After a watershed FY24, Zomato's quick commerce platform seems to have turned around its story and fortunes with a huge spike in revenue

Blinkit reported total revenue of over INR 2,300 Cr for the year, and is said to have turned adjusted EBITDA positive in March 2024

CEO Albinder Dhindsa said a large part of the outsized growth for Blinkit has come due to store expansion strategies with 75 net new stores added in Q4 alone

Exactly a year ago, we asked if food delivery can solve Zomato’s Blinkit problem — but now after a watershed FY24, the quick commerce platform seems to be the one doing the heavy-lifting for Zomato.

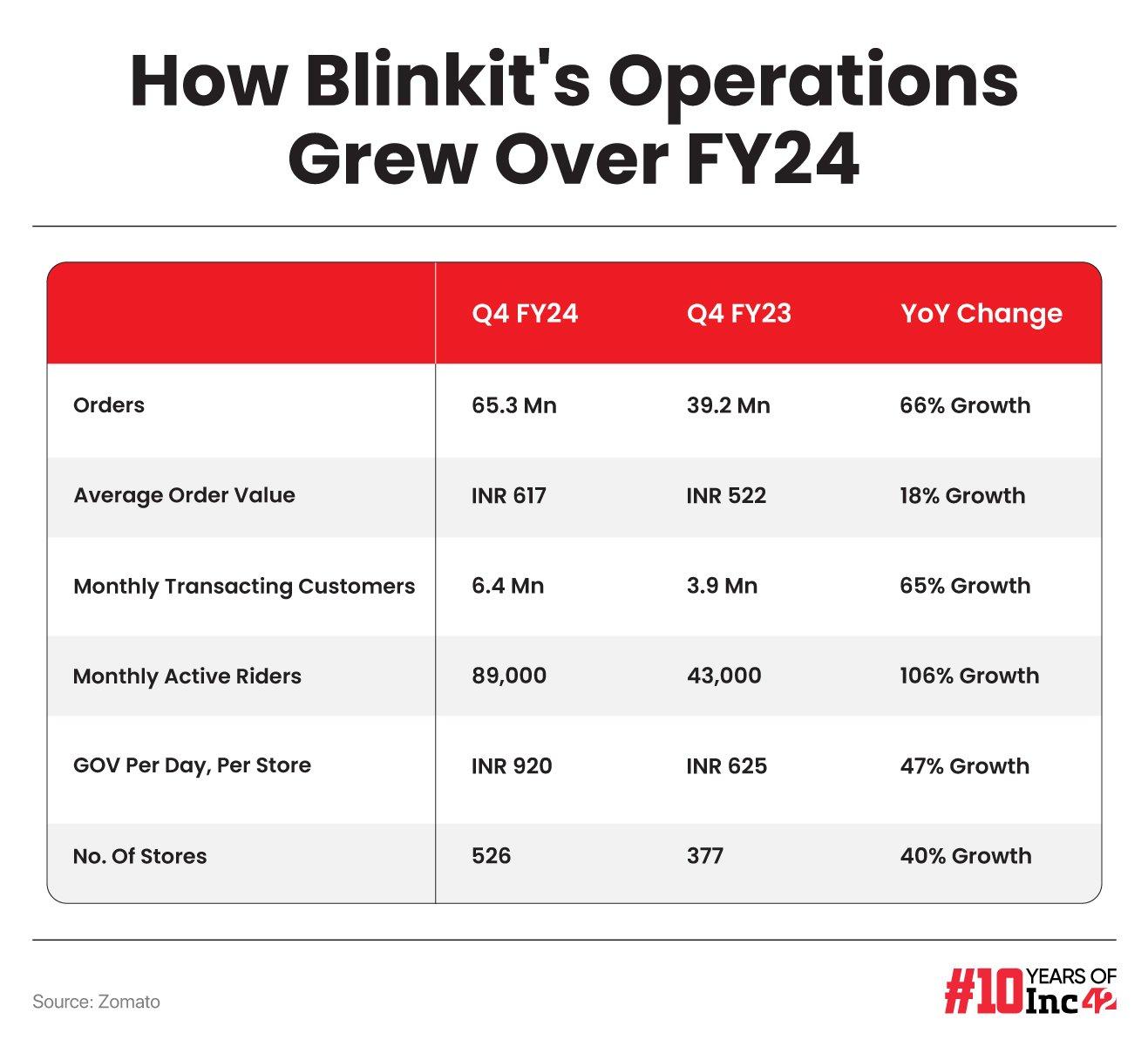

Here’s some perspective: Zomato’s food delivery gross order value grew 28% year-on-year (YoY) and declined 0.6% quarter-on-quarter (QoQ), whereas quick commerce GOV almost doubled on a YoY basis and saw a sharp 14% sequential jump.

