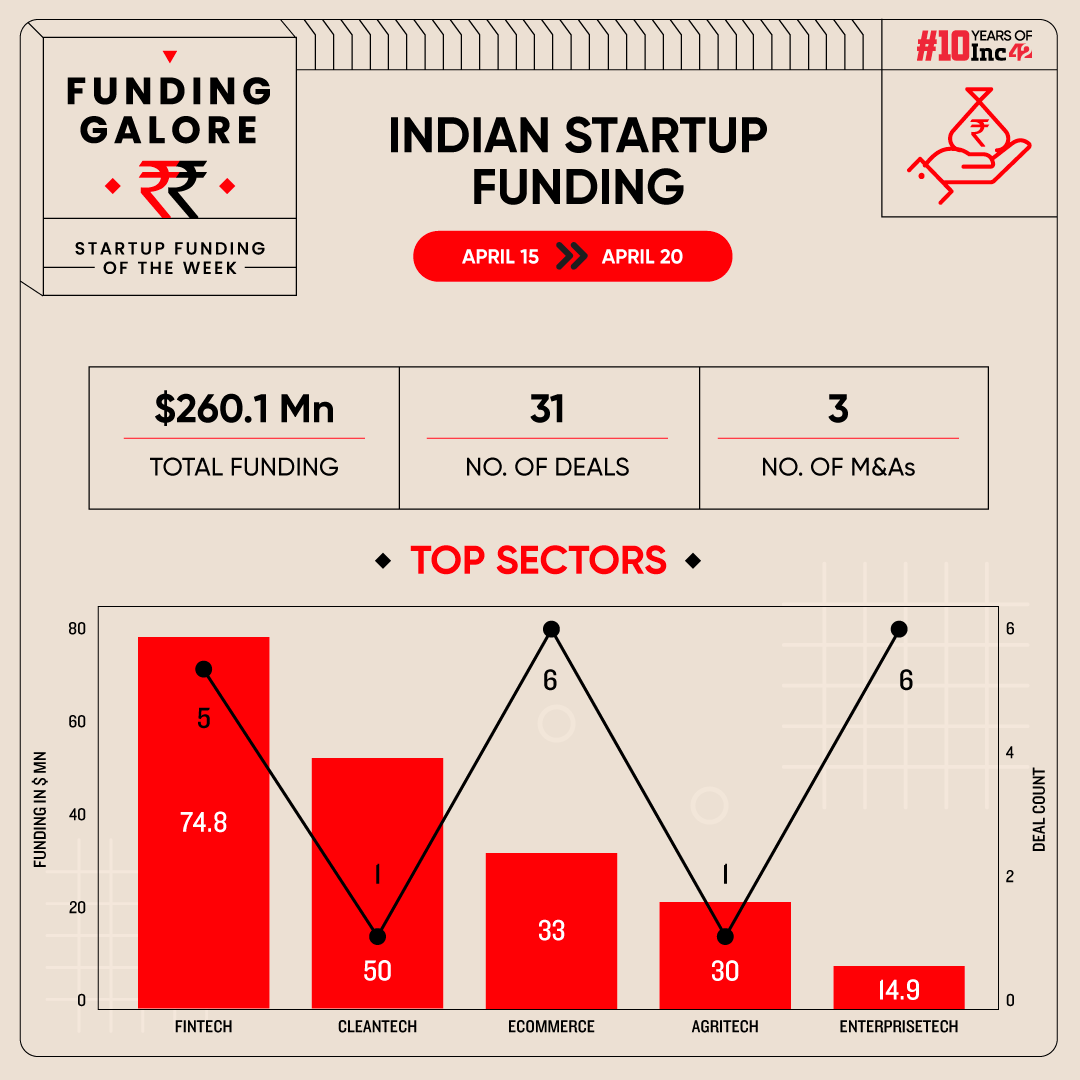

Indian startups cumulatively raised $260.1 Mn from 31 deals between April 15-20

Fintech took the leader spot this week with startups in the sector cumulatively raising $74.8 across 5 deals

Seed funding slightly picked up this week to $26.2 Mn, a 17% increase from $21.6 Mn from last week

After an uptick in the investment activity across the Indian startup ecosystem, funding saw a marginal dip in the third week of April. Between April 15 and 20, startups cumulatively raised $260.1 Mn across 31 deals, a 9% drop from $286.3 Mn secured across 16 deals in the preceding week.

