A $1.5 Bn, 6-year-old startup Slice has been taking legacy banks in India heads on by offering collateral-free credit lines

Five years after its inception, Slice makes a u-turn from its core biz model amidst the RBI crackdown

Monetisation, and profitability are nowhere in sight although Slice has raked in $270 Mn till date, signed a INR 90 Cr deal with Mumbai Indians for primary sponsorship for IPL earlier this year

“I turned 28 few weeks back. I want @sliceit_ to become a unicorn before I get to 30”

Last year, Slice founder Rajan Bajaj tweeted his dream of seeing his fintech startup enter the unicorn club before he turns 30. Well, Slice got there well before that deadline — by the end of 2021, its valuation surged to the $1 Bn mark — rising 5X in six months as the likes of Tiger Global, Insight Partners poured in $220 Mn.

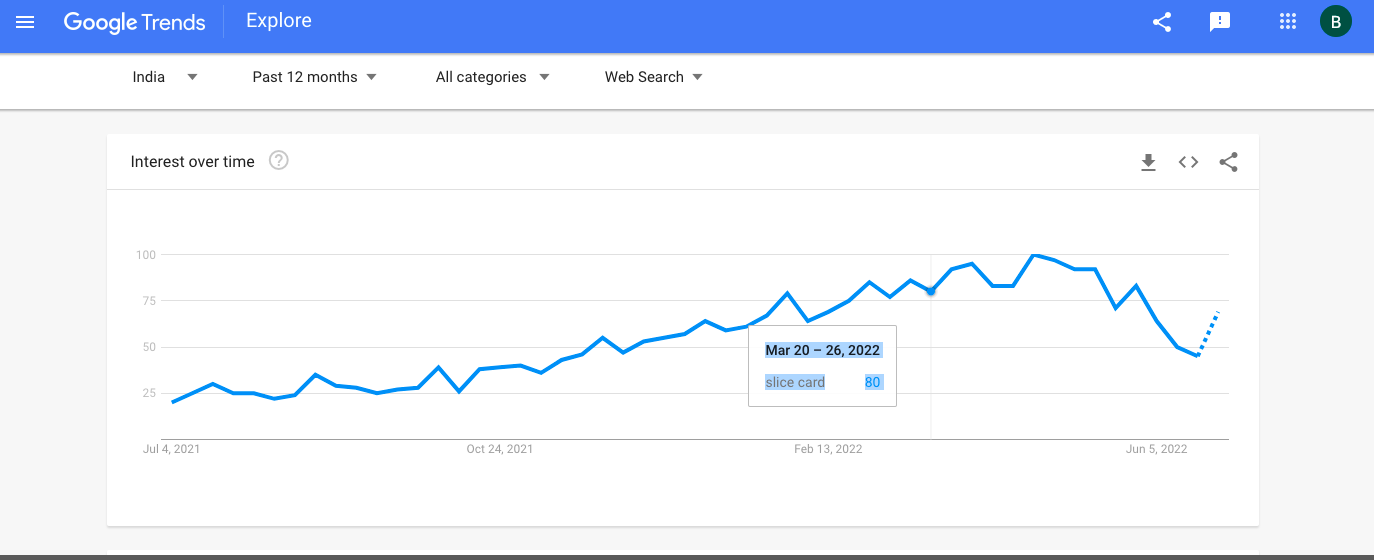

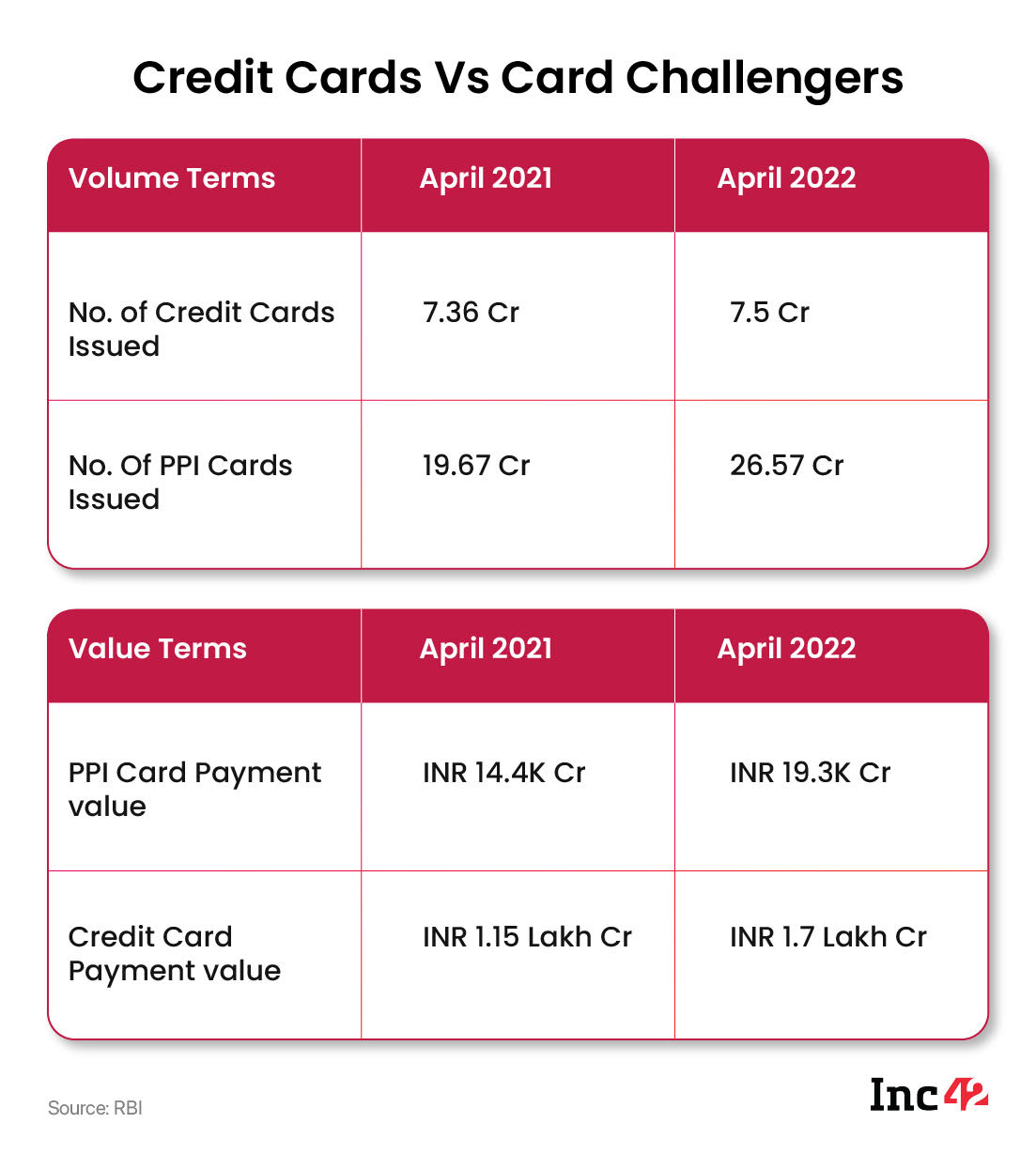

It’s not just the valuation that shot up. At the time of the unicorn round in November 2021, Bajaj claimed Slice was issuing 2 Lakh Slice cards (PPI-based cards) per month up from 20K in the beginning of 2021. And in 2022, the company claims this has grown to 3 Lakh cards issued per month.

Everything seemed to be on the right track, except it wasn’t.

A Reserve Bank Of India notification in June barred NBFCs from offering credit on PPI and that meant Slice can no longer challenge credit cards as easily as it used to before. At the same time, the startup has also made changes to its repayment terms that have rankled many users.

Not to mention, the Slice Android app was flagged by the Google Play Store temporarily for data security, which in many cases blocked the usage of other payments and fintech apps for users. And as we will see, not only has the fintech unicorn lost much of its momentum of the past year due to these regulatory and product issues, but its business model also has enough holes for anyone to wonder what Slice will do next.

Through multiple pivots, marketing blitz, cash burn to acquire and retain customers, the story of Slice now is one of a struggle for sustainability and a search for profitability.

The Slice Product Story

Slice is not the first stop on Bajaj’s entrepreneurial journey. During his IIT Kharagpur days, Bajaj founded a startup called Mesh Internet before joining the Flipkart product team. He also launched a furniture rental startup, which pivoted to auto rentals and then became a shared economy startup that eventually shut down. Bajaj has seen through it all.

