If and when its latest round materialises, Zepto would have raised nearly $1.2 Bn since inception in 2021

The quick commerce game in India right now is a game of stealing the spotlight. If Blinkit grabbed the attention with its FY24 performance last month, it’s time for Zepto

This past week, Zepto was in the spotlight for two very different reasons, which underline the present state of the quick commerce business.

First, the Mumbai-based unicorn grabbed attention with a head-turning $650 Mn round, talks for which are said to be in the final stages. That’s a massive infusion for a three-year-old company, but also speaks volumes about what it takes to grow a quick commerce business, and it’s not just for Zepto, mind you.

Second, an ice cream delivered by Zepto to a Mumbai customer was found to be contaminated with a human finger. The social media meme fest aside — and there were plenty of them — the issue highlighted that scaling up rapidly comes with some serious challenges that also have to be addressed by Zepto, Blinkit, Swiggy and other players.

So this Sunday, let’s take a look at the other side of the quick commerce boom. After a brief detour into these top stories from our newsroom this week:

- Kenko In Catch-22: The Peak XV-backed startup is staring at an uncertain future and a potential shut down over an investor deadlock and has even laid off more employees in 2024

- The Sherpa’s View: The former NITI Aayog CEO and current G20 Sherpa for India, Amitabh Kant is bullish about the future of Indian tech particularly given the focus on semiconductor industry, EVs and green energy

- Introducing The D2C Retreat: Inc42 is launching The D2C Retreat, an exclusive 3-day ‘unconference’ bringing together India’s top D2C and retail leaders to drive innovation in Indian retail

Quick Commerce Fuel Guzzlers

By now, there can be no argument that creating and sustaining a large consumer business in India takes plenty of capital. If and when its latest round materialises, Zepto would have raised nearly $1.2 Bn since inception in 2021.

The latest round, which brings in CRED-backer DST Global and Lightspeed, would see the company valued at close to $3.5 Bn, thrusting it into the upper echelons of India’s unicorn club. This is after three full years of operations, one of the most unique journeys in the Indian startup ecosystem for sure.

The fact that Zepto reached a revenue base of INR 2000 Cr+ in its second full year in FY23, which is well higher than many other unicorns shows the massive momentum behind the company and quick commerce. For context, Blinkit only reached that mark in FY24, one year later, despite being around since 2013 as Grofers before pivoting to quick commerce in December 2021.

But what Zepto’s story also shows is how expensive it is to run a quick commerce business. The company has only got here after raising more than $580 Mn thus far, and the next leg of the journey will take more than that.

It’s not just Zepto of course. Zomato is investing INR 300 Cr ($38 Mn) in Blinkit over the next few weeks. The company has invested INR 2,300 Cr ($290 Mn) in Blinkit since the acquisition in August 2022.

Swiggy is looking at an IPO in the next year or so, and is said to be in talks to raise fresh funding before the potential public listing. Swiggy was the first to enter the quick commerce space with Instamart and is expected to close FY24 with revenue of over INR 5K Cr.

Zomato’s infusion comes as ecommerce giant Flipkart and JioMart are set to foray into the quick commerce space. Moreover, Blinkit plans to double its store count in 2024, which would require plenty of capital as well.

Similarly, Zepto is likely to make a major push in terms of adding more locations and expanding the delivery network. The quick commerce platform has added multiple additional revenue streams in addition to commissions from orders to improve its bottom line.

Where’s Zepto Heading?

As cofounder and CEO Aadit Palicha has said several times since last year, Zepto’s advantage is its singular focus on executing the quick commerce model. In terms of revenue, it has worked well at least as far as FY23 is concerned.

Plus, in FY24, Zepto shored up its bottom line further with the introduction of platform fees, handling charges, surge fee and a separate “cart fee” for orders below INR 100. It also unveiled a new membership programme Zepto Pass, starting at INR 99 a month, for select users.

For FY24, the numbers are likely to be significantly higher. Reports in the past said the company claims to be on track to turn EBITDA positive by end of Q2 FY25 with over INR 10,000 Cr in gross order value or GOV.

Even as Zepto pushes for growth, a portion of the new funds are also likely to go towards fulfilling tax obligations for a potential reverse flip from Singapore to India. The startup is said to be close to redomiciling to India and also has eyes on a public listing by 2026.