Note: This week’s funding galore also includes deals from the preceding week

Funding Galore: Indian Startup Funding Of The Week [April 8 – April 20]

Date

Name

Sector

Subsector

Business Model

Funding Round Size

Funding Round Type

Investors

Lead Investor

11 Apr 2024

iBUS

Enterprisetech

Horizontal SaaS

B2B-B2C

$200 Mn

–

National Investment and Infrastructure Fund

National Investment and Infrastructure Fund

16 Apr 2024

GPS Renewables

Cleantech

Waste management

B2B

$50 Mn

Debt

Punjab National Bank, HDFC Bank, Yes Bank, HSBC Bank, Kotak Mahindra Bank, ICICI Bank, Citibank, Vivriti Capital, Northern Arc, Spark Capital, Tata Capital, SIDBI

–

18 Apr 2024

Altum Credo

Fintech

Lendigtech

B2C

$40 Mn

Series C

Z3Partners, Oikocredit, British International Investment, Aavishkaar Capital, Amicus Capital

Z3Partners, Oikocredit

16 Apr 2024

ProcMart

Ecommerce

B2B Ecommerce

B2B

$30 Mn

Series B

Fundamentum Partnership, Edelweiss Discovery Fund, Paramark Ventures, Sixth Sense Ventures, IndiaMART

Fundamentum Partnership, Edelweiss Discovery Fund

19 Apr 2024

Ecozen

Agritech

Farm Inputs

B2C

$30 Mn

Equity and Debt

Nuveen, InCred Credit Fund, US International Development Finance Corporation

Nuveen

10 Apr 2024

Neysa

Enterprisetech

Horizontal SaaS

B2B

$20 Mn

Seed

Matrix Partners India, Nexus Venture Partners, NTTVC

Matrix Partners India, Nexus Venture Partners, NTTVC

9 Apr 2024

Sprinto

Enterprisetech

Horizontal SaaS

B2B

$20 Mn

Accel, Elevation Capital, Blume Ventures

Accel

10 Apr 2024

Recykal

Cleantech

Waste management

B2B

$13.2 Mn

Pre-Series B

360 ONE Asset Management

360 ONE Asset Management

17 Apr 2024

RING

Fintech

Lendigtech

B2C

$12 Mn

–

Trifecta Capital

Trifecta Capital

15 Apr 2024

JJG Aero

Deeptech

IoT & Hardware

B2B

$12 Mn

–

CX Partners

CX Partners

18 Apr 2024

Beyond Odds

Edtech

Online Certification

B2C

$11 Mn

Seed

Matrix Partners India, Lightspeed India, InnoVen Capital, Alteria Capital, Ritesh Agarwal, Gaurav Munjal, Mayank Kumar, Ramakant Sharma, Sumer Juneja

Matrix Partners India, Lightspeed India

15 Apr 2024

Varthana

Fintech

Lendigtech

B2B-B2C

$10 Mn

Debt

BlueOrchard Finance

BlueOrchard Finance

11 Apr 2024

AVIOM HFC

Fintech

Lendigtech

B2C

$10 Mn

Debt

BlueOrchard Microfinance Fund

BlueOrchard Microfinance Fund

18 Apr 2024

Uniqus Consultech

Enterprisetech

Enterprise Services

B2B

$10 Mn

Series B

Nexus Venture Partners, Sorin Investments

Nexus Venture Partners

17 Apr 2024

LightFury

Media & Entertainment

Gaming

B2C

$8.5 Mn

Seed

Blume Ventures, MIXI, Gemba Capital, Kunal Shah, Gaurav Munjal

Blume Ventures

17 Apr 2024

Wow! Momo

Consumer Services

Hyperlocal Delivery

B2C

$8.3 Mn

–

Z3Partners

Z3Partners

15 Apr 2024

RupeeRedee

Fintech

Lendingtech

B2C

$7.8 Mn

Equity and Debt

InCred Finance, Grow Money Capital, APV Management

InCred Finance, Grow Money Capital

16 Apr 2024

ClickPost

Logistics

Logistics SaaS

B2C

$6 Mn

Series A

Inflexor Ventures Partners, Athera Venture Partners, Riverwalk Holdings, Rebright Partners

Inflexor Ventures Partners, Athera Venture Partners

8 Apr 2024

axio

Fintech

Lendingtech

B2C

$6 Mn

Debt

Alteria Capital

Alteria Capital

8 Apr 2024

Planys

Deeptech

Robotics Process Automation (RPA)

