What Is COD?

Cash on delivery, also referred to as COD, is a payment method wherein customers have the opportunity to pay for their purchases only when they physically receive the ordered products.

Unlike online payment methods, such as credit/debit cards or digital wallets, COD eliminates the need for upfront payment, thereby mitigating any apprehension or distrust that some customers may have regarding online transactions.

How Does COD Work?

When customers choose the cash-on-delivery option during the checkout process while making a purchase online, the transaction is not completed immediately. Instead, the order is processed and dispatched for delivery.

Once the package reaches the customer’s doorstep, the delivery personnel collects the payment in cash. This payment method provides customers with the chance to inspect the products before paying, ensuring they receive exactly what they expected.

How Is COD Different From Cash In Advance?

Cash on delivery and cash in advance are two distinct payment methods that cater to different customer preferences and situations.

While COD allows customers to pay at the time of delivery, cash in advance requires customers to make full payment before the products are shipped. In the second case, customers can use various online payment options like credit/debit cards, digital wallets, or bank transfers to complete the transaction. Only after the payment is confirmed, the order is processed and dispatched for delivery.

The main difference between the two lies in the timing of payment. COD offers convenience for customers who may not be comfortable with online transactions or who prefer to inspect the product before paying. On the other hand, cash in advance benefits businesses by reducing the risk of non-payment or order cancellations.

How To Start Cash On Delivery For Your D2C Brand?

Having COD as a payment option in your business can be an effective strategy to attract more customers and boost sales. Here’s how you can integrate COD services while selling your products online:

- Partner with reliable delivery services: To offer COD, you need a robust delivery network that can efficiently handle the payment collection process. Partnering with reputed logistics companies ensures timely deliveries and seamless cash collection.

- Set clear payment terms: Define the terms and conditions of your COD service clearly. Specify the areas where COD is available, any additional charges, and the maximum order value eligible for COD. This transparency will prevent misunderstandings and customer dissatisfaction.

- Verify customer details: Before confirming COD orders, ensure the authenticity of customer information. Contact customers for order verification, and record their consent to avoid any fraudulent transactions.

- Logistics delivery personnel: Your delivery team plays a crucial role in the COD process. Provide them with adequate training on handling cash, customer interaction, and ensuring secure transactions.

- Monitor and analyse performance: Keep track of your COD orders, payment collections, and customer feedback. Analyse the data regularly to identify any patterns, potential issues, or areas for improvement.

Why Do Indian Consumers Prefer COD?

- Trust and security: COD offers a higher sense of security and trust for consumers who may be hesitant to share the details of their bank account and other personal information online.

- Limited access to digital payments: While digital payment methods have been growing rapidly in India, many individuals still do not have access to credit or debit cards. COD provides an alternative for these consumers to shop online without the need for electronic transactions.