When he founded Slice in 2016, the idea was to cater to students and young users as a lending platform. The startup, which was called Slicepay at the time, offered a buy-now-pay-later solution exclusively for users between the ages of 18 and 29 for ecommerce purchases. Till 2019, Slice did not have a physical payments instrument, but then it launched one in mid-2019 with much fanfare in partnership with RuPay.

Now, Slice called itself as a credit card challenger, ready to disrupt the conventional financial services industry through its no-frills card which didn’t charge monthly interest for 1-in-3 equated monthly instalments (EMI). Essentially, Slice had turned its BNPL offering into a credit card-like PPI product with no interest, no annual charges and no late fees.

The PPI cards are issued in partnership with SBM Bank and Federal Bank. But the credit lines on them were loaded either through Slice’s subsidiary Quadrillion Finance Private Limited, which is a registered NBFC itself as well as through other NBFCs. Slice’s partners included non-bank lenders such as Vivriti Capital, Northern Arc Capital, InCred, Growth Source Financial Technologies, Ashv Finance among others.

With this bevy of partners offering credit in a flash, Slice was able to grab users across segments. And that’s how the company claimed to have grown 10X since early 2021 in terms of the user base.

It also landed funds to the tune of $300 Mn, most recently raising $50 Mn in its Series C In June this year. Its investors include the likes of Tiger Global, Blume Ventures, Gunosy Capital, Moore Strategic Ventures, Insight Partners among others. Lending to Gen Z students and millennials was unchartered territory for Indian banks and NBFCs — they simply did not want to handle the risk assessment headache. But fintechs took on the burden and the market opportunity for lending is huge.

As per Inc42’s State Of Indian Fintech Report Q2 2022, the lending tech segment is a $270 Bn market opportunity with nearly $5.4 Bn invested in over 160 startups since 2014.

But unsecured lending — where one lends to customers without necessarily accounting for their credit scores or taking collateral — is risky. And the RBI and other regulators have been keeping a close eye on this sector. Regulatory loopholes were leveraged, but a number of frauds also emerged combined with people committing suicide or complaining about harassment. So inevitably this drew the RBI’s eye to the sector.

However, regulations by themselves do not upend any company, as long as there is a sustainable revenue model, and a path to profitability.

But as we will see soon Slice did not.

Existential Threats For Slice

Without a clear cut set of regulations, the digital lending space was something of a wild west, which has now prompted authorities to act. Slice was trying to work in a regulatory grey area since there were no clear-cut regulations for the BNPL sector.

RBI governor Shantikanta Das had claimed that the risk to consumer money remains a top priority for the central bank.

And on June 20, 2022, the RBI issued a circular barring NBFCs from loading credit lines on prepaid instruments such as the Slice card. Prepaid instruments also include co-branded cards, payment cards, digital wallets and more.

This change has given sleepless nights for the BNPL players, a fintech sector executive told Inc42 requesting not to be named.

