With an eye on long-term success, Uber's India playbook not only revitalizes its global strategy but also positions the country as a crucial hub for innovation and growth

Reaching towards the breakeven, the company has collaborated with some of the biggest Indian players as it marches towards green mobility in India

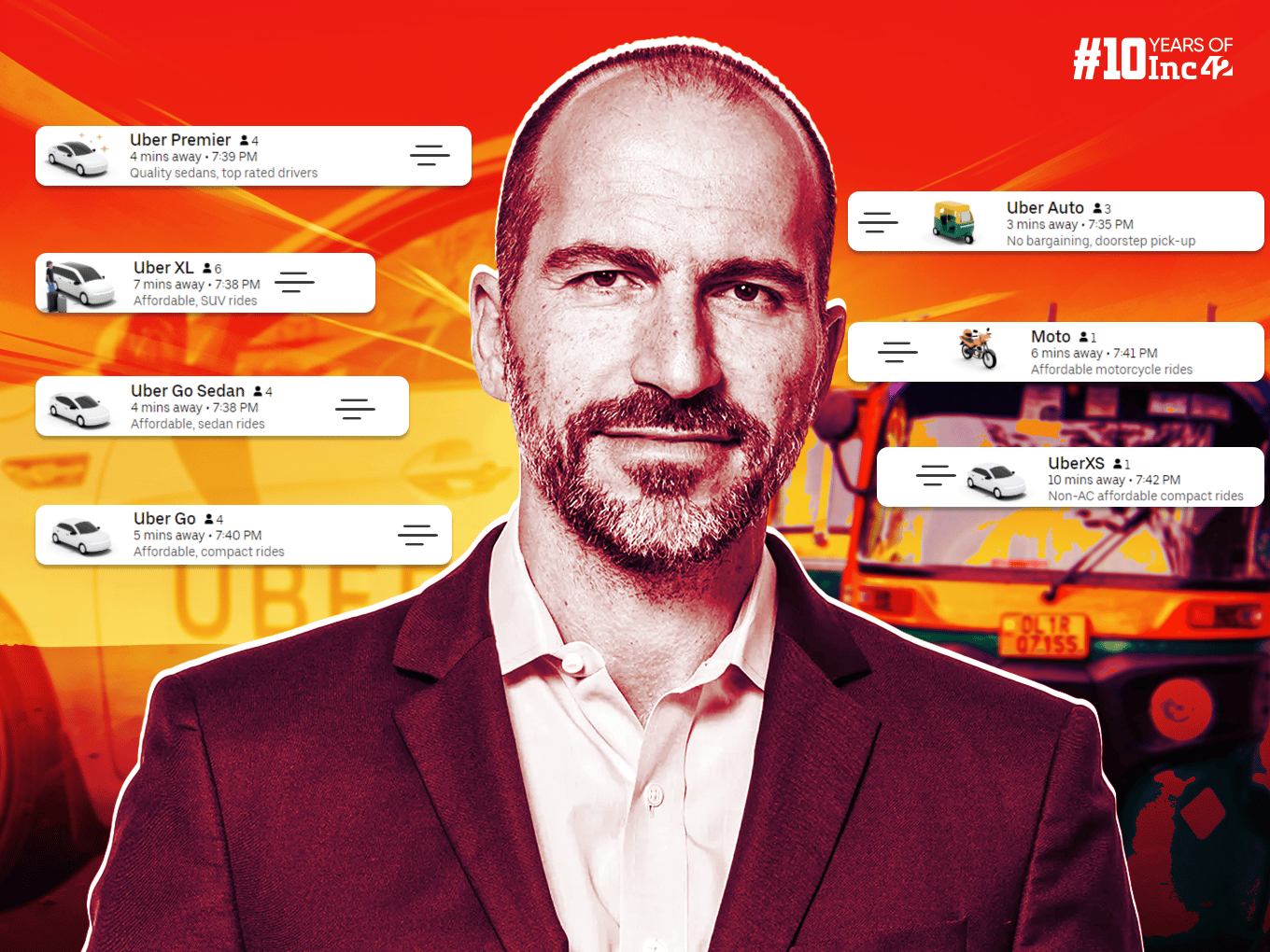

For Uber, “India is the gateway to the world” says company’s CEO Dara Khosrowshahi who was on a recent visit to India

Paytm is caught in an unprecedented crisis and if it seeks a journey to emulate, the fintech giant should look no further than Uber.

