ReshaMandi’s story is anything but typical because instead of winding down after failures in its business model, the startup is looking to respawn through another company

Founders Mayank Tiwari and Saurabh Agarwal allegedly coerced employees to join Genzr Solutions Private Limited, even as hundreds of former employees await salary dues

The startup, which has raised more than $40 Mn in equity funding since its inception in 2020, is also facing multiple insolvency pleas in the NCLT for unpaid dues to lenders

Three founders come together to launch a startup which is solving a real problem, the startup raises millions from VCs, launches many products and looks to scale up aggressively, but eventually the momentum is stalled and the startup has to wind down.

This is a fairly typical and unremarkable montage of what happens to most startups. But ReshaMandi’s story is anything but typical, because instead of winding down, ReshaMandi is looking to respawn inside another company.

And in the process, investors in ReshaMandi are likely to be left with nothing to show for their capital, while employees that have waited for salaries for months might also be left empty-handed.

Here’s a gist of what’s happening: Hit by a cash crunch and revenue challenges, ReshaMandi started laying off employees in June 2023. It offered employees a ‘chance’ to work without salaries for three months. The employees who did so found out that there was no cash for any of the pending salary payments. These employees are still awaiting their dues.

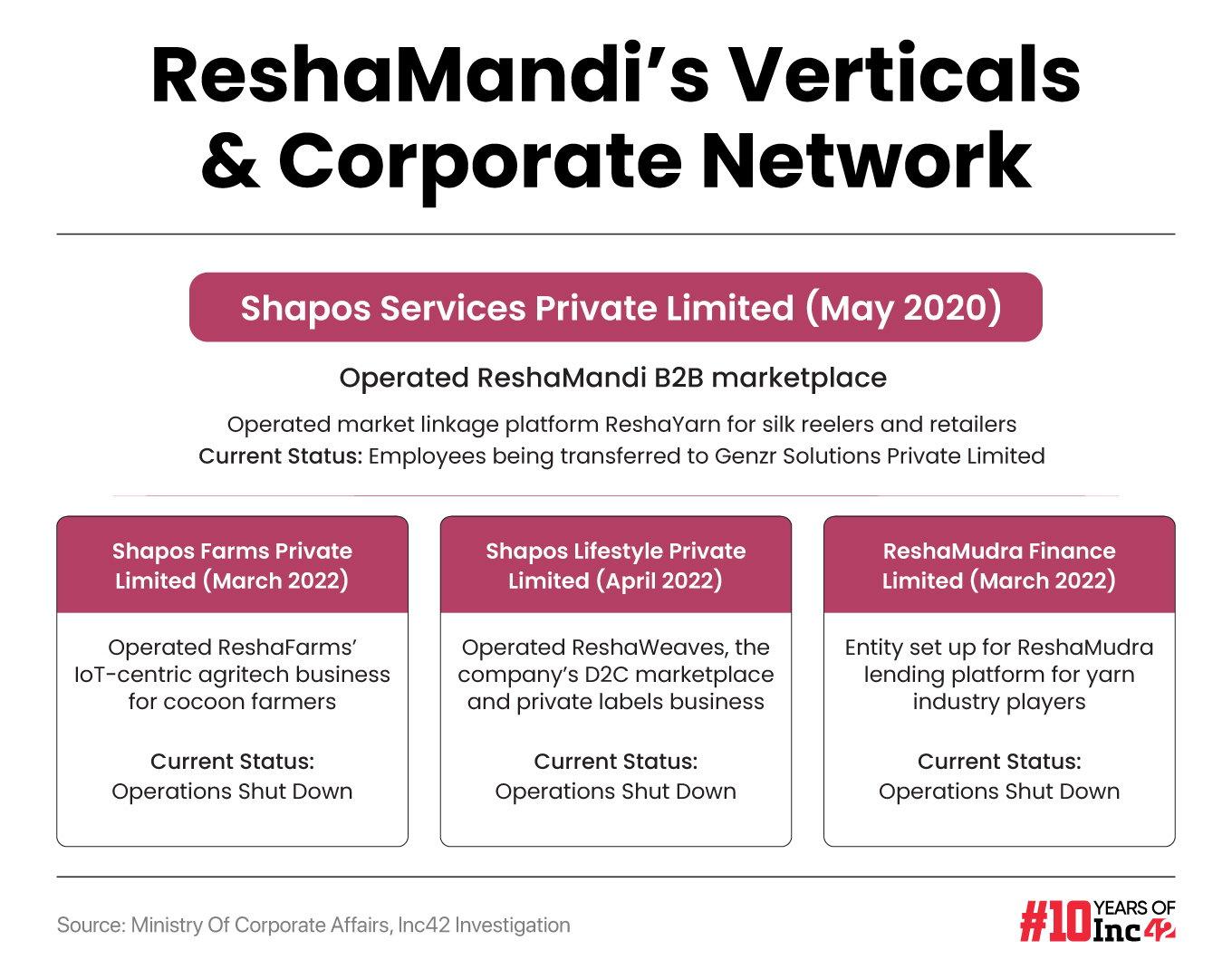

ReshaMandi, which operates a B2B fibre, silk and yarns marketplace and other verticals for silk supply chain, scaled down over the past year.

By December 2023, the workforce had been cut down by nearly 85%, and in March 2024, the few employees that were holding ReshaMandi together despite delayed salaries were given another ‘choice’ — Move from Bengaluru to Noida-based Genzr, operated by Genzr Solutions Private Limited, and get paid the salary backlog as a ‘signing bonus’.

“It’s not just employees who are moving to Genzr. Even the two founders of ReshaMandi have joined Genzr and all key personnel have moved,” according to one of the dozens of former employees and other sources that Inc42 has spoken to over the past few months.

It’s not that such deals are not commonplace, it’s just that Genzr — by all indications — is seemingly not in a position to pull off such a deal.

