOP?

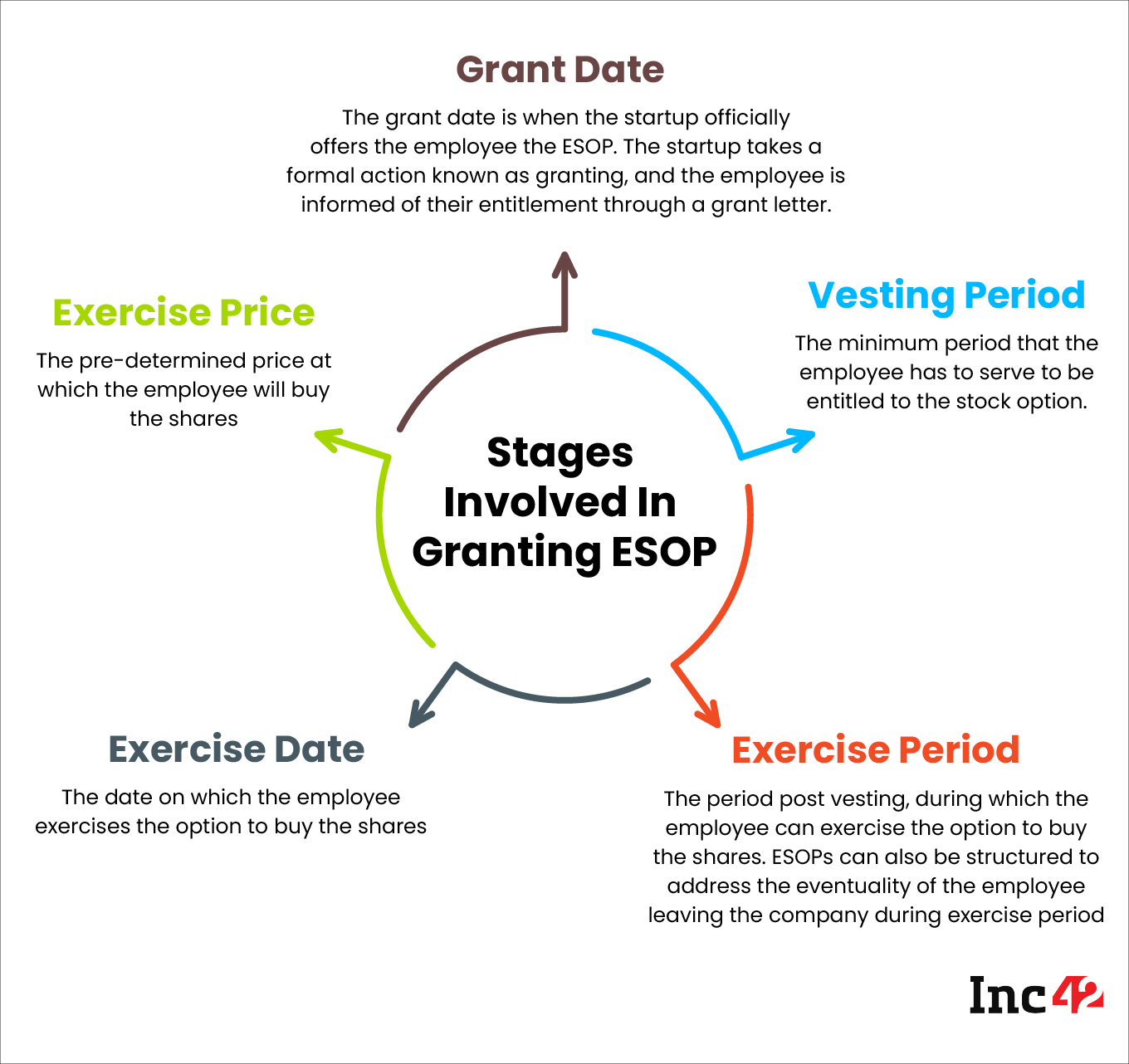

Employee Stock Ownership Plan (ESOP) is a form of employee benefit plan designed to incentivise employees by providing them with company stocks. Employees can encash these stocks after a specific period at a pre-determined value.

How Does It Work?

“Many people think that ESOPs are just paper money. But the good news is that the Indian startup system has seen multiple ESOP buybacks. Great companies do multiple buybacks and these events are the only way to instil confidence in people,” said Mukul Rustagi, cofounder of Classplus, during a panel discussion hosted by Inc42.

