What Is Equity Funding?

Equity funding is a type of funding where a company sells its shares or stake in exchange for capital investment from investors. As part of the deal, investors get to own a stake in the company, have special rights, and get involved in the decision-making process.

How Does Equity Funding Work?

When startups require funding, they often seek investment from angel investors, venture capitalists or institutional investors, which usually involves selling a portion of the company’s equity.

As a startup grows into a successful company, it will likely have multiple rounds of equity funding to support its growth and expansion plans. Depending on the stage of growth and the type of investors involved, the startup may use different equity instruments for its funding needs.

For instance, angel investors and venture capitalists, who are typically the first to invest in a startup, often prefer convertible preferred shares over common stock.

As a company grows and considers going for an initial public offering (IPO), it may sell common stock to institutional and retail investors. If the company requires additional capital later on, it can go for a follow-on public offer (FPO) or other routes such as a rights issue or an offering of equity units that include warrants as an incentive.

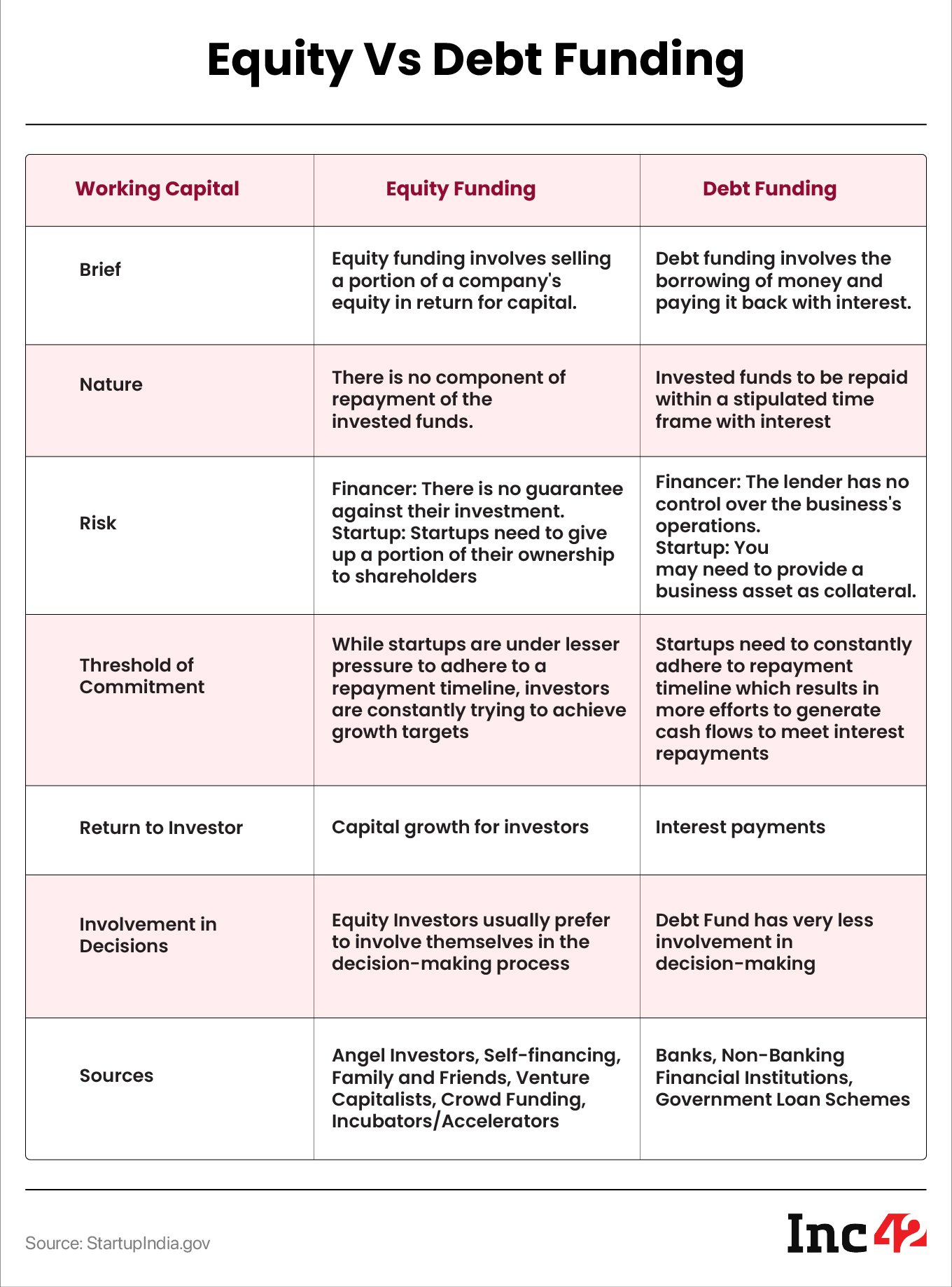

What Is The Difference Between Equity Funding And Debt Funding?

How Is Equity Funding Different From Crowdfunding?

It involves selling shares to investors for capital, while crowdfunding involves soliciting small contributions in exchange for rewards. Equity funding is subject to more regulations and is often used by startups, while crowdfunding is more accessible and used by a wider range of businesses.

The Securities Exchange Board of India (SEBI) allows all forms of crowdfunding, except equity crowdfunding.

Which Types Of Businesses Are Best Suited For Equity Funding?

The seed stage is usually when the first round of equity funding takes place. As the startup matures, it goes in for further rounds of funding (Series A, B, C, and so on).

How Do Investors Benefit From It?

High growth startups may potentially offer high returns to investors. Besides, investors get a stake in the company, liquidity, and diversification benefits. Investing in multiple companies can help spread the risk and potentially earn higher returns. However, investing in startups and early-stage companies is also risky, and investors should carefully consider the potential risks and rewards before investing.