In May 2019, Uber — once valued at $120 Bn by Wall Street analysts — suffered the largest first-day dollar loss in US IPO history. Its value plummeted to about $69 Bn, just over half of its lofty IPO expectations.

Then, the Covid-19 pandemic hit and dented Uber further. It closed offices worldwide, including its Mumbai and Los Angeles support offices, and fired more than 7,000 employees globally, including 600 in India. Another 200 Indian employees were then let go as the cutbacks continued in the aftermath of the pandemic.

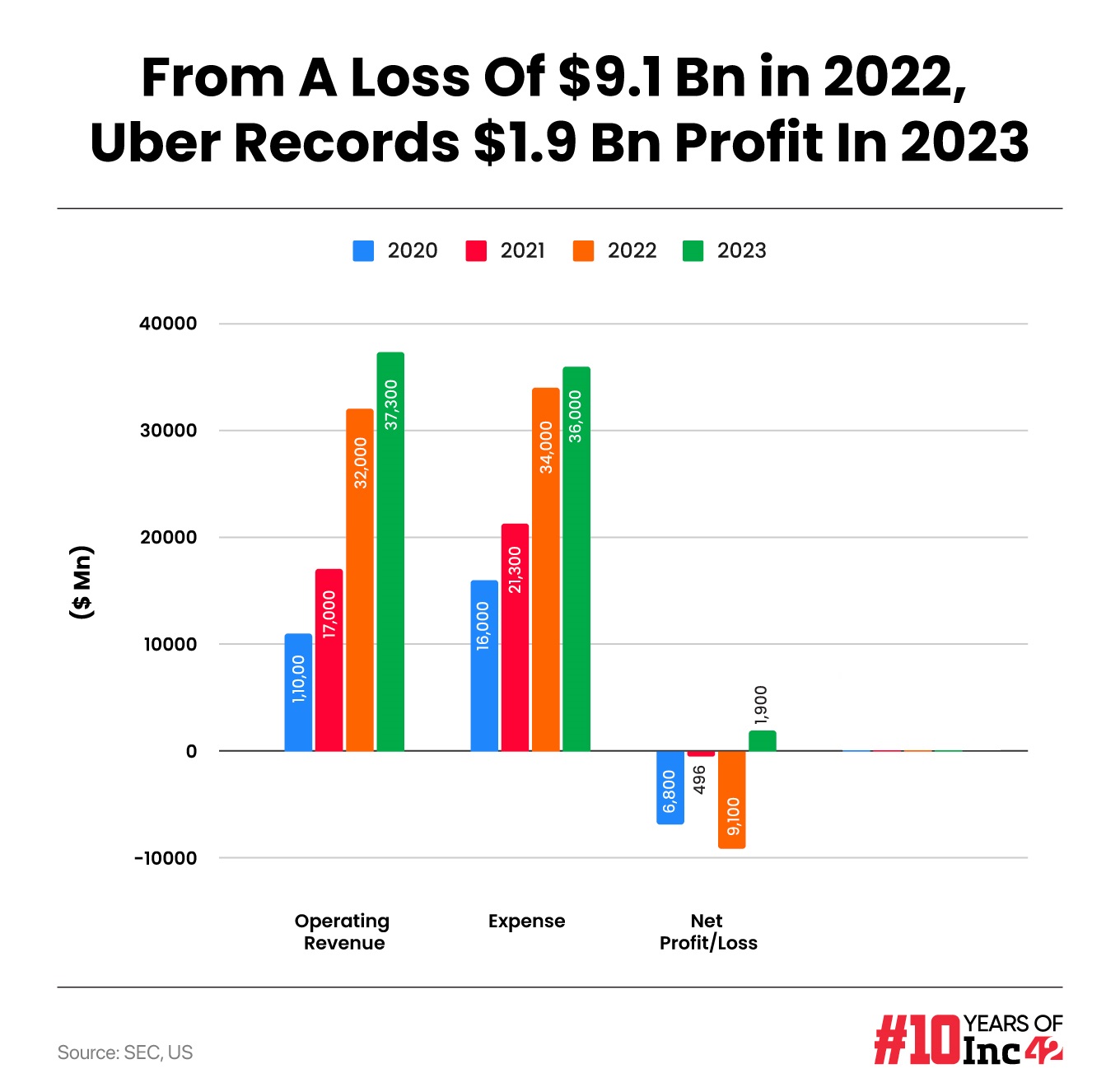

Fast forward to 2024, Uber has turned profitable, generating over $1.9 Bn in profits worldwide. The company is standing tall at a $160 Bn market valuation.

In India, the company anticipates reaching breakeven by year’s end, thanks to a clear roadmap for the market. More than anything, Uber has figured out a place for India in its global business.

Having previously lost its ground in China, India has become the critical battleground for Uber. Establishing its first and largest engineering centre in Asia in Bengaluru, Uber is developing products in India, tailored for global consumption.

If ride-hailing arch rival Ola, being a home-grown startup has been counting on the PM Modi-led campaign AtmaNirbhar Bharat or “Vocal for local” campaign, Uber is countering the narrative with its Indian tech and engineering team, and a “Local for Global” approach.

Even global CEO Dara Khosrowshahi called India “the gateway to the world” for Uber on his recent visit, where he also raised some eyebrows with his comments on the price-sensitive Indian market.

But as Ola looks to improve its mobility game, and in the face of competition from Rapido, BluSmart, Red Taxi, Namma Yatri and others, what’s Uber’s strategy for India’s rapidly evolving market?

Uber’s playbook for India hinges on green mobility, digital public infrastructure, and partnerships with industry giants. Each of these is a critical pillar for Uber to make the most out of its investment into India in the long run.