In Zepto’s corner is the fact that none of its major rivals currently have focussed on building up private labels, whereas the Mumbai-based company launched meat brand Relish in late 2023. Relish is reportedly clocking INR 150 Cr in annual recurring revenue and can be INR 1,000 Cr standalone business by the time Zepto plans its IPO in 2026.

Dark Store Hurdles

Growing competitive intensity is also likely to push Zepto, Blinkit and Swiggy to spend more to acquire users, and it would also complicate expansion plans as more platforms fight for dark store and warehousing space.

And it’s looking increasingly like authorities and consumer protection bodies are looking to take a fine-tooth comb to quick commerce operations.

In this light, the Zepto ice cream incident from this past week makes for bad reading. The company has not officially responded to the incident, but there have been questions about whether quick commerce platforms have their eye on quality of products, expiry dates and hygiene of perishable goods.

While grocery was the primary focus for a long time, platforms are rapidly updating their warehouse and dark store layouts to accommodate new product categories, larger appliances and other products.

At the same time, they are pushing hard to bring D2C brands on board. Quick commerce has given a new meaning to the fast moving consumer goods segment, where products tend to get sold out every day.

In fact, many of these D2C brands themselves are pushing to scale up and quality control issues trickle down to quick commerce quickly. Brands — particularly food and beauty brands — realise that quick commerce is a major channel for them and as a result, they are accelerating manufacturing to meet the demands of these channels.

Besides Zepto, in early June, the Telangana food safety department raided a Blinkit warehouse and found the premises to be “disorganised, unhygienic and dusty”. The department also seized edible items worth INR 82,000 from the premises, which either did not comply with food safety norms or had expired licence.

The Central Consumer Protection Authority (CCPA) had reportedly asked quick commerce players Blinkit, Swiggy Instamart, Zepto and Big Basket (BB Now) to prove their ‘10 minute’ delivery claims. Many of these platforms don’t actually deliver in 10 minutes, though the advertising hinges around this promise.

In the past, we have seen government bodies crack down on ecommerce platforms for counterfeit goods, fake orders, delivery fraud and most recently, predatory pricing and brand or seller bias. Will this focus on cleaning up the online shopping journey trickle down to quick commerce as well?

For now, Zepto, Blinkit, Swiggy Instamart and BBNow might not be under the scanner in a major way, but will the rising competition force companies to cut corners when scaling up?

Will Competition Throw Zepto Off?

No matter how we look at it, Zepto has actually managed to disrupt players such as Zomato-owned Blinkit and Swiggy’s Instamart which should ideally have made the most of their existing scale when quick commerce emerged as a category in 2020.

The company saw that grocery by itself would outpace food delivery, and the mixed focus of Zomato and Swiggy allowed Zepto to come out of the left field.

To be clear, Swiggy and Zomato have the larger network in India till now, but Zepto still continues to enjoy the unique advantage of singular focus over its rivals.

The three-horse quick commerce race is about to change though with the entry of Flipkart and Reliance JioMart, as well as the growing reliance of BigBasket on quick commerce.

The Tata-owned platform has replaced slotted deliveries with BBNow, modelled after Instamart, Blinkit and Zepto, and is pumping in serious marketing dollars to grow its customer base.

Mukesh Ambani-led Reliance Industries Ltd (RIL) is reported to be close to launching its own quick commerce operations through JioMart after taking a punt earlier and pulling out. Reliance is looking to deliver groceries in select cities in under 30 minutes and is likely to ramp up operations by next year.

JioMart will tap into Reliance Retail’s network of over 18,000 stores across the country. That kind of scale would allow JioMart to potentially catapult the existing group of quick commerce apps, Blinkit, Swiggy’s Instamart and Zepto as well as Tata-owned BigBasket and Flipkart.

Flipkart is fresh with funds from Google and majority stakeholder Walmart and is also likely to make a major push for grocery delivery, where Blinkit, Zepto and Swiggy have created a precedent on how to make this work.

Can Zepto continue to bank on its execution and singular focus on quick commerce to succeed in a market, where it not only has to fight off Blinkit and Swiggy, but also giants such as Reliance and Flipkart?

