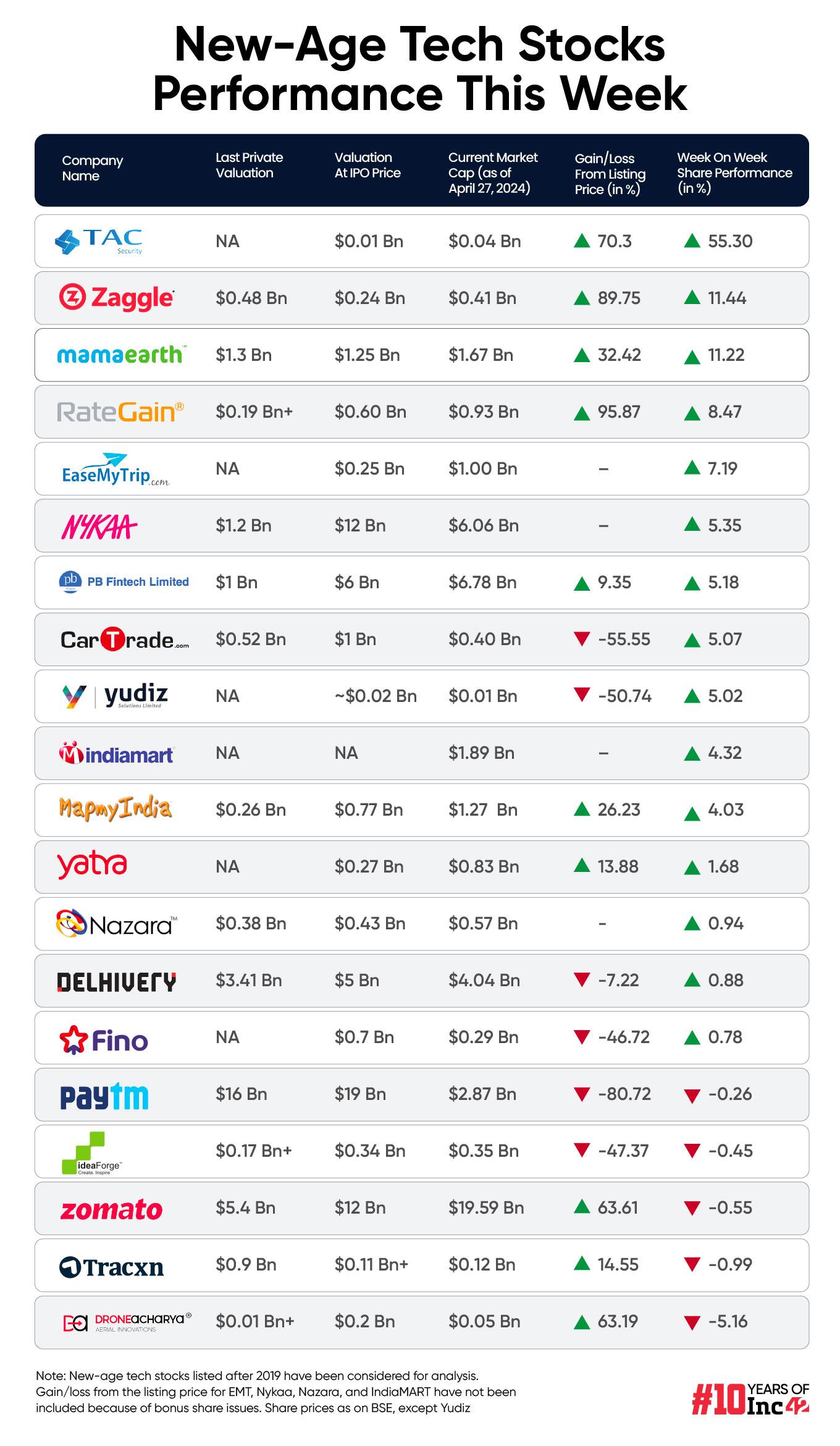

Shares of recently-listed TAC Infosec zoomed a massive 55% on NSE Emerge this week, after rallying over 14% last week

Zaggle, Mamaearth, RateGain and EaseMyTrip were among the 14 other new-age tech stocks which gained this week

In the broader market, benchmark indices Sensex and Nifty50 gained 0.88% and 1.23%, respectively, this week

Indian new-age tech stocks witnessed a northbound momentum this week on the back of a rally in the broader market, despite mixed global cues and continuing tensions in the Middle East.