Building The Green Ecosystem From The Scratch

The Indian automobile industry as well as the government has set targets for transition from internal combustion engines to electric vehicles with 30% EVs on the road by 2030 for passenger vehicles and 70% for commercial vehicles.

As they push towards this target, OEMs such as Tata and Mahindra have set EV sales targets and so has Uber. While in the US and Canada, Uber has aggressively set the transition deadline of 2030, it is looking to deploy a full EV fleet in India by 2040.

This might seem like an ambitious target, but it also shows Uber has long-term plans for India.

To start with, Uber has launched Uber Green in Delhi, Mumbai, and Bengaluru. The new business allowed passengers to opt for all-electric, zero-emission vehicles through the app, marking a significant step towards on-demand EV mobility in India.

Through strategic partnerships and initiatives, Uber is not only tripling the number of electric vehicles on its platform but also connecting millions of riders with electric rides annually, earning recognition from the Science Based Targets Initiative for its science-based emissions reduction targets.

To bolster EV growth, Uber is expanding its fleet partner network. Collaborating with Lithium Urban Technologies, Everest Fleet Private Limited, and Moove, 25,000 electric vehicles will be deployed across seven major cities, accelerating the transition to electric mobility. This effort builds upon previous partnerships, such as the MoU with Tata Motors in February.

In the two-wheeler segment, Uber has partnered with Zypp Electric to deploy 10,000 electric two-wheelers by 2024 under the UberMoto category, enhancing sustainable mobility options. Already, over 1,000 Zypp Electric two-wheelers operate on UberMoto in Delhi.

To facilitate EV adoption, Uber has inked an MoU with the Small Industries Development Bank of India (SIDBI), making INR 1,000 Cr in low-interest loans available to fleet partners for EV and CNG vehicle purchases.