What Are Some Common Sources Of Equity Funding?

Here are the most common sources:

-

Accelerators and incubators

-

Angel investors

-

Angel networks and syndicates

-

Corporate and corporate venture capitalist (CVC)

-

Family offices & multi-family offices

-

Government bodies & public institutions

-

Indian startups (like Flipkart investing in PhonePe)

-

Investment banks

-

Venture capital firms

-

Crowdfunding (scarcely seen)

What Is The Process For Getting Equity Funding?

Startups need to identify potential investors, create a business deck, pitch their business to investors, undergo due diligence, negotiate terms and close the deal. After receiving the funding, the startups should work closely with investors, provide regular updates on progress, and use the funding to grow and expand operations.

How Much Equity Should Be Offered To Investors?

There is no fixed rule on how much should be offered to investors. It depends on various factors, such as the company stage, funding requirements, growth prospects. Investors usually seek a significant enough equity stake to justify their risk while leaving enough ownership with the founders to incentivise them.

How Long Does It Take To Obtain Equity Funding?

Securing equity funding can take several weeks to a few months, depending on factors like the stage of the company, the amount of funding required, and the investors’ due diligence process.

What Are Some Common Equity Funding Terms And Concepts?

Some common equity terms are:

- Valuation: The process of determining the worth of a company or its assets.

- Dilution: A decrease in the stake held by existing shareholders in a company.

- Pre-money valuation: The value of a company right before it receives funding.

- Post-money valuation: The value of a company after it receives funding .

- Equity stake: The percentage of ownership that an investor holds in a company.

- Convertible preferred shares: A type of security that gives investors the right to exchange the shares for a predetermined amount of common stock during a specific period of time.

- Anti-dilution provision: A clause that protects investors from dilution by adjusting the conversion price of their shares.

- Term sheet: A summary of the key terms and conditions of an equity funding deal which serves as the basis for negotiation between the startup and investors.