In fact, till April 2024, Genzr Solutions Private Limited used to go by the name Top 12th Academy Private Limited, which was incorporated in 2009 as an education company. There was no overlap in the business of ReshaMandi and Genzr (Top 12th Academy) till the latter amended its article of association in March 2024 to carry on the business of fibre and silk supply.

Founded in 2020 by Mayank Tiwari, Saurabh Agarwal, and Utkarsh Apoorva (who quit in 2022), ReshaMandi raised $40 Mn+ in equity funding from Creation Investments, Omnivore, Venture Catalysts and other VCs, as well as nearly INR 300 Cr ($25 Mn) in debt from venture debt investors and other lenders.

In FY23, Genzr reported INR 50,000 in revenue — that is not a typo — whereas ReshaMandi reported INR 413 Cr in revenue in FY22 and in the past had claimed to have crossed INR 1,200 Cr in revenue in FY23.

Worse still, employees who ‘joined’ Genzr were asked to do the same work they were doing at ReshaMandi.

“The management is trying to recreate ReshaMandi in another startup as they don’t want to be associated with the previous corporate entity which ran ReshaMandi. So they are starting afresh in another company after burning all the funds raised for ReshaMandi,” one source told Inc42.

Are you starting to see why we said the ReshaMandi story is not simply a story about a failed startup?

So what business does Genzr have paying lakhs of rupees of salary backlog for ReshaMandi? And why did a startup with millions in funding need such a drastic helping hand? Here’s what our investigation showed us.

Where’s The Funding?

It was a yes or no question — “How many of you will be able to work without salaries for the next three months?” ReshaMandi cofounder Mayank Tiwari asked employees exactly one year ago.

The question instilled fear and confusion among 400-odd employees of ReshaMandi, who till then were under the impression that the startup had already raised a new round which would set the company up for growth.

The truth, as many employees alleged in conversations with Inc42, was that there was no money and what began as delays in salaries in June, worsened soon after with no salaries being paid at all.

“I know people who had to take loans to survive in an expensive city such as Bengaluru, while the management didn’t have a clear response on the salary,” one former employee who worked at ReshaMandi until May 2023 and is still unpaid added.

