The round, which was a mix of primary and secondary share sale, also saw participation from other investors, Purplle said without disclosing their names

In addition to the funding round, Purplle announced its ESOP liquidity programme, offering liquidity of INR 50 Cr to its employees

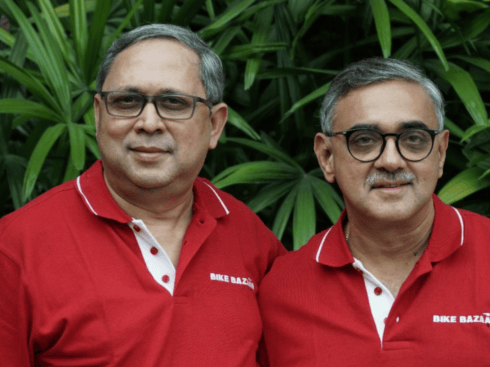

Founded in 2012 by Manish Taneja and Rahul Dash, Purplle sells beauty products and appliances

Beauty ecommerce marketplace Purplle

The round, which was a mix of primary and secondary share sale, also saw participation from other investors, the startup said in a statement, without disclosing their names.

While the startup didn’t disclose the valuation at which the funds were raised, a report last month said that it would be valued at $1.2 Bn-$1.3 Bn.

Commenting on the funding, Purple cofounder and CEO Manish Taneja said, “We will constantly innovate and leverage our technology and data capabilities to provide our customers with the best omnichannel experience. In increasing its shareholding in Purplle, ADIA has continued to support us as we pursue our vision of building a sustainable and profitable business.”

In addition to the funding round, Purplle announced its largest-ever Employee Stock Ownership Plan (ESOP) liquidity programme, offering liquidity of INR 50 Cr to its employees.

Purplle said it has granted ESOPs to 320 employees till date, of which 85 have liquidated INR 75 Cr worth options across three buybacks. In the new ESOP liquidity programme, 26% of beneficiaries are women.

Founded in 2012 by Manish Taneja and Rahul Dash, Purplle sells beauty products and appliances. It sells products of several D2C brands, including Plum, WOW Skin Science, mCaffeine, Maybelline and SUGAR Cosmetics, on its platform.

Purplle claimed it has quadrupled its gross merchandise value (GMV) in the last three years. “Purplle is operationally profitable and expects to grow its online platform faster than the industry while scaling offline stores and improving profitability,” it added.

The startup saw its operating revenue rise 116% to INR 474.9 Cr in the financial year 2022-23 (FY23) from INR 219.8 Cr in FY22. However, net loss grew 13% to INR 230 Cr during the year from INR 203.6 Cr in FY22.

The Indian beauty and personal care (BPC) market is projected to reach a size of $30 Bn by 2027, growing at an annual rate of 10%, making it the fastest-growing among large economies. Major players like Nykaa, Myntra, Mamaearth, and Tira are intensifying efforts to capture market share.

Reliance Retail ventured into the beauty and personal care (BPC) market last year with Tira, an omnichannel platform. Since then, it has expanded Tira’s offline presence to 10 stores across major cities in India. In April, Tira introduced two private labels.

Meanwhile, Nykaa said its owned brands in the beauty segment grew 39% in FY24.

As a result, investors are making a beeline to infuse capital in the startups in the beauty and personal care space.

In June, D2C beauty brand RENEE Cosmetics raised INR 100 Cr (around $11.9 Mn) in its Series B1 funding round co-led by existing backers Evolvence India and Edelweiss Group. In the same month, personal care major Lotus Herbals floated a $50 Mn fund to invest in early stage startups in the beauty category.

Last month, D2C personal care startup 82°E raised INR 50 Cr (around $6 Mn) as part of its extended seed funding round.

Ad-lite browsing experience

Ad-lite browsing experience