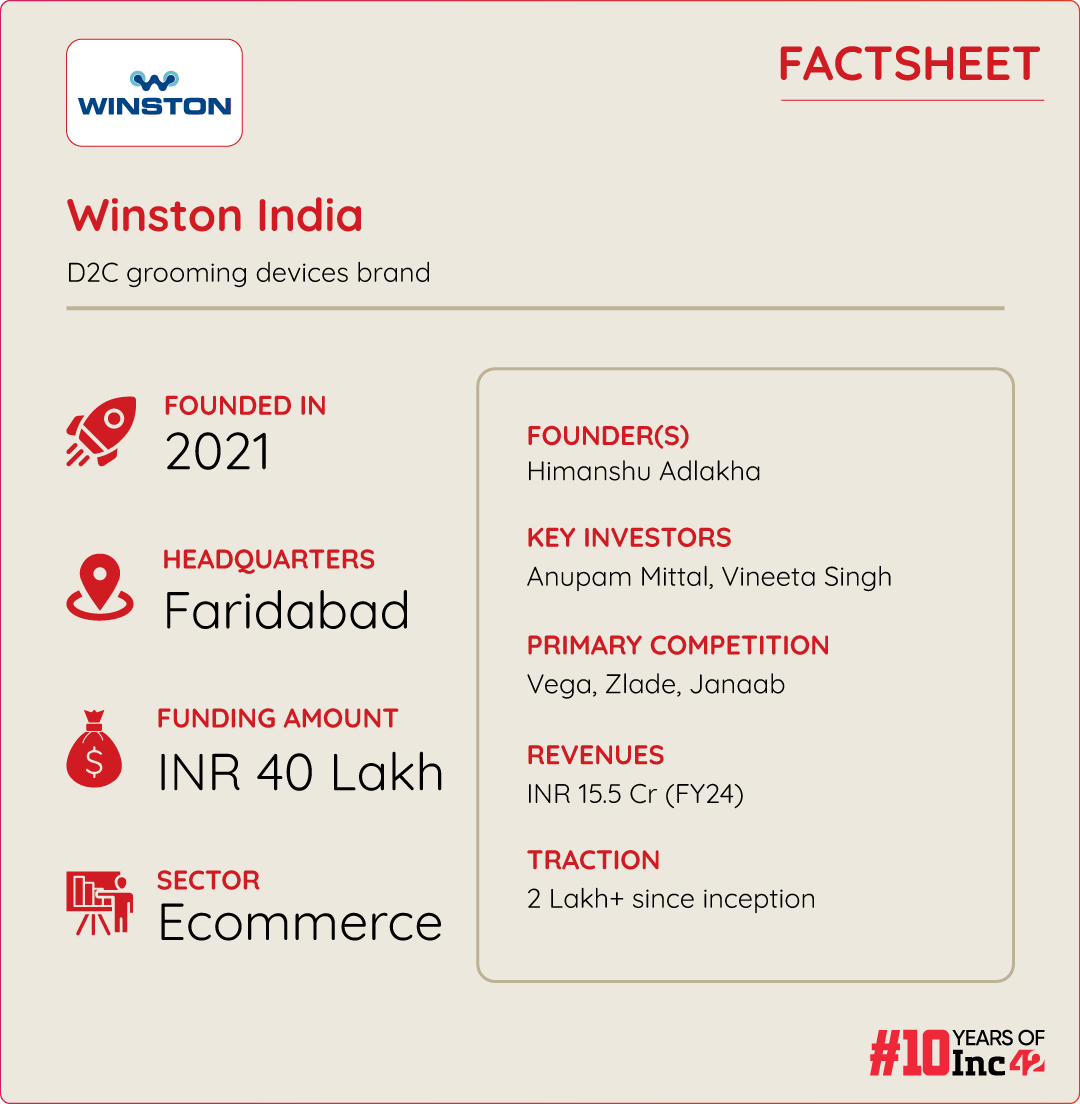

Founded in 2021, Winston is a D2C personal care electronics brand, which locks horns with goliaths like Philips, Vega, Xiaomi, and Beardo, among others, in the crowded Indian hair clipper market, projected to become a $2.05 Bn market opportunity by 2029

The startup was able to raise INR 20 Lakh each from SUGAR Cosmetics's Vineeta Singh and Shaadi.com's Anupam Mittal, when it appeared on Shark Tank India last year

Adlakha is optimistic about the company's future, as he has set his eyes on capturing a 5-6% of the Indian hair trimmer market, which he estimates to be currently worth INR 8,500

When Himanshu Adlakha completed his engineering degree in 2013, he had a clear goal in mind — to join his family’s import and export consumer electronics business while establishing a brand in the rapidly growing beauty and personal care industry.