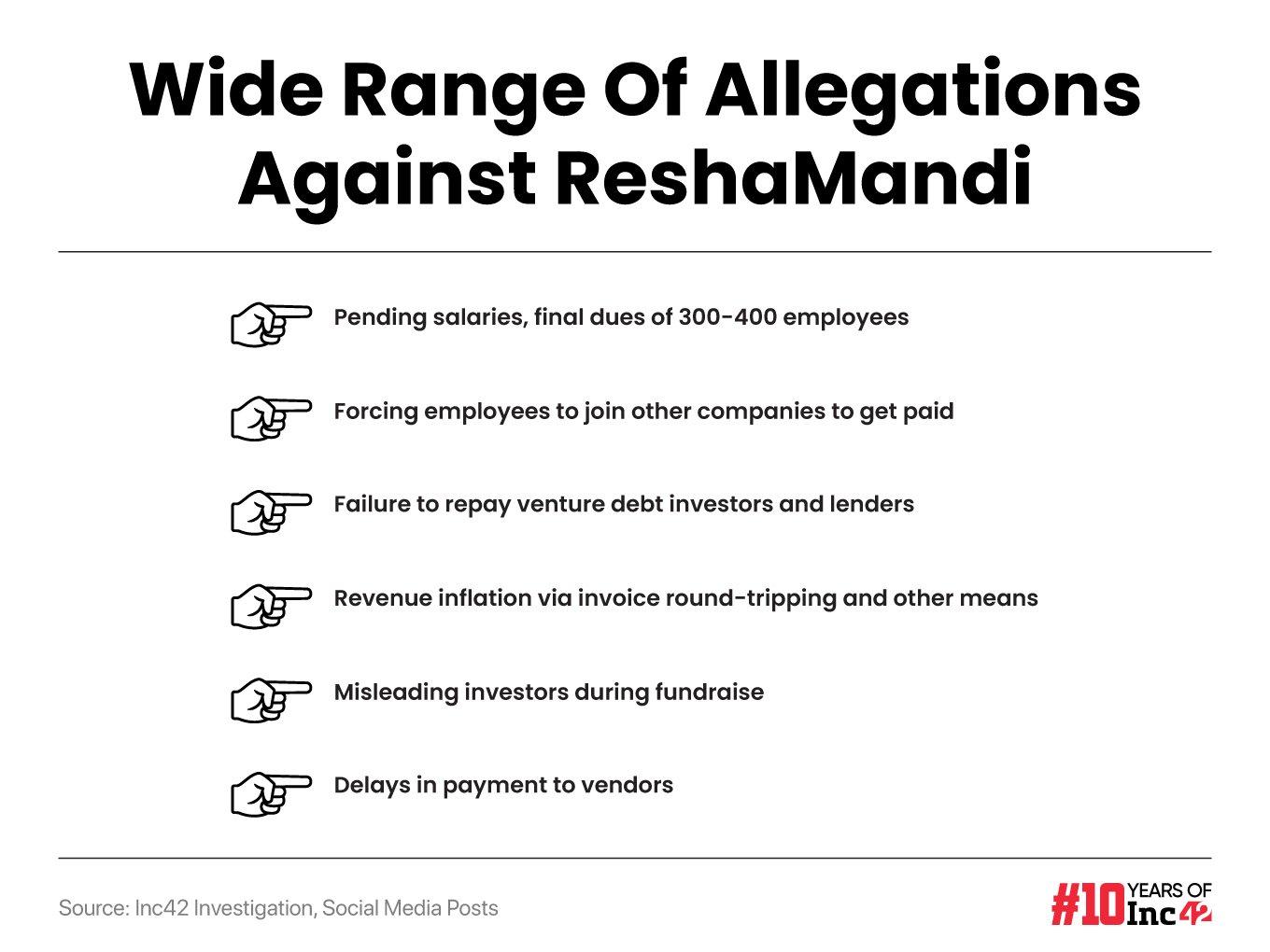

Sources told Inc42 that Reshamandi was facing a host of issues, with allegations ranging from lax corporate governance to financial mismanagement.

From 500 employees in January 2023 to around 100 by the end of the year, the company scaled down heavily. And in the process, 300-odd employees are still awaiting their final dues and salaries. Besides this, ReshaMandi is said to have failed to credit tax deducted at source (TDS) and provident fund contributions for these employees, despite deducting these amounts on the pay slip.