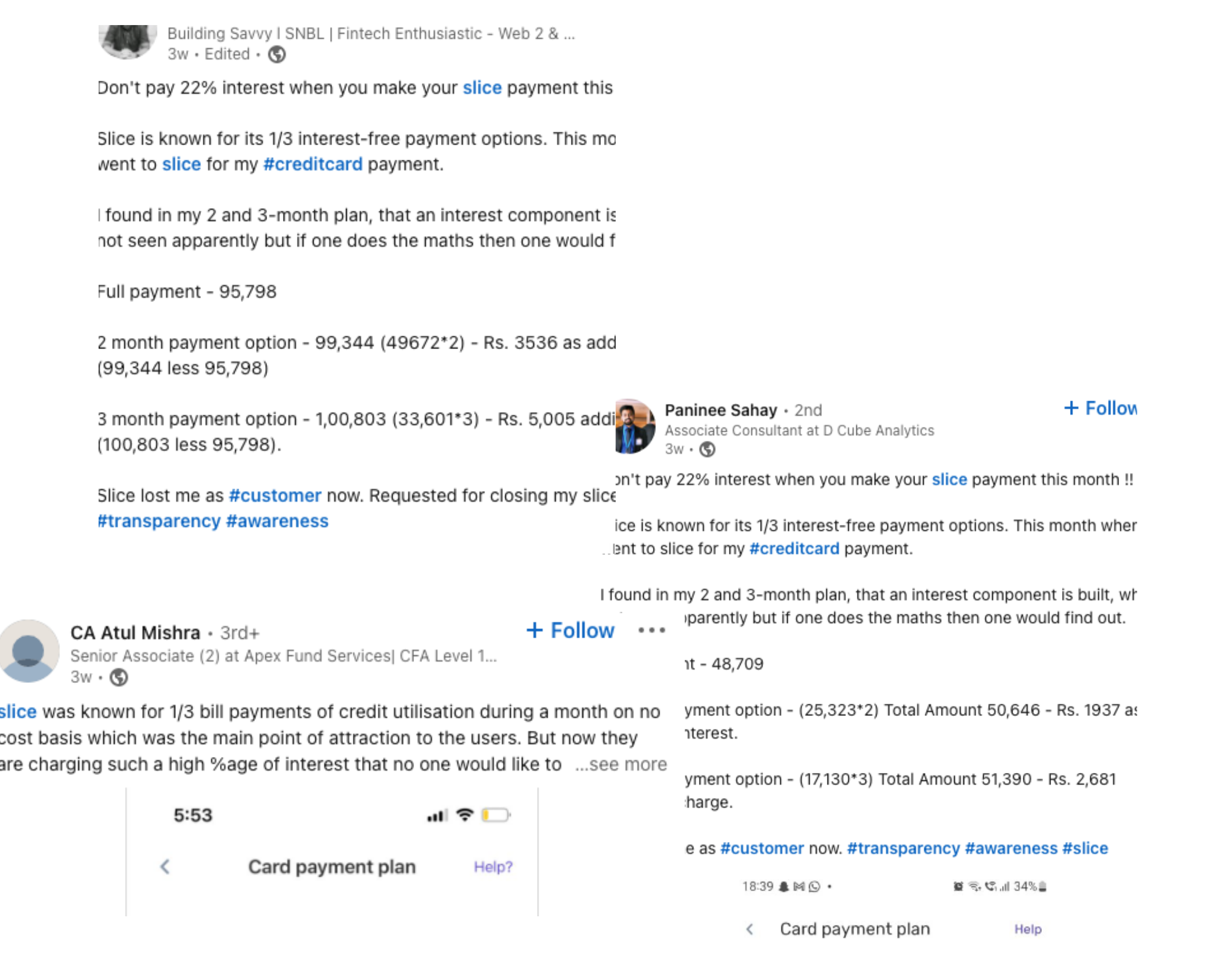

Just before this notification, in May 2022, Slice made key changes to its core product i.e BNPL. Unlike other BNPL options, Slice users would have to pay monthly interest for any pending dues not paid in the first month.

If reports are to be believed the interest rates for late or non-payments is as high as 36%. Slice has officially declined to comment on this sudden change in its 1-in-3 payments model, and why it is charging a seemingly exorbitant interest rate.

Understandably, this was a rude shock to the many Slice users, which are said to have an average age of 23. These are largely young workers or students and Slice was a window of hope for credit, when conventional credit cards were a no-go.

Slice’s rolling back of its USP saw much outrage on social media. Users told Inc42 that because they would have to clear their 1-in-3 Slice payments in the first month itself, it’s proving to be costlier than some credit cards.

“The interest rates are very high — even above 30%-40%,” one Slice user told us.

And unlike in 2021, Bajaj’s tweets now are not about valuation dreams but survival.

As per reports, Bajaj also assured employees in an email that Slice is well capitalised and the current focus is on understanding the RBI’s objectives and operating in the regulated environment.

RBI’s Curveball For Credit Card Challengers

Others in the fintech ecosystem such as BharatPe’s ex MD, Ashneer Grover have blamed the notification on RBI’s affinity to protect the established banking sector and the legacy lenders. However, changing regulations are a reality for financial services and even large banks cannot escape them.

Slice had set out to challenge the traditional banking industry, especially the credit card giants. But given that the global economic climate is less than clear right now, such challenges often falter in front of regulations

As noted investor and India Quotient founding partner Anand Lunia said during this month’s Inc42 Fintech Summit 2022, in the current market, fintech firms cannot afford to have an anti-bank stance if they want to survive. But Slice was doing exactly that and it would have to rewrite a lot of its current playbook, experts believe.

For instance, according to Ram Rastogi, a digital payment strategist and chairman of the Fintech Association for Consumer Empowerment (FACE), RBI’s changes could deal a severe blow to the BNPL industry as a whole.