Furthermore, Uber is spearheading EV charging infrastructure development. Partnering with BP pulse and JioBP, as well as GMR Green, it aims to provide high-speed charging facilities for Uber EVs across India.

With big players like Uber entering India’s EV ride-hailing market will create a long-lasting positive impact on clean mobility and a big boost to the infrastructure. Speaking to Inc42, serial entrepreneur Ajesh Saklecha, cofounder of Ozone Motors and Tride Mobility said that one of the biggest issues with EVs is that driver-partners may face financial constraints however, with fleet operators and Uber entering the segment, the initial cost could be easily tackled, including the fast charging infrastructure they are setting up.

“Once the issue is tackled, the lifetime cost of the vehicle could easily be earned back within two years increasing individual drivers’ income & ROI since the average running cost of the vehicle is INR 1 per Km, for the operators it could vary INR 3-5,” said Saklecha.

Saklecha’s Ozone Motors is an E4W OEM that developed an agile and affordable Modular born smart electric platform that could fit a body style of a four door Car, seven seater shuttle or even cargo ev.

Building On India’s Digital Public Infrastructure

During his recent stop in Bengaluru, CEO Khosrowshahi oversaw Uber’s partnership with the Open Network For Digital Commerce (ONDC).

The digital commerce network offers a set of specifications designed to foster open interchange and connections between buyers, platforms, and sellers. While ONDC has brought on Namma Yatri, Ola and others as mobility partners, Uber is the latest major player to come on board.

Like UPI, ONDC is the latest piece of India’s digital public infrastructure and Uber is looking to capitalise on the DPI wave for its next leg of the India journey.

Ola joined ONDC last year, initially to test its food delivery services for select users. On the other hand, Uber is exploring the full gamut of mobility services ONDC can unlock.

This collaboration would help Uber gain more users by improving the availability of Uber services on ONDC buyer apps. From the point of view of competing with Indian ride-hailing companies, this is a cost-effective strategy.

Plus, it helps Uber gain a share of the public transport usage in the world’s most populous country. For instance, in multiple cities, it has already integrated public buses on its app, and ONDC is the pipeline to get into other states and cities as well.

Uber is thus considering new services like intercity bus and metro rail ticket bookings in India through a partnership with ONDC.

Explaining how Uber could leverage India’s DPI, CEO Khosrowshahi told Infosys chairman and Aadhaar architect Nandan Nilekani in a fireside chat that payments and UPI was the first step.

UPI Lite, which is like a predefined wallet linked to UPI accounts for low-ticket purchases would make the transactions more seamless and easier. According to reports, Uber is also planning to introduce Uber Money to India. The idea is to float similar products like Ola Financial does for Ola Cabs. Besides, Uber Money could also offer co-branded credit and debit cards.

Secondly, the digital KYC verification system is both for drivers as well as for car registrations. Driver verification has become more efficient through Aadhaar KYC and Digilocker, reducing verification costs for both drivers and vehicles.

Thirdly, the widespread adoption of FASTag on highways has minimised the waiting times at toll gates, and improved the efficiency of intercity and intracity movement, which Uber has leveraged for newer services.

Fourthly, the integration of AI in Indian languages means that driver and rider communication has improved.

As for the ONDC framework, Khosrowshahi believes the network offers a standardised platform for services, ensuring interoperability and accessibility for all players.

Nilekani also suggested that Uber should re-enter the food and grocery delivery segment in India via ONDC. “The system is waiting for who could do it at scale and speed. And, you guys do it very well,” remarked Nilekani.

But while that may not be on the cards any time soon, Uber is focussing heavily on building financial services and its tech stack in India.

Forging Big Partnerships

When it comes to long-term expansion in India, Ola plans to go solo as far as possible with Ola Electric and its inhouse infrastructure for charging and manufacturing. However, Uber is busy forging big partnerships. This includes deals with Tata, Reliance and Adani, the three biggest corporate houses in India.