Sunday Roundup: Startup Funding, Tech Stocks & More

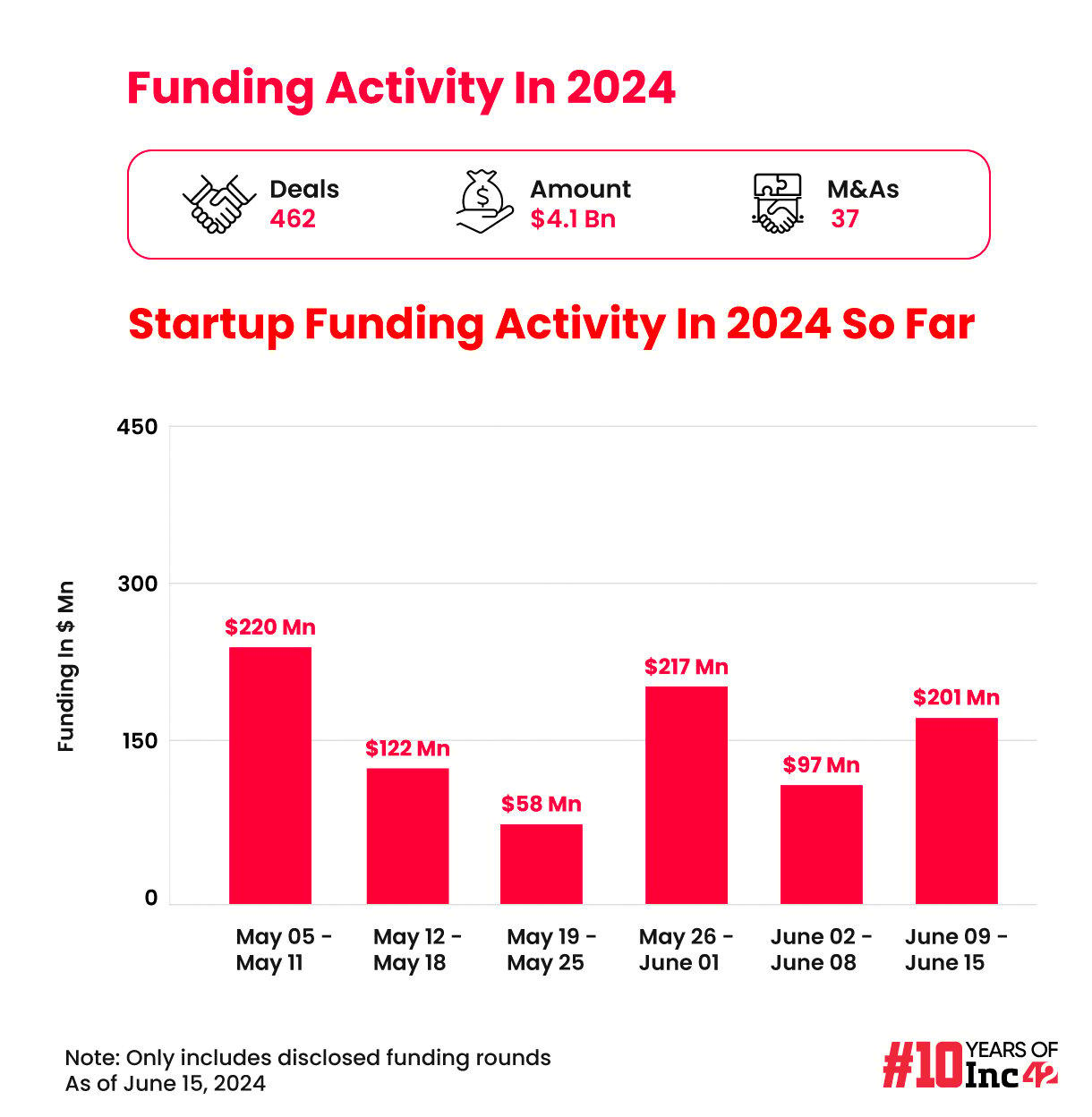

- This past week, startups cumulatively bagged funding of $201 Mn across 21 deals, with Battery Smart’s $65 Mn round making the bulk of this tally