In response to our questions, ReshaMandi said: “At the foremost, we would like to mention that ReshaMandi was established in 2020 to bridge the gap existing in the ecosystem today, solving for which could set India as the top silk superpower and would have helped us set our name in the agritech space.”

However, the company did not respond to specific questions around allegations of financial mismanagement, the involvement of Genzr Solutions, why Reshamandi expanded into new verticals and then scaled back in two years.

The statement from the company further claimed that the first few quarters of 2023 saw tremendous growth where revenue grew by 3X compared to 2022. “However, we started to face some challenges which are a normal course of business for a company in our space i.e. collections from our retailers and the funding winter which impacted almost every startup in the ecosystem in one way or the other.”

ReshaMandi also claimed that there are no corporate governance issues or company restructuring. And it added: “Owing to the challenges we saw based on the financial crunch we are trying to navigate, we had to take some calls to keep the company afloat. Those decisions were taken in the best interest of the company and to be accountable for the fiduciary responsibility we have towards our shareholders, board members and lenders.”

But the company declined to explain the Genzr connection, nor did it tell us what happened to the millions that Reshamandi had already raised for its operations.

Expansion Without A Plan

ReshaMandi operates in the B2B fashion and textile supply chain space, which is rife with challenges related to scaling up. The high-profile controversy around Zilingo in 2022 and Accel-backed Fashinza’s hard pivot from fashion supply chain to fashion manufacturing are a testament to this.

The case once again typifies the misplaced optimism of startups that raised funds in an easy market in 2021 and then failed to live up to the expectations, thanks to a spray-and-pray approach and the lack of a clear product-market fit for many new verticals. Along the way, to rise up to the expectations of investors, startups have also turned to revenue inflation, double-booking revenue, invoice round-tripping and more.

According to employees, ReshaMandi’s downfall was due to rapid expansion across verticals, immediately before and after it raised funds in October 2021.

The company began as a crop advisory and supply chain platform for silk farmers, connecting them to reelers, weavers and manufacturers. It set up three new entities in March and April 2022 to manage new verticals — precision farming, financing, and a consumer brand, as shown above.

Even before it had completed two years of operations and proven its supply chain model, the company had entered into territories that called for a completely different design thinking to develop products.

Building a silk supply chain platform is leagues apart from running a D2C brand, or building an IoT-centric precision farming platform. While we can see the logic of building a vertically integrated platform for silk supply, ReshaMandi had not even ironed out the kinks in its primary business.

To add to these, Reshmandi also acquired a stake in Healios Wound Solutions LLP and launched beauty products under the brand SeriSkin, which is now manufactured by Esthetic Insights Private Limited, where ReshaMandi has no involvement.

With these new verticals and millions of dollars in funding, there was pressure to grow. Naturally, ReshaMandi undertook extensive hiring and went on to launch ambitious programmes:

- Set up a processing centre in Karnataka’s Ramanagara silk cocoon market, claimed to be Asia’s second-largest market of its kind

- Acquihired software development firm Hashtag to bolster IoT offerings, but the precision farming product has been wound down

- Announced its foray into the Middle East and North Africa for silk supply; operations shut down as Reshamandi has scaled back

Most of these initiatives have either been phased out or transferred to other businesses, as seen in the case of SeriSkin.

Sources alleged that before it raised funding, the startup had around 200-250 employees. This count rose to around 600 by the mid of 2022. Teams were also sent to Paris and Dubai to represent ReshaMandi and bring in international business and promote the Resha Weaves D2C brand which has now been shuttered.

Around this time, the company was also said to be in talks with Temasek for a Series B growth round in early 2023. But this round never went through.

In August 2023, ReshaMandi cofounder Agarwal told a publication that Temasek will revisit the deal after a quarter, but given the current situation at ReshaMandi, this is unlikely to be on the table now.

According to sources, the company fell victim to the growth-at-all-costs mindset, which drove it to inflate revenues in FY23 and FY22. It’s very likely that Temasek and other investors caught wind of the allegations now being raised by employees on social media and in their conversations with us.

