The round will be a mix of both primary and secondary transactions

SoftBank is also expected to participate in the fundraise, while early investors Helion Venture Partners and Eight Roads Ventures are set to make partial exits

Whatfix is expected to raise primary capital at a valuation of $800 Mn

Private equity firm Warburg Pincus is reportedly looking to lead a funding round of $100-150 Mn (about INR 833 Cr to INR 1,250 Cr) in SoftBank-backed B2B SaaS startup Whatfix.

The round will be a mix of both primary and secondary transactions.

Citing sources close to the matter, ET reported that SoftBank is also expected to participate in the fundraise, while early investors Helion Venture Partners and Eight Roads Ventures are set to make partial exits.

It is pertinent to note that SoftBank holds more than 13% in the Bengaluru-based startup.

The report further added that Whatfix

“Warburg has been engaging with Whatfix for a while and has issued the term sheet now. They are set to lead the round,” one of the sources told ET.

In September last year, it was reported that Warburg Pincus had early stage talks with Whatfix.

This development follows deal activity among several SaaS unicorns, including Innovaccer and Icertis. SoftBank may increase its stake in Icertis, while US health and insurance giant Kaiser Permanente is expected to lead a new funding round at a flat valuation.

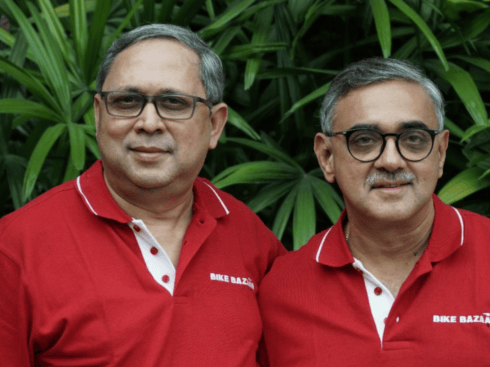

Founded in 2013 by Khadim Batti and Vara Kumar, Whatfix generates revenue through subscriptions and professional services provided to businesses. The digital adoption platform offers solutions for onboarding new customers, effective training, and enhanced user support by displaying contextual content at the moment of need. The startup claims to serve several Fortune 500 companies with its solutions.

In FY 2023, the B2B SaaS startup reduced its net loss by 53% by lowering expenses. The startup reported a net loss of INR 328.33 Cr for FY23, compared to INR 706.26 Cr in FY22.

The company saw a 65.14% increase in operating revenue, rising to INR 284.74 Cr in FY23 from INR 172.42 Cr in FY22.

Whatfix has raised a total funding of nearly $140 Mn till date. Besides SoftBank, the startup counts the likes of Peak XV, Eight Roads Venture, F-Prime Capital, Anupam Mittal, Cisco Investments and Helion Ventures among its investors.

With its vibrant startup ecosystem and burgeoning talent pool, India has emerged as a key player in the global SaaS landscape. Government initiatives, vertical-specific solutions, and a focus on security and compliance are driving this growth.

The Indian SaaS ecosystem has the potential to generate $50 Bn – $70 Bn in revenue and $500 Bn in enterprise value by 2030. With this growth, India can become the second-largest SaaS ecosystem globally.

Ad-lite browsing experience

Ad-lite browsing experience