Uber-Adani: During his India trip, Khosrowshahi has also explored a potential strategic partnership with Adani. This collaboration would entail integrating Uber’s services into the Adani One mobile app, enabling customers to book airport transportation conveniently.

According to reports, Uber and Adani could forge a JV to speed up the green infrastructure around mobility. This includes plans to procure electric vehicles and brand them under its name. These branded vehicles will then be deployed on Uber’s ride-hailing platform.

Uber-Tata Partnership: Besides having ordered 25K vehicles worth around INR 300 Cr, Uber is also said to be in talks with Tata Digital for the Tata Neu platform. Tatas are reportedly looking to integrate Uber app within the Superapp to anchor customer acquisition and engagement. Uber has also onboarded Tata AIG for the insurance of its driving partners as well as riders.

Uber-Reliance: Uber has a global mobility agreement with BP pulse which will also be enforceable in India in partnership with JioBP for fast-charging Uber EVs and also tying up with GMR Green to further enhance the changing infrastructure network for Uber EVs.

“Besides, Adani’s which is yet to be formed, most of these partnerships are generic and there is not much to be expected from them. For instance, before Tata Digital and Uber, a similar partnership was announced between Jio Money and Uber. It didn’t work. While Uber has been open to forging partnerships, particularly in India, most of these didn’t turn as projected,” said a mobility advisor who did not wish to be named.

Here it must be noted that partnerships do not always align and germinate as intended or signed initially. Uber’s partnerships with Yulu, Bajaj and Mahindra did not exactly fall in line as initially envisioned, thanks to Covid.

Some of the partnerships such as with Tata Motors, JioBP and Adani could go well beyond the Indian market as well, but it’s critical for winning in India.

Why Uber Wants To Win In India

In the fireside chat with Nilekani, Khosrowshahi said, “India is one of the toughest markets out there. The Indian customer is so demanding and doesn’t want to pay for anything. If Uber can make it in India — and I think that our team is making some great things here — then India is the gateway to the world for us.”

The company’s Bengaluru and Hyderabad development centres handle 13 critical technology functions for Uber globally, including the Rider app, Uber Eats, Uber’s fintech risk and payments solutions, the maps services and solutions, Uber for Business, adtech and more.

Will the Uber India team move the extra mile to offer Uber Pay as its own UPI payments and wallet, as Ola does with Ola Money? The company did not respond to this.

Now, with ONDC and Uber Green, Uber sees its India playbook contributing to its global business. “If the product works in India, it will work in other developing markets as well.”

While India is the tech playground for Uber, it’s also shown signs of becoming a breakeven market.