From Revenue Inflation To Fake Vendors

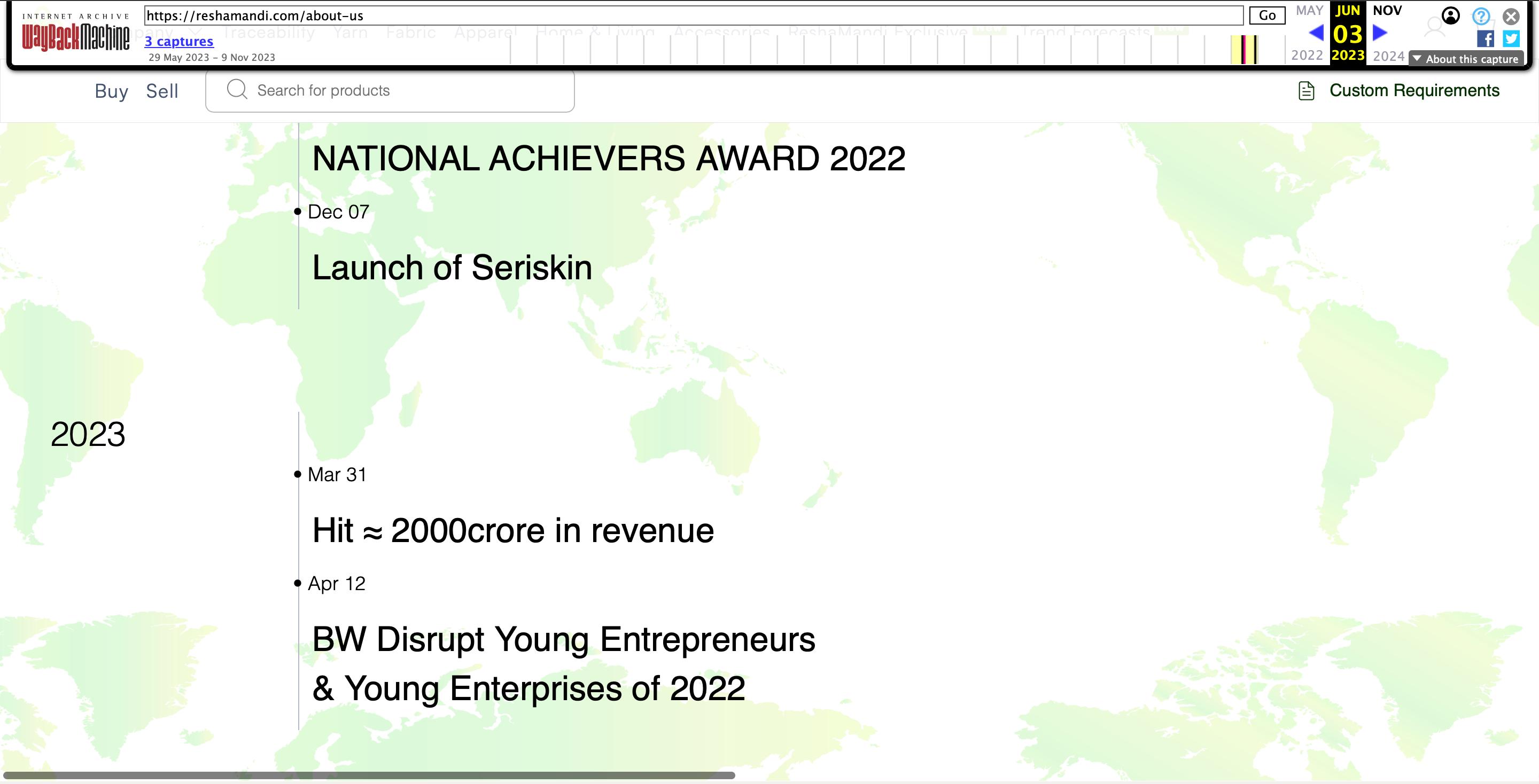

As of January 2023, ReshaMandi claimed to have revenue of INR 1,248 Cr in the first three quarters of FY23, and was targeting INR 2,000 Cr for the full year, as per its website. In comparison, the company reported revenue of INR 414 Cr in FY22 (March 2022).

Incidentally, these projections, which were reported by ET in January 2023, have now been deleted from ReshaMandi’s website.