Prior to this, the RBI and NPCI had proposed linking credit cards to UPI in a bid to boost credit card penetration in the country. So far only RuPay cards have been proposed for this linking, but it could cover other credit card providers such as Visa or Mastercard in the future.

This also poses a challenge to credit card challengers such as Slice, Uni and others who are claiming to solve credit card concerns for both merchants and end-users.

A Goldman Sachs note said the credit card linkage proposal is set to hit the BNPL-based fintech companies and could lead to higher issuance of credit cards due to ease of use of UPI.

Holes In Slice’s Model

With its biggest USP of interest-free payments now in the bin, Slice is no longer an attractive proposition for many in its target audience. The company declined to reveal its monthly active user base or even the number of transactions month-on-month after the rollback of interest-free split payments.

Slice claimed it has no data to share in this regard, but a cursory look at Google Trends data shows a substantial dip in search interest for Slice and its rival Uni after March 2022.

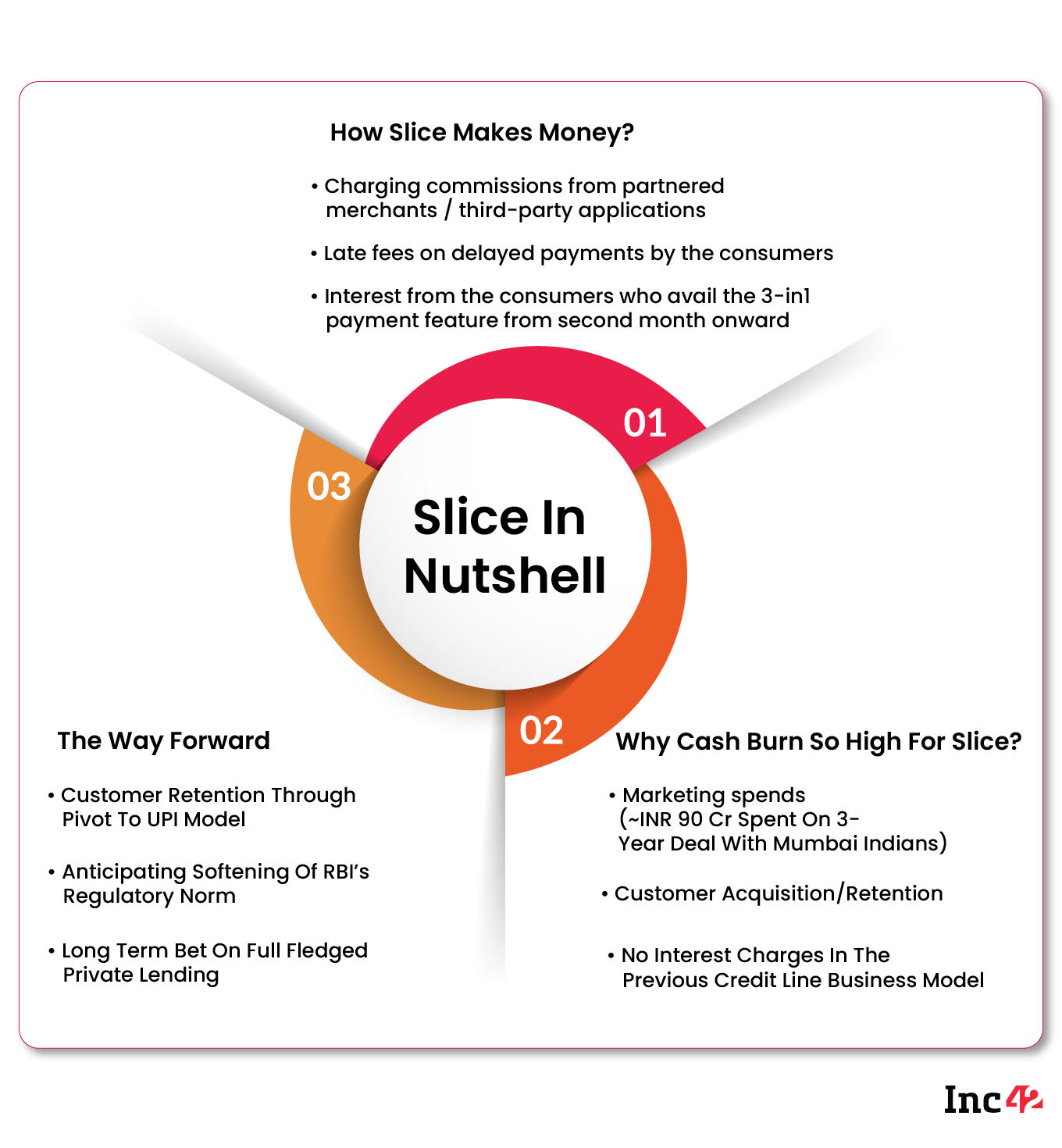

Industry experts are of the opinion that transactions will fall and user decline is inevitable because Slice, like others, has a huge reliance on marketing spend to acquire customers.