B2B

$5 Mn

–

Ashish Kacholia

Ashish Kacholia

15 Apr 2024

ClaimBuddy

Fintech

Fintech SaaS

B2B

$5 Mn

Series A

Bharat Innovation Fund, CAC Capital, Chiratae Ventures, Rebright Partners

Bharat Innovation Fund

14 Apr 2024

Butterfly Learnings

Healthtech

Home Healthcare

B2C

$3.8 Mn

Series A

Insitor Impact Asia Fund, Enzia Ventures, IIMA Ventures, Foundation Botnar, 9 Unicorns, Venture Catalysts

Insitor Impact Asia Fund, Enzia Ventures

16 Apr 2024

Medulance

Healthtech

Healthcare Services

B2C

$3 Mn

Series A

Alkemi Growth Capital, Dexter Capital, Aman Gupta, Namita Thapar

Alkemi Growth Capital

11 Apr 2024

AutoNxt Automation

Cleantech

Electric Vehical

B2C

$3 Mn

Pre-Series A

Saama Capital, Amit Singhal, Bluehill Capital, Keiretsu Forum, Soonicorn Ventures

Saama Capital

12 Apr 2024

Arrivae

Ecommerce

D2C

B2C

$2.5 Mn

Series B

Mithun Sacheti

Mithun Sacheti

15 Apr 2024

Clientell

Enterprisetech

Horizontal SaaS

B2B

$2.5 Mn

Seed

Blume Ventures, Chiratae Ventures, Artha Venture Fund, Z5 Capital

Blume Ventures

18 Apr 2024

ZEPIC

Enterprisetech

Horizontal SaaS

B2B

$2.1 Mn

Pre-Seed

Neon Fund

–

19 Apr 2024

Spintly

Deeptech

IoT & Hardware

B2B

$2 Mn

Seed

Accel, Chakra Growth Fund

–

18 Apr 2024

Includ

Ecommerce

D2C

B2C

$1.5 Mn

Seed

Incubate Fund Asia, Escape Velocity, Abhishek Goyal, IIM Indore Alumni Angel Fund

Incubate Fund Asia

11 Apr 2024

Age Care Labs

Healthtech

Home Healthcare

B2C

$1.2 Mn

–

SIS Limited

SIS Limited

16 Apr 2024

Amwoodo

Ecommerce

D2C

B2C-B2B

$1 Mn

–

Rainmatter

Rainmatter

18 Apr 2024

Circle Of Games

Media & Entertainment

Gamming

B2C

$1 Mn

–

Nazara Technologies, Hashgraph Association

–

8 Apr 2024

PlatinumRx

Healthtech

Online Pharmacy

B2C

$800K

Seed

India Quotient

–

10 Apr 2024

Zulu Defence Systems

Deeptech

Dronetech

B2B

$750K

Seed

Finvolve

Finvolve

16 Apr 2024

Varco Leg Care

Ecommerce

D2C

B2C

$500K

Seed

Sunicon Maiden Fund

Sunicon Maiden Fund

15 Apr 2024

WeCare

Healthtech

Diagnostics Services

B2C

$350K

–

–

–

16 Apr 2024

PlanckDOT

Enterprisetech

Horizontal SaaS

B2B

$350K

–

–

–

18 Apr 2024

Sapience Automata

Deeptech

Robotics Process Automation (RPA)

B2C-B2B

$210K

Seed

Inflection Point Ventures

Inflection Point Ventures

11 Apr 2024

Garden of Joy

Consumer Services

B2C-B2B

$101K

Seed

Inflection Point Ventures

Inflection Point Ventures

11 Apr 2024

Simactricals

Cleantech

Hyperlocal Services

B2C-B2B

$90k

Pre-Seed

SanchiConnect

-t

16 Apr 2024

IWill

Healthtech

Telemedicine

B2C

–

–

Microsoft

–

15 Apr 2024

TraqCheck

Enterprisetech

Horizontal SaaS

B2B

–

–

Caret Capital, Culture Cap

–

15 Apr 2024

Advance Mobility

Logistics

Supply Chain

B2B

–

–

GrowthCap Ventures

GrowthCap Ventures

10 Apr 2024

Blue Tokai Coffee Roasters

Ecommerce

D2C

B2C

–

–

12 Flags Group

–

18 Apr 2024

Svish

Ecommerce

D2C

B2C

–

–

Ruchirans Jaipuria, Shikhar Dhawan

–

16 Apr 2024

EMotarad

Ecommerce

D2C

B2C

–

–

MS Dhoni

–

9 Apr 2024

BlackCarrot

Ecommerce

D2C

B2C

–

–

Neha Dhopia

–

17 Apr 2024

Almonds Ai

Enterprisetech

Horizontal SaaS

B2B

–

–

–

–

Source: Inc42

*Part of a larger round

Note: Only disclosed funding rounds have been included

Key Startup Funding Highlights Of The Week

- While we saw a mega deal last week, with iBUS’ securing $200 Mn funding from NIIF, there were no mega deals this week.