TAC Infosec, the latest addition to the list of the new-age tech stocks under Inc42’s coverage, emerged as the biggest gainer this week. The stock jumped a massive 55% this week, after gaining over 14% last week.

Meanwhile, 14 other stocks also gained this week in a range of 0.7% to over 11%.

While the shares of Zaggle and Mamaearth rallied over 11% each this week, RateGain surged 8.5%, and EaseMyTrip zoomed 7.2%.

Among the other top gainers were Yudiz, Nykaa, PB Fintech, and CarTrade, with their shares gaining over 5% each this week on the BSE.

However, DroneAcharya turned out to be the biggest loser, with its shares declining 5.2% this week. Shares of Zomato, Paytm, ideaForge, and Tracxn also saw marginal falls this week.

In the broader market, benchmark indices Sensex and Nifty50 gained 0.88% and 1.23%, respectively, this week. However, after a steady rally in the first four trading sessions, Sensex ended Friday’s session 0.82% lower at 73,730.16 and Nifty declined 0.67% to 22,419.95.

Speaking on the correction in the market by the end of the week, Prashanth Tapse, senior VP (research) at Mehta Equities, said the fall was on expected lines as both benchmark indices had rallied for five straight sessions and profit-taking was due for some time.

“Correction is also attributed to global factors after the Japanese yen fell to a new 34-year low and disappointing US data pushed its benchmark yields to over 4.7%, thus worsening hopes of an interest rate cut in the medium term,” said Tapse.

Meanwhile, a fresh uptick in international crude oil prices amid the ongoing conflict in the Middle East is expected to continue to weigh on domestic inflation, the analyst believes.

Now, let’s take a look at the performance of some of the new-age tech stocks this week.