Kaushik Saha, a financial services professional and a veteran in the BFSI sector told us, “Slice’s cash burn per month is very high in the industry and profits are a far sight. One has to understand that when it comes to a BNPL or co-branded cards, the promise of no interest bill payments, cahbacks, rewards means a big hole in the pocket of the company usually.”

While a fintech startup may accept losses given that VC funding is accessible, the larger NBFCs or banks that offer the credit will never forego profits. The same would be the case for merchant partners, Saha added.

“The only revenue stream is charging commissions from third-party applications, partnered merchants for each transaction,” Saha said.

So, what can Slice hold onto? Its user base, perhaps? But here too there is a discrepancy in how many users it actually has.

For instance, at the time of its $50 Mn fundraise in June this year, it claimed to be issuing more than 300K cards per month, which would be comparable to India’s biggest banks such as SBI, HDFC. It also touted a user base of 12 Mn, with another 10 Mn seemingly on a waitlist.

But sources close to the company told Inc42 that Slice is bleeding customers rapidly and the number of registered users as of December 2021 was just around 4 Mn. That is a 66% decline in just one month.

Of course, fintech startups in general have been inflating their user numbers so much so that it is actually considered a vanity metric by many. Including Zerodha’s Nithin Kamath, who debunked the myth around fintech’s total addressable market behind huge at Inc42’s Fintech Summit. Kamath said that the total daily active users for all fintech platforms in India are just around 25 Lakh or 2.5 Mn users.

Interestingly, Slice added a UPI payments feature just before the RBI’s changes were announced. Others in the startup ecosystem believe this is a user retention play.

Can UPI Save Slice?

Like Ravisutanjani Kumar, VP of partnerships at edtech startup Testbook, who had earlier led the partnerships role at fintech startup Jar, says the UPI might help retention for Slice, but even so UPI by itself cannot be a panacea for the deeper problems of the business model.

“When it comes to extending credit lines, it is usually the NBFC from where the credit is sourced. The bank partnerships are leveraged for logistical support, technology, card issuance and more. Credit card challengers are spending resources on customer acquisitions, marketing spends and then absorbing the losses which puts a question on their revenue model,” he told Inc42.

Some believe that Slice may have seen RBI’s move coming, and so in mid-June when it announced the $50 Mn fundraise, it laid emphasis on its UPI payments service, and not so much on its core Slice card proposition.

Slice would also be expected to answer its investors on revenue and profitability, neither of which are hallmarks of UPI apps due to extant regulations around zero merchant discount rate (MDR). However, an average user might not delete the Slice app if it has the option of UPI payments, though why they might choose Slice over PhonePe, Google Pay or others is still a question that Slice cannot answer.

The Question Of Data Sanctity

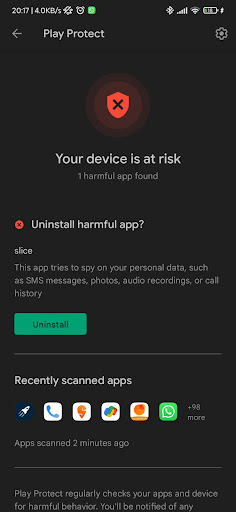

To add to Slice’s woes, user retention might be impacted given a recent flag raised by Google Play Store for Slice’s Android app. Google has flagged Slice’s app over security concerns including access to personal data of users such as SMS messages, photos, audio recordings and call history.

The flag meant that users could not even open or use other payment apps since the device was thought to be compromised. Inc42 was able to independently verify that the security alert did block users from using other apps.

Slice later clarified calling it a technical glitch, but it would have undoubtedly spooked some users after the major change around interest-free payments. It remains to be seen whether this episode also had a negative impact on Slice’s download and installed base metrics over the past month.

How Will Slice Pivot Next?