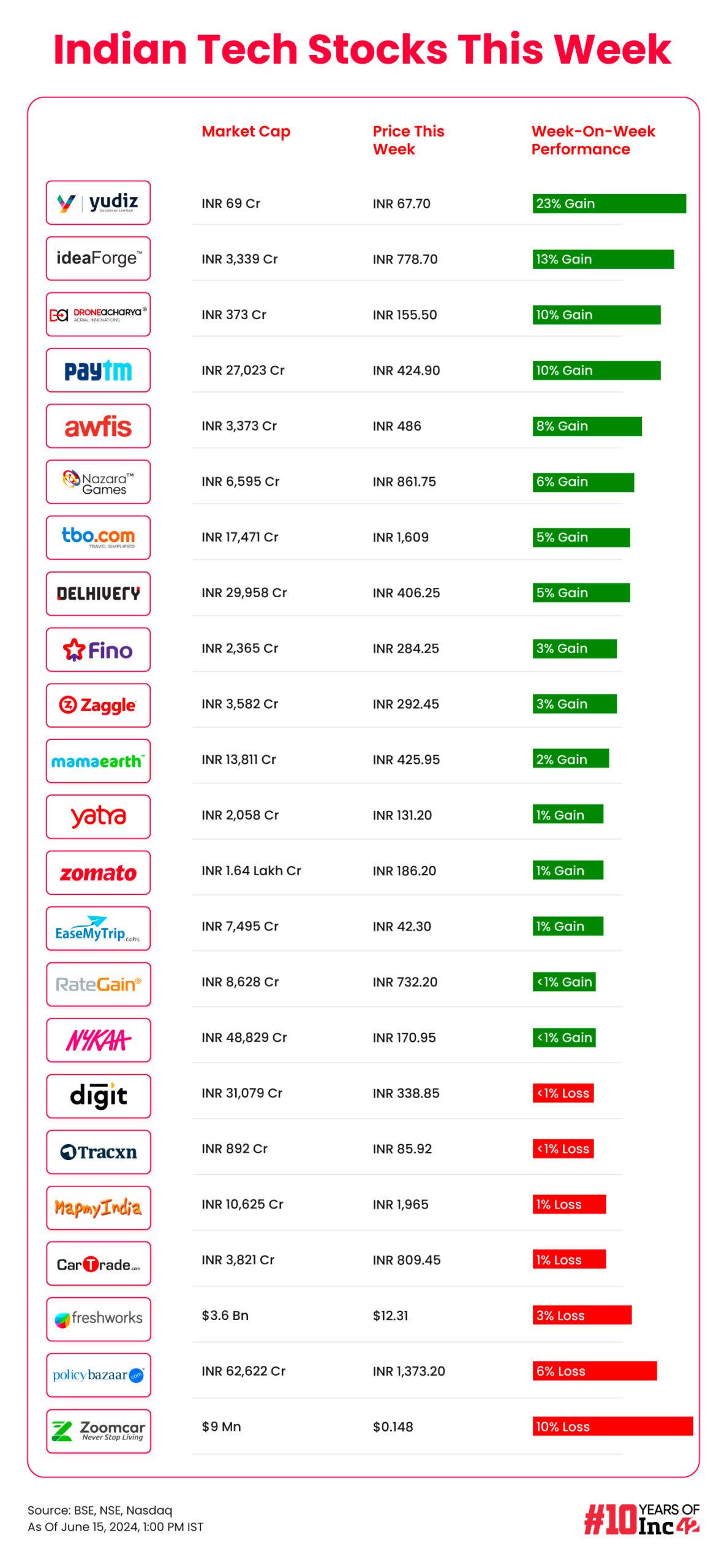

- Nykaa expects its fashion business to only become EBITDA positive by FY26, or nearly two years from now. How will the markets react to this timeline?

- The NCLT has directed BYJU’S to maintain status quo with regard to existing shareholders and their shareholding, effectively putting a halt to its $200 Mn rights issue

- Data from recruitment firms points towards a declining trend in salaries for key edtech roles, with annual pay falling by almost 50% compared to the highs of 2021

- Times Internet has reaped at least $1 Bn from selling its multiple digital properties since 2022, with ET Money’s $44 Mn deal being the most recent example

Ad-lite browsing experience

Ad-lite browsing experience