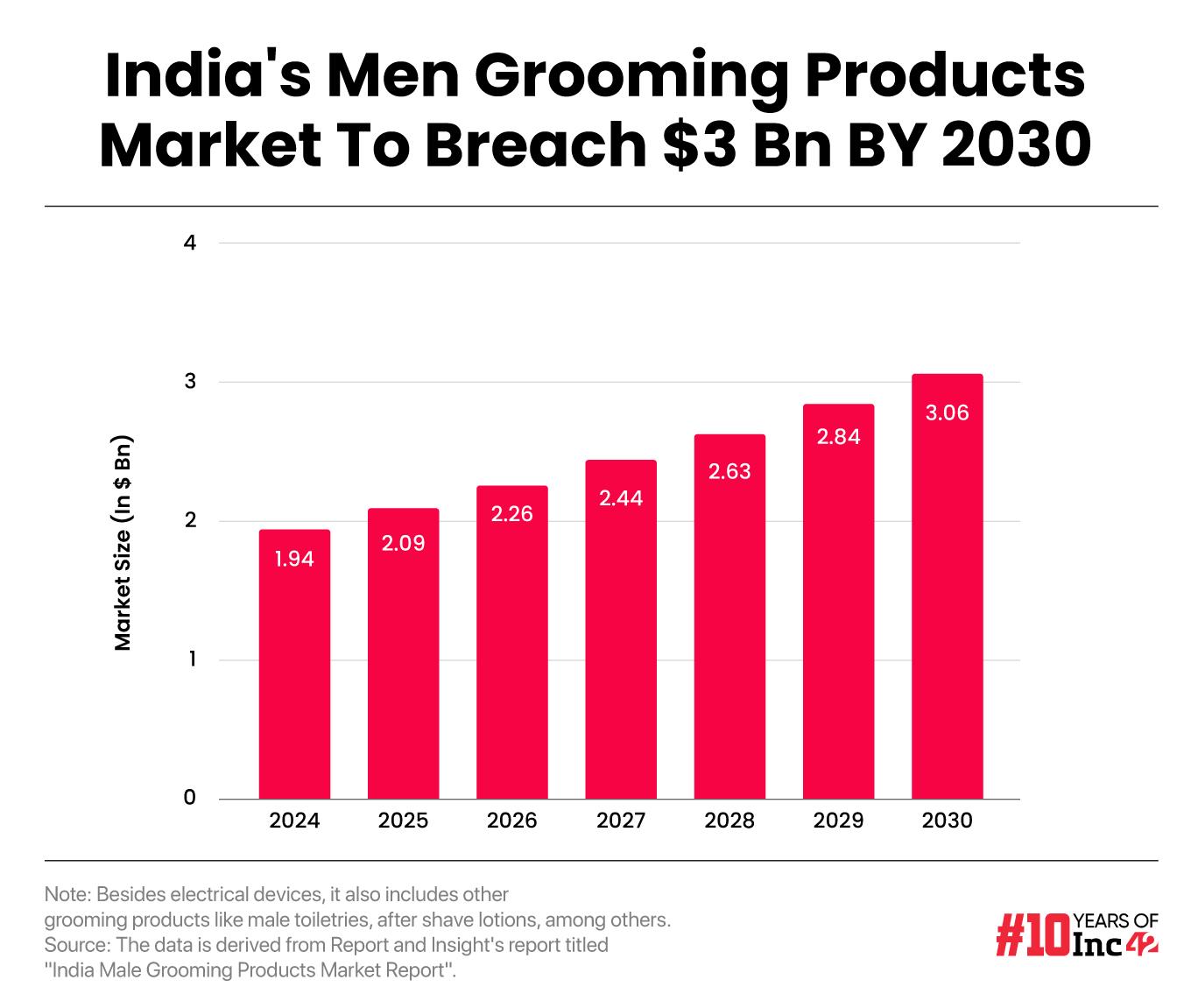

More than a decade later, Adlakha is the cofounder of Winston, a D2C personal care electronics brand, which locks horns with goliaths like Philips, Syska, Vega, Xiaomi, and Beardo, among others, in the crowded Indian hair clipper market, projected to become a $2.05 Bn market opportunity by 2029.

It is, however, imperative to mention that Adlakha’s road to the incorporation of Winston in 2021 and getting featured on Shark Tank India in 2023 has been a long and challenging one.

Nevertheless, the founder claims to have garnered a revenue of INR 15.5 Cr in the financial year 2023-24 (FY24) against a revenue of INR 4.78 Cr in FY23. He has set his eyes on generating INR 45 Cr in FY25.

Adlakha claims to have served a combined customer base of 2 Lakh users. It sells various types of hair clippers and other electronic beauty and personal care products such as blow dryers, electric toothbrushes, massagers, etc. via its website and online marketplaces.

Winston: The Pandemic Kid

After completing his engineering studies in 2013, Adlakha was set to join his father’s import-export business, Global Electronics Distribution. The company manages the offline distribution of consumer durable goods for brands like LG, Blue Star, and Philips.

Although the prospect of having a stake in the distribution business excited him, Adlakha was more inclined toward building a brand in the personal care space.

To gain a deeper understanding of how some of the biggest companies in this segment functioned, Adlakha interned at Philips for six months.