While there were always questions about the sustainability of credit card challengers given their low-margin revenue model, reliance on cashbacks and discounts and no-interest terms, the RBI notification makes all those questions moot. Lending itself has been impacted — whether it is sustainable or not.

The marketing blitz by Slice includes a three-year deal to become the principal sponsor of Reliance-owned Mumbai Indians in the IPL. The deal reportedly cost Slice INR 90-92 Cr and was said to be one of the most expensive deals during IPL 2022.

Bajaj said in a statement that though there is a zero correlation between cricket and a financial product, the Mumbai team and Slice have a shared hunger, which will help take his brand to millions of viewers and cricket fans.

It is not really clear at this point whether Slice will continue sponsoring Mumbai Indians, especially as the revenue tap runs dry.

So in a way, it is an existential crossroad for Slice. The company cannot possibly continue to run a low-margin lending business in 2022, when there is not much liquidity in the market to go on a customer acquisition blitz. Plus the cost of capital has also increased due to repo rates being hiked. So the startup has to capitalise on its existing user base instead.

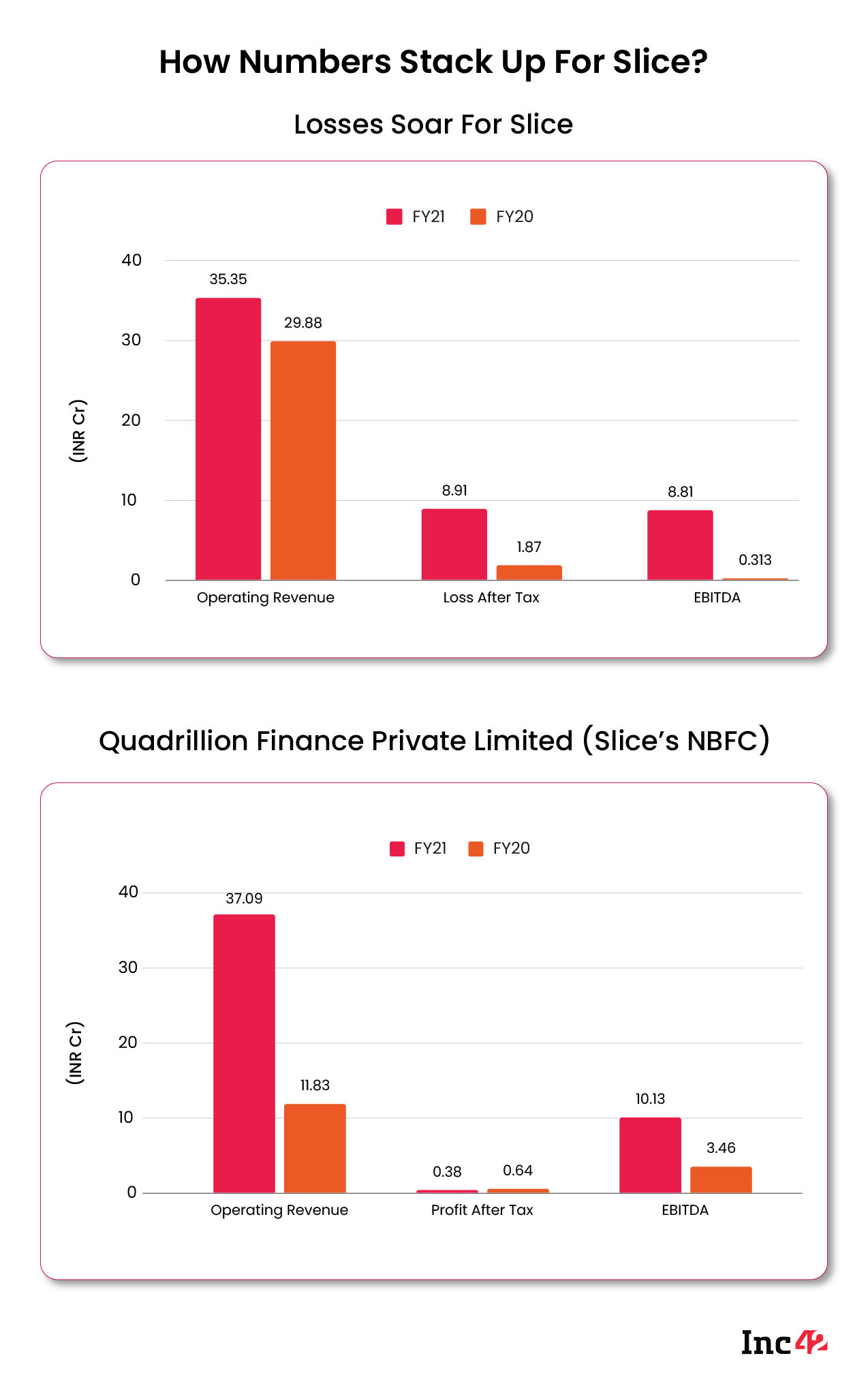

Notably, the higher marketing spending and lack of profits of Slice’s parent company Garagepreneurs Pvt Ltd found a mention in rating firm CareEdge’s recent advisory. However, Quadrillion (QFPL), Slice’s NBFC subsidiary, is profitable.

QFPL reported a net profit of INR 8.61 Cr for H1 FY22 as compared to INR 38 Lakh for FY21, As on 9MFY22,(first 9 months of FY22) the profit stood at INR 17.82 Cr.

As per a CRISIL report, in the nine months ending December 31, 2021 for FY22, the group reported a loss of INR 127.8 Cr, as against a loss of INR 8.5 Cr in FY2021. QFPL reported a nine-month (FY22) profit after tax of INR 17.1 Cr, up from INR 4 Lakh in 2021.

However, the parent company is likely to take another 12 to 15 months to break even, the ratings agency said. “The losses were primarily on account of higher operating expenses (Opex), emanating mainly from marketing and customer acquisition expenses led by significant expansion of its customer base,” CareEdge added.

According to its latest financials, Slice’s losses jumped 394% to INR 8.9 Cr in FY21. At the same time, its revenue from operations grew by around 18% to INR 35.3 Cr in FY21. Further, slice reported a 34% increase in its expenses, which reached INR 47.8 Cr in FY21.

While the company managed to garner a positive operating cash flow of INR 4.6 Cr during FY20, the operating cash flows were at a negative INR 2.2 Cr during FY21. At the end of FY21, Slice had INR 12.4 Cr of cash or cash equivalents in the bank.