Screenshot of ReshaMandi’s Website

Screenshot of ReshaMandi’s Website

Former employees alleged that the revenue shown to investors and the public for FY23 was inflated through fake invoices, reporting pending collections as booked revenue invoice discounting, and sales to customers that never existed. The company is also said to have onboarded vendors that did not exist.

“Early last year, I was sent to check on our buyers in the Delhi NCR region. When I reached the location, I was shocked. The address housed a building with a rickety exterior. The outstanding amount from this buyer was almost half a crore,” one of the sources told us.

The problem is compounded by the fact that most silk reelers, silk weavers, farmers and manufacturers deal in cash, as is the standard practice in the industry. Such cash-heavy models are typically more prone to revenue leakage and disparities in booked revenue and the collected revenue, as we have seen in multiple cases in the past two years.

Inc42 couldn’t independently verify these claims by employees around fake vendors because the startup is yet to file its FY23 financials with the Ministry of Corporate Affairs.

Sources further claimed that ReshaMandi had a tough time in recovering payments from such sellers. There are other concerns which could be seen as red flags particularly related to financial controls.

In March 2022, Reshamandi appointed former EY executive Ritesh Kumar Talreja as CFO, who quit within a year. He was replaced by former KPMG executive Samadrita Chakravarty, who quit within nine months.

Other executive positions have also been vacated in recent months. For instance, Abhishek Kumar, the former SVP of marketing, and HR head Subramanya Srikan quit within seven and eight months of joining, respectively. This is in addition to the departure of cofounder Apoorva less than two years after starting the company.

Inc42 reached out to Chakravarty, who was CFO at ReshaMandi till October 2023, but did not receive responses about these allegations raised by employees.

As stated earlier in the story, the company declined to comment on specific allegations and did not respond to questions about these discrepancies.

Sources claim that ReshaMandi shut down most of its nearly 45 warehouses at the end of last year. The startup also shifted its registered office to a coworking space in Bengaluru, but it’s not clear how many employees are currently working there.

Reshamandi’s Streak Of Loan Defaults

By all indications, ReshaMandi has all-but wound down operations across its various verticals. And it’s not just employees who are awaiting dues from ReshaMandi but also vendors and lenders.

As per sources, the startup has debt and trade payables to the tune of INR 250 Cr – INR 300 Cr to vendors and lenders.