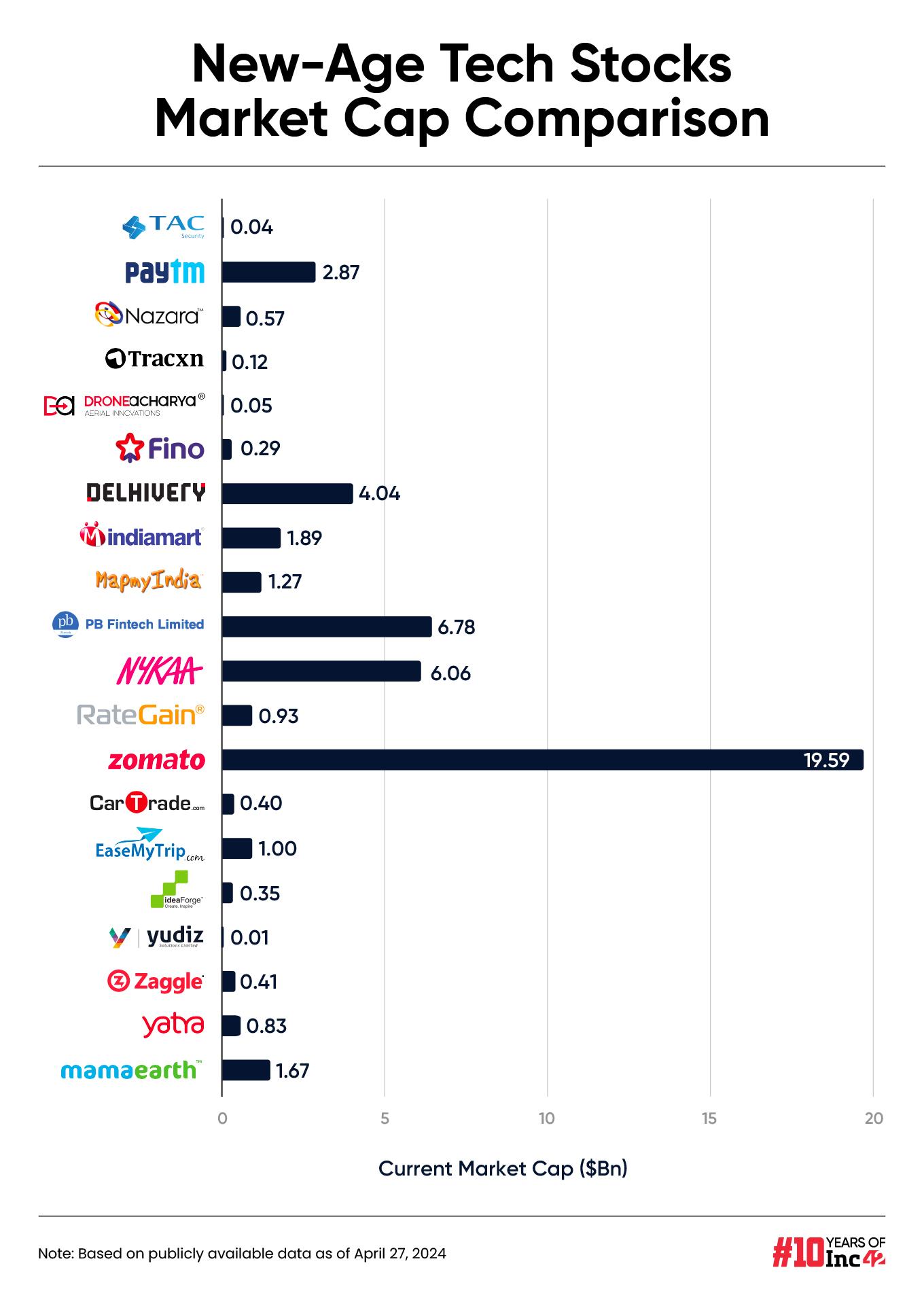

Reversing the previous week’s slump, the 20 new-age tech stocks ended this week with a total market capitalisation of $49.17 Bn as against $47.67 Bn last week.