The user acquisition cost, retention concerns and low margins is something that Slice seemingly does not have an answer for. Its monthly cash burn is as high as INR 30 Cr, one industry veteran privy to its operations said.

It will have to shed the cashbacks, rewards and no-interest model to stay in the game in the long run, the same person added.

The Way Ahead For Slice

One potential upside for Slice is the data that it has collected over the years of payments, repayment patterns, shopping behaviour and more. This could turn into a saviour, providing Slice and other companies deeper insights into customer engagements and could help the Bengaluru-based startup venture into secured lending by analysing transactional data.

“One has to understand that data is sacrosanct. This is an open secret that many internet firms, especially B2C companies, are engaged in selling data to third-party apps, fintech firms and other corporations,” another industry insider said.

However, data processing and sharing regulatory loopholes might not be around for much longer given that India is looking to make its data protection and storage laws more stringent in the near future. Plus, building a scalable fintech business just on top of transactional data is not viable in the long run.

In essence, Slice’s entire business model has been flipped upside down. Some companies including Jupiter and Lazypay temporarily paused BNPL services. UPI is just a band-aid, but Slice will need more.

“Investors need to be pacified and the regulatory clouds are hovering. UPI remains the safest bet as of now,” the insider quoted above added.

Fintech experts, we spoke to believe that many startups will eventually end up pivoting to full-fledged lending where the revenue model and profit path is relatively clearer and well established.

Bad debts and NPAs should ideally not pose a major challenge given that such formal lending businesses need more stringent risk assessment of borrowers. But then Slice will compete with big banks and other major digital lenders, where too it will have to spend to attract customers.

For now, it is a purely wait and watch game of whether startups such as Slice are able to convince authorities to bring some relief from the regulatory onslaught. Even if that comes along, the revenue model problems will not be overcome overnight and customer acquisition will still be a challenge given the intense competition, even if Slice pivots to full-fledged lending or bank-led BNPL.

Amid the global economic downturn and an intense focus on sustainability, it promises to be a stormy summer ahead for the Indian BNPL brigade. As the only unicorn to emerge from this segment so far, Slice’s future could very well determine the future of BNPL in India.

Update Note: July 14, 2022 | 17:50

- Added Slice and QFPL’s FY22 financials for the first nine months, ending December 31, 2021

Ad-lite browsing experience

Ad-lite browsing experience