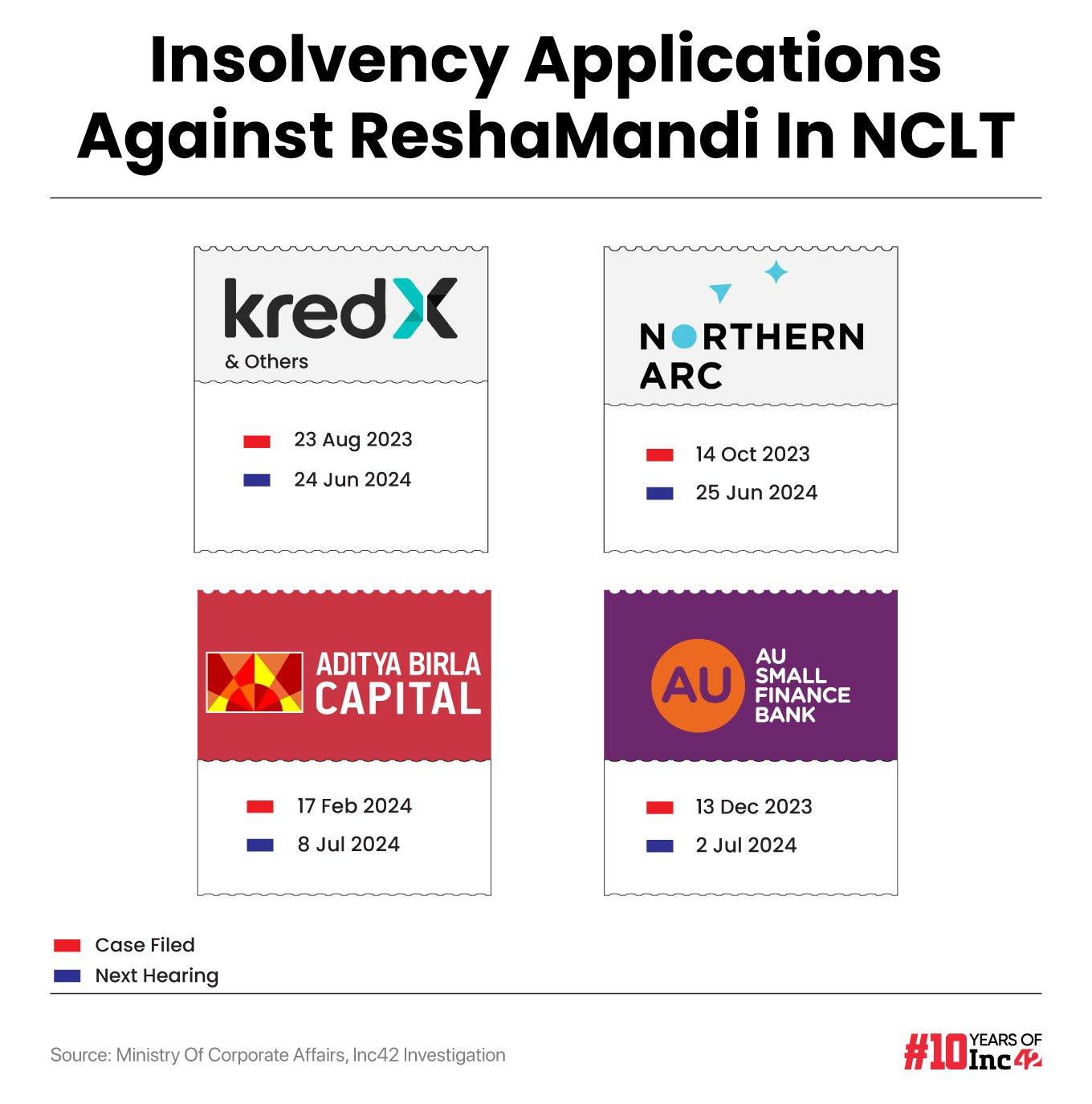

At least three venture debt lenders and another vendor have taken the company to the National Company Law Tribunal Court (NCLT) under Section 7 of the Insolvency & Bankruptcy Code, 2016.

Northern Arc’s application pertains to a total debt of INR 14.4 Cr availed by ReshaMandi from Northern Arc. The debt was recalled through a notice dated July 7, 2023 pursuant to certain instances of default by ReshaMandi. The matter is currently pending with NCLT.

Besides this, AU Small Finance Bank (AU SFB) has also filed an NCLT application against ReshaMandi to recover an amount of INR 9.7 Cr. Northern Arc, along with other creditors, holds a pari-passu charge over certain assets of Reshamandi that were hypothecated to secure borrowings from AU SFB.

One of the above lenders told Inc42 that ReshaMandi is a delinquent borrower, which indicates that the company has fallen behind on repayments. “They have done business with high credit-risk vendors and sellers. And right now, they are not getting their money back,” the lender told Inc42.

It must be noted that all venture debt investors have suffered. Stride Ventures and Innoven Capital were repaid the amount invested in ReshaMandi, Inc42 has learnt from the respective firms.

Decoding The Genzr Connection

Finally, the most striking aspect of the ReshaMandi meltdown is how the startup dealt with employees this year by forcefully transferring them to Noida-headquartered Genzr — as mentioned at the beginning of this story.

“In early 2024, we were told that ReshaMandi doesn’t have the money to pay pending salaries so we should resign and join Genzr. The management said we would get the pending three months of salary as a joining bonus from Genzr,” one such employee who joined Genzr from ReshaMandi told Inc42.

No explanation was given for the transfer between the companies. But Genzr did clear the salary backlog for some employees who moved from ReshaMandi.

The Genzr website doesn’t reveal much besides the fact that it is into the textile and apparel supply chain business, similar to ReshaMandi. This is despite the fact that Genzr Solutions Private Limited is registered to do business as an education company.

As per the MCA documents, Genzr made amendments in its articles of association in March 2024 to allow it to design, manufacture and trade in natural and artificial fibres, fabrics, textiles, and offer services in fibre supply chain with technology interventions for yarn manufacturers, fabric mills, and weavers, fibre farmers, and retailers. If that sounds familiar, it’s because this was ReshaMandi’s core business model.