The Companies Act 2013 permits the allotment of shares in the form of ESOPs to a startup (or its holding/subsidiary). To grant ESOPs, it must be approved by at least 75% majority of shareholders in a startup at pre-determined value.

What Are The Benefits Of Issuing An ESOP?

Benefits For Employees: ESOPs offer several benefits to employees such as stock ownership, dividend income and the ability to buy shares at a discounted rate. Employees can become part owners of the company, earn additional income through dividends, and invest in the company at a preferential rate.

Benefits For Startups: By offering ESOPs, startups can retain talented employees, boost productivity and attract new employees, especially in the initial stages when high salaries may not be feasible.

Who Can Participate In An ESOP?

Eligibility for ESOPs is extended to employees, with the exception of directors who hold more than 10% equity in the company, promoters, or individuals who are part of the promoter group (including immediate relatives).

How Are ESOPs Taxed?

Tax is imposed on ESOPs at two points: during exercise and at the time of selling shares.

Exercise Of ESOPs: The difference between the fair market value (FMV) and the exercise price is taxed as salary, depending on the salary slab of the employee.

Selling Shares: In this case, the difference between the sale price and exercise price is taxed as capital gains. An exemption under Section 54F allows long-term capital gains from ESOPs to be used for purchasing residential property, subject to certain conditions.

According to the 2020 Budget amendment, employees receiving ESOPs from a startup are not required to pay tax in the year of exercising the option. TDS (tax deduction at source) on the perquisite or head salary is deferred until specific events occur, such as the expiry of five years from the year of ESOP allotment, date of sale of the ESOP or termination of employment.

What Happens To An ESOP If The Company Is Sold?

If a company gets acquired, employees might have the chance to cash their ESOPs. For example, when Flipkart acquired Myntra, employees who had ESOPs were allowed to sell their shares after leaving the company.

In some cases, however, employee stocks may be transferred to the acquiring company or they may be able to cash out only a portion of their stock. When a company receives funding or sells stake, there is a scope for ESOP monetisation. However, sometimes only the founders have the option to sell their shares, while employees don’t. Additionally, as the company sells more stake, the value of employees’ stock may decrease due to dilution, but its value increases.

Can An ESOP Be Used To Finance A Business?

No, an ESOP cannot be directly used to finance a business. ESOPs are designed as employee benefit plans to provide employees with the opportunity to own shares and nurture a sense of trust among the employees and the business.

What Are Some Of The Legal Requirements For Setting Up An ESOP?

Here’s what startups should keep in mind while issuing an ESOP:

- The ESOP document should be in compliance with the Companies Act 2013.

- A notice of the board meeting must be sent to all directors at least seven days prior to the meeting.

- Set the share price for the ESOP issuance, determine the date and time, and authorise the summoning of a general meeting to adopt a special resolution for the ESOP issuance. Pass the resolution for issuing shares through the ESOP.

- After two weeks, provide the draught minutes to each director and upon the board’s adoption of a resolution, submit the MGT-14 form with the Registrar of Companies.

- Schedule a general meeting. However, the notice for the meeting should be sent to the company’s directors, auditors, shareholders and secretarial auditors at least 21 days prior.

- Pass a special resolution to authorise the general meeting for the issuance of ESOP shares to the company’s employees, directors, and officers.

- Send stock purchase options to the company’s directors, officials, and staff members.

- If a private firm intends to issue an ESOP share (ESOP for private companies), it must make sure that the issuing of shares through an ESOP is authorised under the articles of association (AoA).

How Are ESOPs Valued?

As per Securities and Exchange Board of India (SEBI) guidelines, companies granting stock options to employees have the freedom to set the exercise price, provided it aligns with their accounting standards, as prescribed by the central government under section 133 of the Companies Act, 2013.

ESOP Buybacks In 2022

In 2022, several Indian startups conducted ESOP buybacks to reward their employees. Overall, Indian startup employees made over $196 Mn through buybacks last year.

Here’s a look at some of the biggest ESOP buybacks in 2022:

What Are The Disadvantages Of ESOPs For Startups?

Managing an ESOP can be complex and time-consuming, involving tasks like plan administration, legal compliance, and documentation upkeep. This can be especially challenging for bootstrapped startups, which lack expertise and time.

Another consideration is the cost, which includes transaction and setup/maintenance expenses. Despite these costs, the tax advantages and overall benefits of having an ESOP can outweigh them, making it a worthwhile option for startups.