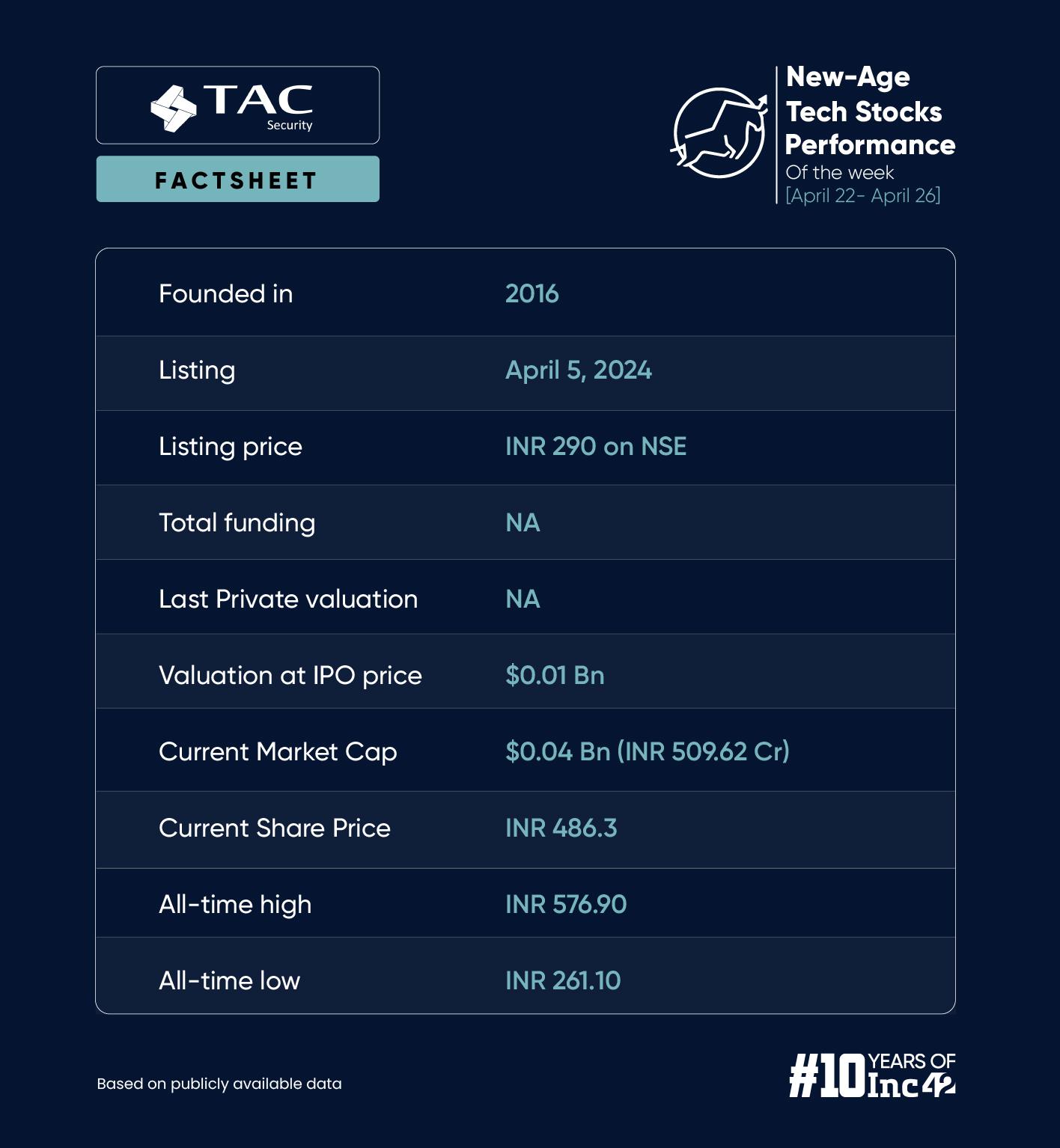

TAC Infosec’s Impressive Rally

Continuing as the biggest gainer among the new-age tech stocks for the second straight week, Vijay Kedia-backed SaaS cybersecurity startup TAC Infosec rallied 55% this week.

It is pertinent to note that the startup listed on NSE Emerge earlier this month at a premium of 173.6% to its issue price of INR 106. TAC Infosec got listed at INR 290 and closed the week over 70% higher from the listing price at INR 494.

This week, the shares also touched a record high of INR 576.9.

In a recent development, TAC said it has been appointed as a key cyber security assessor for the App Defense Alliance (ADA).

In a statement, TAC said that the ADA, which was originally launched by Google in 2019 to combat malicious Android apps, is now transitioning to the Joint Development Foundation (JDF) under the Linux Foundation. By joining the ADA, TAC would strengthen the alliance’s defence against evolving digital threats, it said.