- Cleantech startup GPS Renewables secured a $50 Mn debt round on April 16, marking the largest fundraise of the week.

- At a sectoral level, fintech hogged the limelight this week, as startups in the space cumulatively raised $74.8 Mn across 5 deals. Total funding for fintech startups stood at $16 Mn last week across two deals.

- Last week’s leader enterprisetech slipped to the fifth spot with startup’s cumulatively raising $14.95 Mn. However, the sector saw the highest number of six deals this week.

- VC firms Chiratae Ventures, Rebright Partners, Blume Ventures and Z3Partners were the most active investors this week, backing two startups each.

- Seed funding slightly picked up this week to $26.2 Mn, a 17% increase from $21.6 Mn from last week.

Startup Acquisitions From Last Two Weeks

- Marking its fourth acquisition in the gaming space after Calling Station, Spartan Poker and BatBall11, OneVerse Gaming bought online poker platform PokerSaint.

- News aggregator DailyHunt’s parent VerSe Innovation acquired digital newsstand platform Magzter. With the acquisition, VerSe launched DailyHunt Premium, a subscription-based service that will grant users access to premium content.

- Aurionpro Solutions is set to acquire a 67% stake in banking and insurance focused PaaS startup Arya.ai in a deal valued at $16.5 Mn.

- Last week on April 12, enterprise tech startup Postman acquired SaaS platform Orbit for an undisclosed amount.

- On April 9, Cloud kitchen startup Ghost Kitchens India announced the acquisition of The Shy Tiger in an all-cash deal.

- Manav Garg led Eka was acquired by US-based private equity firm Symphony Technology Group (STG) on April 8. The Bengaluru-based CTRM software company was merged with STG owned UK based Quor Group.

Startup Fund Launches Of This Week

- Venture capital (VC) firms Caret Capital and Ev2 Ventures joined forces to launch Caret Capital Fund II, a $50 Mn India-focussed fund.

- Angel Network BizDateUp launched an INR 200 Cr Category I Alternative Investment Fund (AIF) to invest in technology startups.

- Revenue-based financing startup Klub joined hands with U GRO Capital to disburse INR 150 Cr credit to digital small and medium enterprises (SMEs) across different growth stages.

- Zerodha’s Nikhil Kamath launched ‘WTFund’, a new grant initiative for young entrepreneurs below the age of 25. The fund will back up to 40 startup founders with a non-dilutive grant of INR 20 Lakh each.

Other Major Developments From The Last Two Weeks

- With its sights set on becoming India’s 116th unicorn, proptech startup Square Yards is in talks with investors to raise $120 Mn at a valuation of over $1 Bn, sources told Inc42.

- Affiliate marketing startup Flickstree is in talks with new and existing investors to raise $10 Mn-$12 Mn in its Series B round. It plans to use fresh funds to expand its presence beyond India.

- Ecommerce unicorn Meesho is looking to raise $500-$650 Mn from investors at a valuation of $3.9 Bn. This will potentially peg the startup 20% lower than its last reported valuation of $4.9 Bn.

- Agritech startup Ninjacart invested in Philippines-based agri-fisheries startup Mayani. The fresh investment was made through its VC arm Ninja Ventures as a part of its global expansion plans.

- CaratLane founder Mithun Sacheti and Flipkart cofounder Binny Bansal joined early-stage fund Xeed Ventures as anchor limited partners (LPs).

- IIM Ahmedabad’s startup incubator has announced its support for 14 startups from Indore in its first Cohort of the Indore Smart City Accelerator programme.

- Electric vehicle (EV) manufacturer Bounce Infinity is in talks with new as well as existing investors Peak XV Partners, Accel Partners, and Falcon Edge to raise a funding round of up to $40 Mn within the next three months.

- Lightspeed Venture Partners saw two top level exits last week with India arm’s partner Abhishek Nag and partner from US fund Vaibhav Agrawal stepping down.

- Private equity (PE) firm Singularity Growth announced on April 10 that it has invested INR 400 Cr in Lohum, Akshayakalpa, and three others from its second fund – Singularity Growth Opportunities Fund II.

- Early last week, investment firm Filter Capital announced the final close of its maiden CAT II AIF growth-stage fund – Filter Capital India Fund I – at INR 800 Cr (close to $100 Mn).

Ad-lite browsing experience

Ad-lite browsing experience