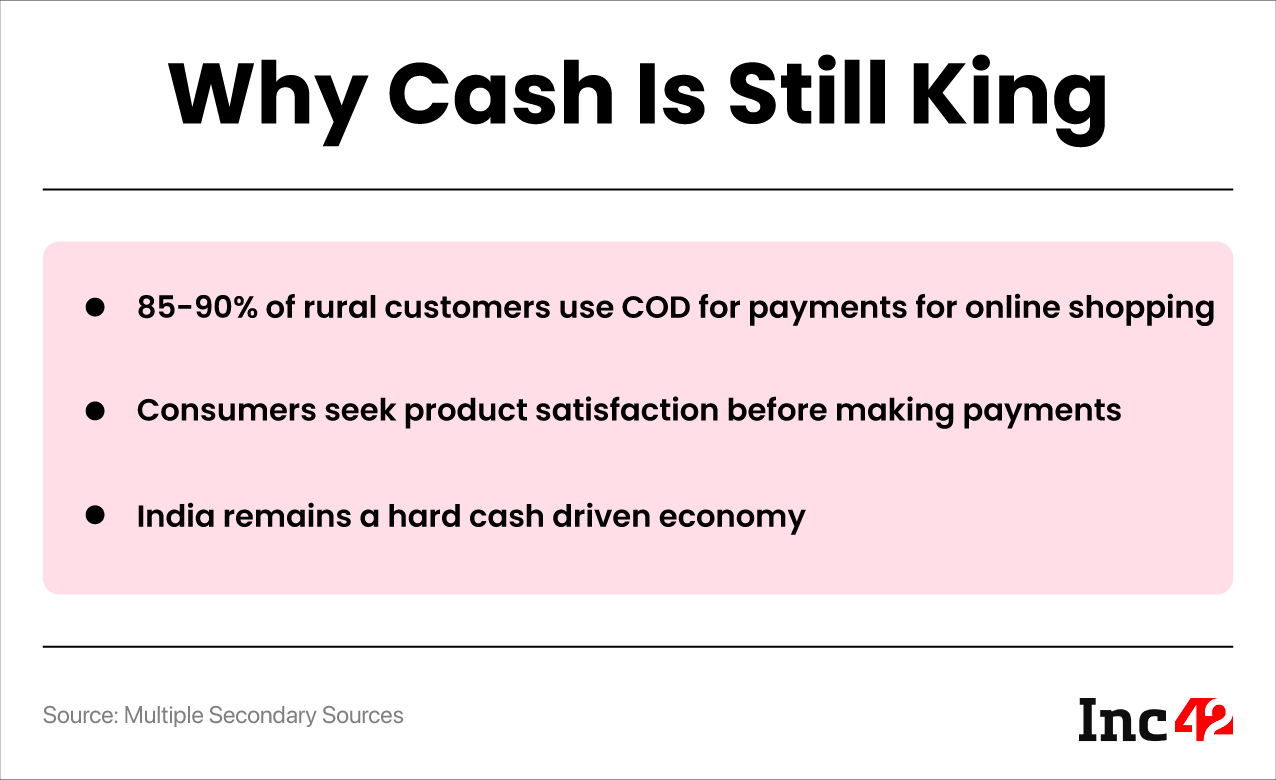

- Cash economy: India has traditionally been a cash-driven economy, and many people are more comfortable handling cash than using digital payment methods. COD aligns with this cultural aspect, making it a convenient option for a significant portion of the population.

- Delivery and returns: COD allows customers to pay at the time of delivery, allowing them to verify the product’s quality and condition before making the payment. If they are not satisfied with the product, they can refuse to accept it without any financial loss.

- Rural market penetration: India’s rural areas still account for a significant portion of the population. These regions might have limited internet access and awareness of digital payment methods, making COD a preferred choice for online purchases.

- Lack of banking infrastructure: In certain regions, access to formal banking infrastructure and financial services may be limited. COD offers a more accessible and straightforward payment option in such areas.

What Are The Disadvantages Of COD And How Can Brands Be Careful?

Alongside its advantages, cash on delivery (COD) could have some disadvantages as well.

- Increased operational costs: COD transactions necessitate additional logistics and management procedures, resulting in increased operational costs for businesses. Handling currency introduces security risks, such as the potential for larceny, mismanagement, or deception during the delivery and payment process.

- Order cancellations and returns: COD orders are more likely to be cancelled or returned than prepaid orders. Customers may place orders without a distinct intent to purchase, causing businesses to waste time and resources.

- Payment delays: With COD, businesses do not receive payment immediately. The collection procedure may be time-consuming, thereby delaying cash flow.

- Having only cash on delivery (COD) as a payment option may limit your customer base. Some consumers may favour digital payment methods and refuse to purchase from companies that do not provide them.

Meanwhile, to mitigate the impact on businesses, brands can:

- Diversify payment options: Providing a variety of payment methods, including digital payment options such as credit/debit cards, mobile wallets and online banking, can encourage consumers to opt for prepaid options and reduce reliance on COD.

- Implement order verification: Before shipping a product, brands can verify COD orders via SMS or phone calls. This can aid in reducing fraudulent orders and cancellations.

- Collaborate with reputable delivery services: Collaborating with dependable and trustworthy delivery partners can help ensure secure cash management and effective delivery processes.

Brands can incentivise prepayment by offering discounts, cashback, or loyalty points to consumers who opt for digital payment methods.

A precise and customer-friendly return policy can aid in reducing superfluous returns and disputes. Additionally, providing detailed product descriptions and images can help manage customer expectations.

Educate consumers: Brands can educate their consumers on the advantages of digital payment methods and how to use them securely.

Analytics and Data Monitoring: Order data analysis can help identify fraudulent or suspicious patterns of behaviour, enabling brands to take preventative measures.