ReshaMandi’s two founders – Agarwal and Tiwari, as well as other management personnel, are now with Genzr, and are being paid by Genzr. Several sources alleged that ReshaMandi is still trying to recover its pending payments from customers through the employees being paid by Genzr today.

According to an offer letter from Genzr, seen by Inc42, the company’s HR director is Sophronia K, who is also the HR director of Reshamandi.

So, has Genzr acquired ReshaMandi? And if so, how did it complete the transaction with no real revenue? And what about the VCs who had invested in Reshamandi?

According to MCA records, Genzr’s directors are Kaustubh Das and Aditya Jaiswal, who were both appointed earlier this year. It’s not clear if they are related to Reshamandi, or why Genzr has stepped in to pay off the dues to Reshamandi’s employees.

Incidentally, Genzr Solutions Private Limited has received INR 8 Cr (~$1 Mn) in funding in May 2024 from Ivy Icon Solutions LLP, a subsidiary of Hero MotoCorp.

We asked Hero MotoCorp why it chose to invest in a fashion supply chain company that seemingly had no operations till last year and was in an unrelated education business. Hero MotoCorp did not respond to the questions.

Another Startup Bites The Dust

With ReshMandi’s debacle, numerous questions remain unanswered, which have primarily left employees with little to no recourse. Despite filing complaints against the company, sending numerous emails to HR and the founders, Reshamandi’s former and current employees find themselves out of options at this point.

While some have considered legal action, they realise this would not be a swift solution. And many have lost hope of recovering their salaries and dues.

The situation once again underscores the inherent challenges of the B2B fashion industry, and more specifically for the new-age tech companies heavily reliant on investor funding to scale up, and how this creates a pressure to show growth at all costs.

Incidentally, none of the investors who had backed ReshaMandi, responded to Inc42’s questions about the issues that plagued the Bengaluru-based startup.

Once again, an Indian startup’s failure has highlighted concerns about VCs investing without adequate due diligence — a theme that’s very common among startups that raised large early rounds in 2021.

Of course, from a corporate governance point of view, ReshaMandi’s founders are also just as accountable for the mess.

Does due diligence stop with the infusion of funds? Or should investors take responsibility about where the money has been used and whether employees that create value for their portfolio companies are indeed being paid and treated fairly?

One also hopes that the ReshaMandi episode is the final nail in the coffin for the B2B fashion supply chain segment. There is plenty of evidence that this model is fraught with persistent challenges — from sourcing materials and establishing a robust network of genuine vendors and sellers to ensuring integrity of products during transit and storage and the ability to collect payments from vendors.

These challenges have derailed startups and caused losses to investors in the past. Now, ReshaMandi finds itself in this less-than-august company.

Update | June 20, 4:20 PM

After our story was published, ReshaMandi shared additional clarification:

Mayank Tiwari, cofounder of ReshaMandi, said, “We acknowledge that the company is facing severe headwinds in the journey but to make such allegations without proper evidence is tantamount to maligning the organisation name and also the individuals associated with it in the past and present. Hearsay from disgruntled employees to defame or malign the reputation of the org they leave cannot be the premise of work accomplished by the company since its inception. We have had big four doing Internal Audit, Process Control, Statutory Audits, Due Diligence over the whole course of Reshamandi. Multiple lenders, auditors have looked at our books without issues, while lenders continue to help us collect our receivables from the market together. Investors used to do periodic diligence of Reshamandi & it’s untrue to say that it was only done at time of fundraising.”

On the Genzr connection, the company added: “Founders and management remain committed to ReshaMandi, its shareholders, lenders & stakeholders. Founders are not absolved from our duties and continue to remain very much a part of ReshaMandi. We are very well working within the ambit of our fiduciary responsibilities and all efforts are towards reviving the company and settling all financial obligations in the near future. ReshaMandi is a functional entity and founders with current employees continue to be on its payroll. Many past and present business associates of ReshaMandi have engaged in various new ventures together or otherwise, jobs and we cannot control or comment on that.”

Edited By: Nikhil Subramaniam

Ad-lite browsing experience

Ad-lite browsing experience