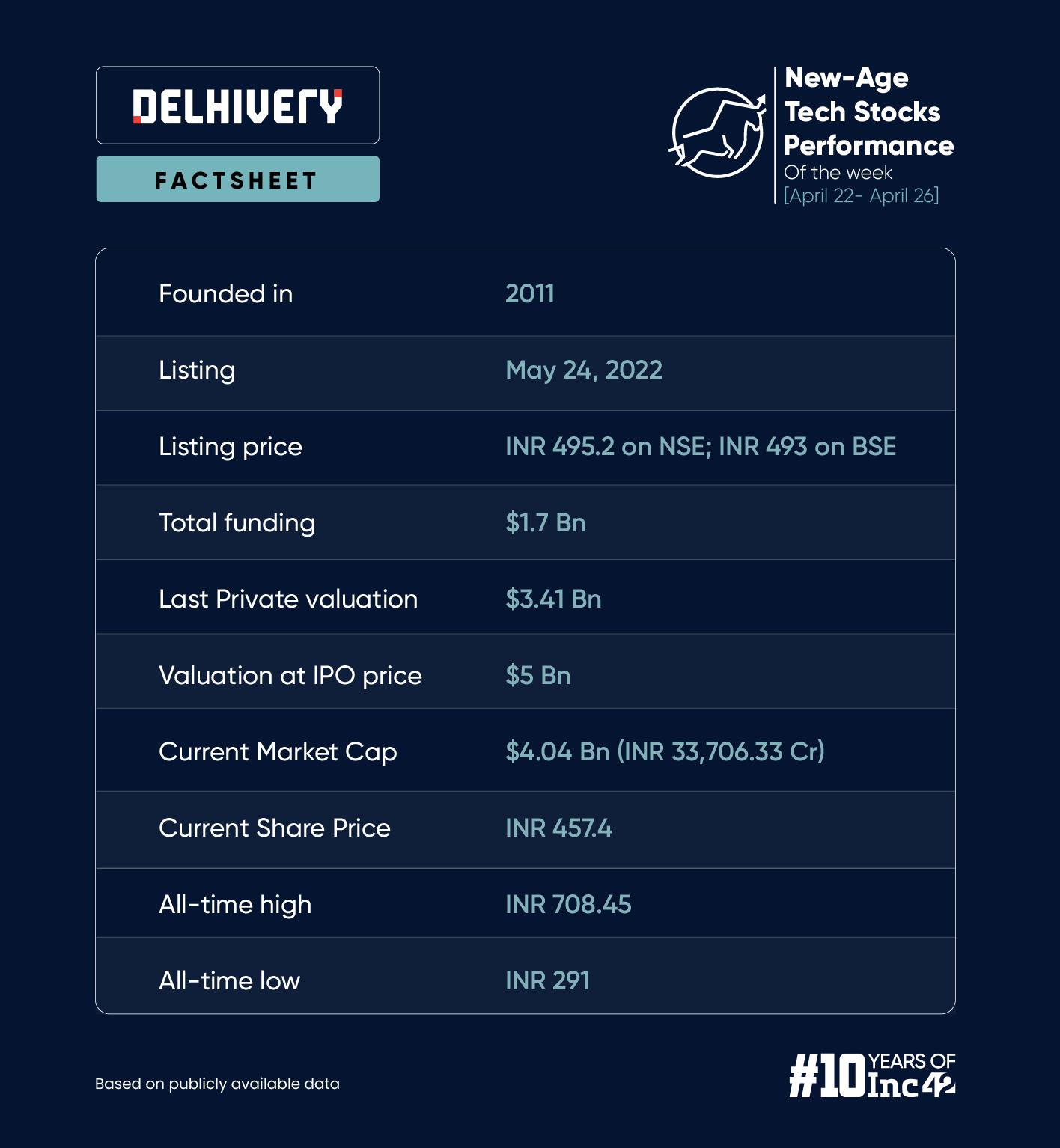

Canada Pension Plan Investment Board Offloads Delhivery Stake

In another block deal in Delhivery, Canada Pension Plan Investment Board offloaded nearly half of its stake for INR 908 Cr.

The fund held 4.38 Cr shares in Delhivery, or a 5.96% stake, at the end of the March quarter of 2024. It offloaded 2.04 Cr shares in the company.

Meanwhile, the offloaded shares were lapped by American Fund Insurance, HSBC India Infrastructure Equity Mother Fund, and Fidelity.

Overall, Delhivery shares witnessed a volatile week and were up about 0.9% on the BSE.

At INR 457.4, the stock is currently trading over 17% higher year to date.

Commenting on the stock, Jigar S Patel, senior manager, technical research analyst, at Anand Rathi, said Delhivery looks bullish on the charts but has a strong resistance at the INR 490 level.

If the stock closes above this level, it might taste INR 600 also, Patel said. However, he added that the stock is expected to trade sideways in the near term.

Paytm’s New Launch

Amid the rising competition in the soundbox market, fintech major Paytm announced the launch of two new soundboxes this week to receive UPI and credit card on UPI payments.

The company, which has been hit by a regulatory storm due to the Reserve Bank of India’s (RBI’s) recent action on Paytm Payments Bank, said that the new devices are fully made in India and equipped with 4G network connectivity.

Meanwhile, its shares continue to remain bearish. This week, shares of Paytm declined 0.3% to end Friday’s trading session at INR 376.9 on the BSE.

Interestingly, despite the recent regulatory concerns, Indian mutual funds increased their shareholding in Paytm during the March quarter of FY24. The stake of mutual funds in Paytm stood at 6.15% at the end of March quarter as against 4.99% at the end of the preceding December quarter.

However, foreign institutional investors (FIIs) lowered their stake in the startup to 60.41% at the end of the March quarter from 63.72% at the end of the December quarter.

Anand Rathi’s Patel said that Paytm looks weak on the charts and the support for the stock is seen at around INR 375.

“If it goes below INR 375 next week, then the shares might fall further till INR 350 or lower,” he added.

Ad-lite browsing experience

Ad-lite browsing experience