“During my time with Philips, I learned about the brand’s procurement process, distribution strategies, and marketing tactics for each product,” he told Inc42.

While his family’s business had already established a robust distribution system over decades, Adlakha realised that understanding procurement was crucial for setting up his own brand in the personal care industry. Applying his insights from Philips, he ventured into China to build connections with manufacturers, and with this, he was ready to mark his foray into the Indian personal care market.

However, much to his chagrin, just when he felt that the time was ripe for him to take the Indian market by storm with his innovative products, the Covid-19 pandemic brought the world to its knees.

An undeterred Adlakha took the help of his wife, Nikita Malhotra, an established businesswoman managing Indian distribution for the US-based women’s personal care brand Flawless, to gauge market sentiment in the personal care space.

“Nikita identified a significant demand for reasonably priced personal care products operating on dry batteries,” Adlakha said.

Based on the discovery, the duo realised that the market conditions were ideal for launching their first product, a face trimmer.

“Designed by a Chinese manufacturer, we imported a small batch and started selling the product through partnerships with a few influencers. Within 16 days, the entire batch of 5,000 products was sold out,” the founder said.

Since then, Winston has expanded its product portfolio from just a beard trimmer to include eyebrow trimmers, callus removers, LED face masks, bikini hair removers, and a total of 18 SKUs. He also claims that Winston has maintained a profit before tax (PBT) rate of 9-9.5% over the past couple of years.

Yet, several key challenges remain for the founder, the biggest one being the company’s China problem.

Winston’s China Problem

While Winston’s product aesthetics may rival many premium brands in the personal grooming sector, its primary USP lies in its diverse product portfolio.

Leveraging a meticulously curated import channel from China, Winston offers a brand appeal and proposition for products at significantly lower prices than its competitors.

It is on the back of this product differentiation that the startup was able to raise INR 20 Lakh each from SUGAR Cosmetics’s Vineeta Singh and Shaadi.com’s Anupam Mittal, when it appeared on Shark Tank India last year.

However, despite making a market presence with its products and attracting the interest of the industry’s top brass, Winston grapples with the issue of managing perceptions when it comes to its China-made product portfolio.

Notably, it is a common perception around the world that China is the leader in producing cheap electronics whose quality and durability cannot be trusted.

In addition to becoming the victim of the stigma attached to the Chinese production of goods, Winston’s heavy reliance on Sino manufacturers exposes it to the risk of being undercut by cheaper Chinese alternatives available in India.

Adlakha saw this issue emerging from a mile away. Therefore, to keep the same at bay, he chose to develop his own designs based on the feedback of its users.

Initially, the company narrowed down to five designs, the moulds of which were then sent to China for manufacturing. The founder said that he invested INR 35-40 Lakh per mould so that he could float fresh designs in the market.

However, he said that he got the shock of his life when he recently found that cheap counterfeits of Winston’s products were selling like hotcakes in the unorganised markets of both India and China.

However, Adlakha said that this won’t deter him from experimenting and floating new designs, as he knows that even the biggest of the brands aren’t immune to the China problem.

To counter this, the founder’s next move will be to set up a manufacturing-cum-assembly unit soon. For this, he is in talks with a few investors to raise funds. In the short term, the startup founder plans to expand its SKUs to 18 from 12 currently.

Way Forward For Winston

Speaking about his plans to establish a manufacturing unit in India, Adlakha said that the Make in India movement has led to a shift in the manufacturing of many electronics products back to India as the country’s manufacturing infrastructure has improved.

“However, in Winston’s segment, this is still not a reality, and dependency on China remains prevalent across the industry. We are actively in talks with investors to raise a fresh round of funding to build an assembly plant in India so that testing and final approval of the product can happen within the country,” Adlakha said.

Adlakha said that Wisnton is eyeing the raise of INR 8.5 Cr (approx. $1 Mn) at a valuation of INR 81 Cr, with the deal expected to materialise within three to six months. Investors such as Gruhas Collective Consumer Fund (GCCF), V3 Ventures, Beyond Seed Ventures, and Mumbai Angels are likely to participate in the round.

Despite the ongoing manufacturing challenges, Adlakha is optimistic about the company’s future prospects. This is because he has set his eyes on capturing a 5-6% of the Indian hair trimmer market, which he estimates to be currently worth INR 8,500.

His confidence stems from Winston’s strong USP of offering high-quality grooming products at lower prices. The company is also preparing to launch a new product line, which Adlakha describes as the ‘Affordable Luxury’ range, featuring products comparable to Dyson but at a fifth of the price.

Yet, the company’s growth trajectory heavily relies on the China import cycle, which Adlakha is currently looking to cull. His direction is in sync with the Indian government’s vision to significantly curb the country’s reliance on China as India is actively making strides towards becoming a global manufacturing hub, with international giants like Apple and Tesla, too, making a beeline to manufacture in the country.

Ad-lite browsing experience

Ad-lite browsing experience