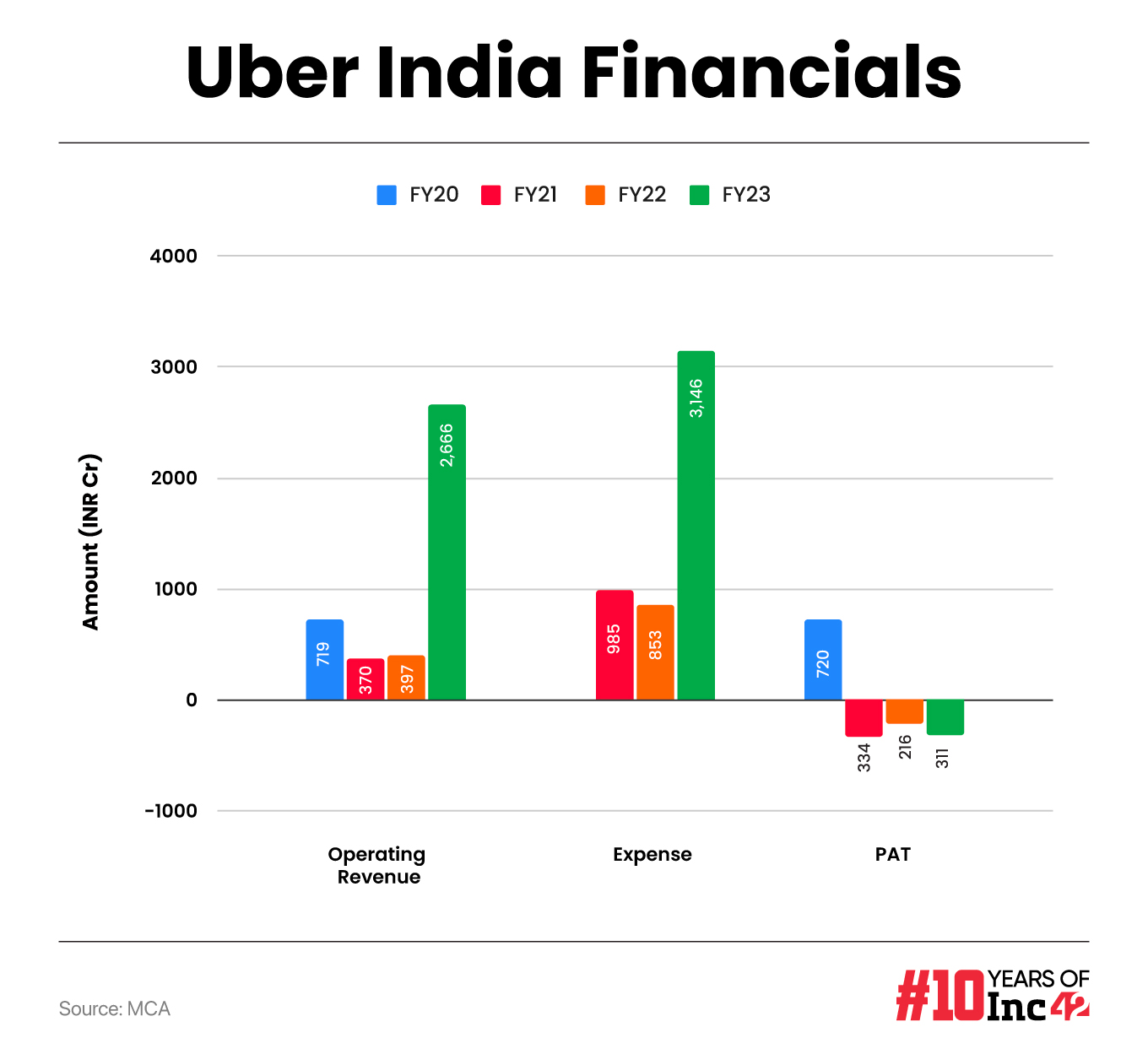

While globally, Uber has turned profitable raking almost $2 Bn in profits, in India it recorded INR 311 Cr in loss in FY23, slightly higher than INR 216 Cr in the previous year. But this is still lower than the loss it suffered in FY21 soon after the pandemic.

Operational revenue surged by 6.5x to INR 2,666 Cr in FY23, which shows the company seems to be on the right track.

And while Khosrowshahi did not respond to Nilekani’s remarks about Uber Eats, selling the business to Zomato seems to be paying off for Uber India.

In January 2020, Uber India sold UberEats business to Zomato in an all-stock transaction, which gave Uber India 9.99% ownership (preferred shares) in Zomato.

In July 2021, Zomato listed publicly and by December 2021, Uber India was sitting on an unrealised gain of $991 Mn on this investment. This has now grown to $1.3 Bn as Zomato’s share price has boomed in the past three-four months.

While UberEats seems to have been a missed opportunity, ONDC opens the door for Uber to take another punt at food and grocery delivery. In fact, ONDC can enable Uber to become the everything app for Indian internet users.

Uber took a long while to figure out what India means to the company, but it looks like eventually it has managed to do that.

[Edited by Nikhil Subramaniam]

Update: March 12, 2024 | 10.47 AM

[The story now incorporates a graph detailing Uber’s financials.]

Ad-lite browsing experience

Ad-lite browsing experience