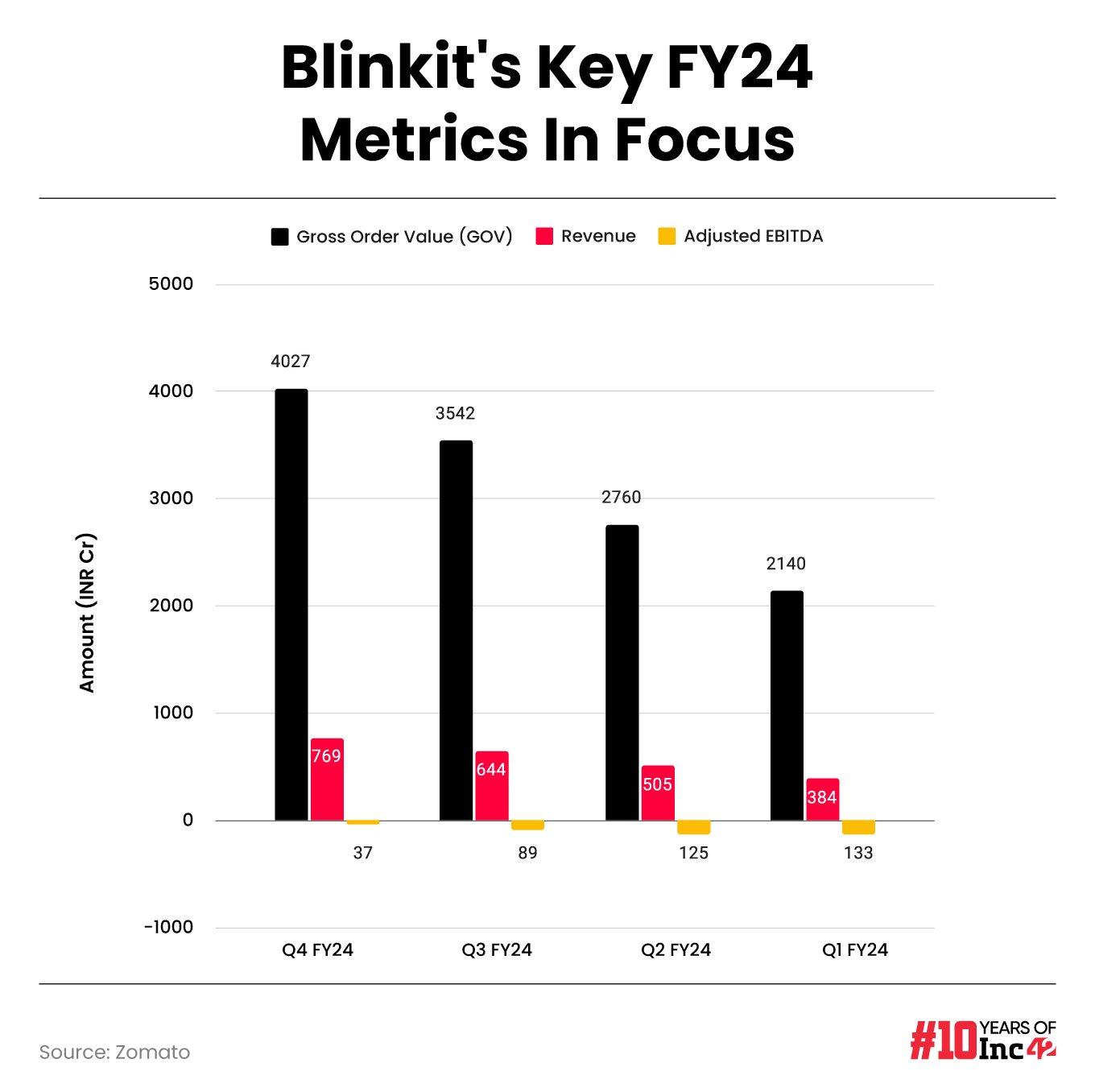

While Blinkit’s revenue for the full FY24 was over INR 2,300 Cr, its GOV or gross order value soared 97% year-on-year (YoY) to INR 4,027 Cr in the quarter ended March 2024.

The quick commerce platform clocked revenue of INR 769 Cr in Q4 FY24 as against INR 363 Cr in the year-ago quarter and INR 644 Cr in Q3 FY24. Importantly, Blinkit turned adjusted EBITDA positive in March 2024, right as it exited FY24.

Beyond the numbers, the focus on Blinkit was clear from the fact that Zomato’s now-signature ‘Shareholders’ Letter’ was largely dedicated to the quick commerce vertical. Blinkit cofounder and CEO Albinder Dhindsa and Zomato cofounder and CEO Deepinder Goyal took turns in celebrating the milestones for the platform over the past year.

While Dhindsa spoke about the growing network of stores in key markets, CEO Goyal pointed out that the Blinkit deal was critical for the company, even though it may have seemed like a risky one at the time of acquisition.

“When we acquired Blinkit, we outlined that one of the key reasons to acquire the business was to defend the food delivery business, because a well entrenched quick commerce player could pose an easy threat to the food delivery business in the long term,” Goyal wrote in the letter.

Expanding The Blinkit Network

Even though Blinkit is a small part of Zomato’s large empire, contributing just under 20% to the total revenue in FY24, this share has grown from 11% in FY23.

Plus, in terms of standalone revenue, its growth outpaced food delivery on a YoY basis as well — 186% YoY growth for Blinkit vs around 40% for the food delivery platform.

A large part of this outsized growth for Blinkit, Dhindsa said, has come due to store expansion strategies. “In Q4FY24, we added 75 net new stores taking our total store count to 526. For comparison, this is more than the number of stores we added in the three preceding quarters cumulatively,” the Blinkit CEO added.

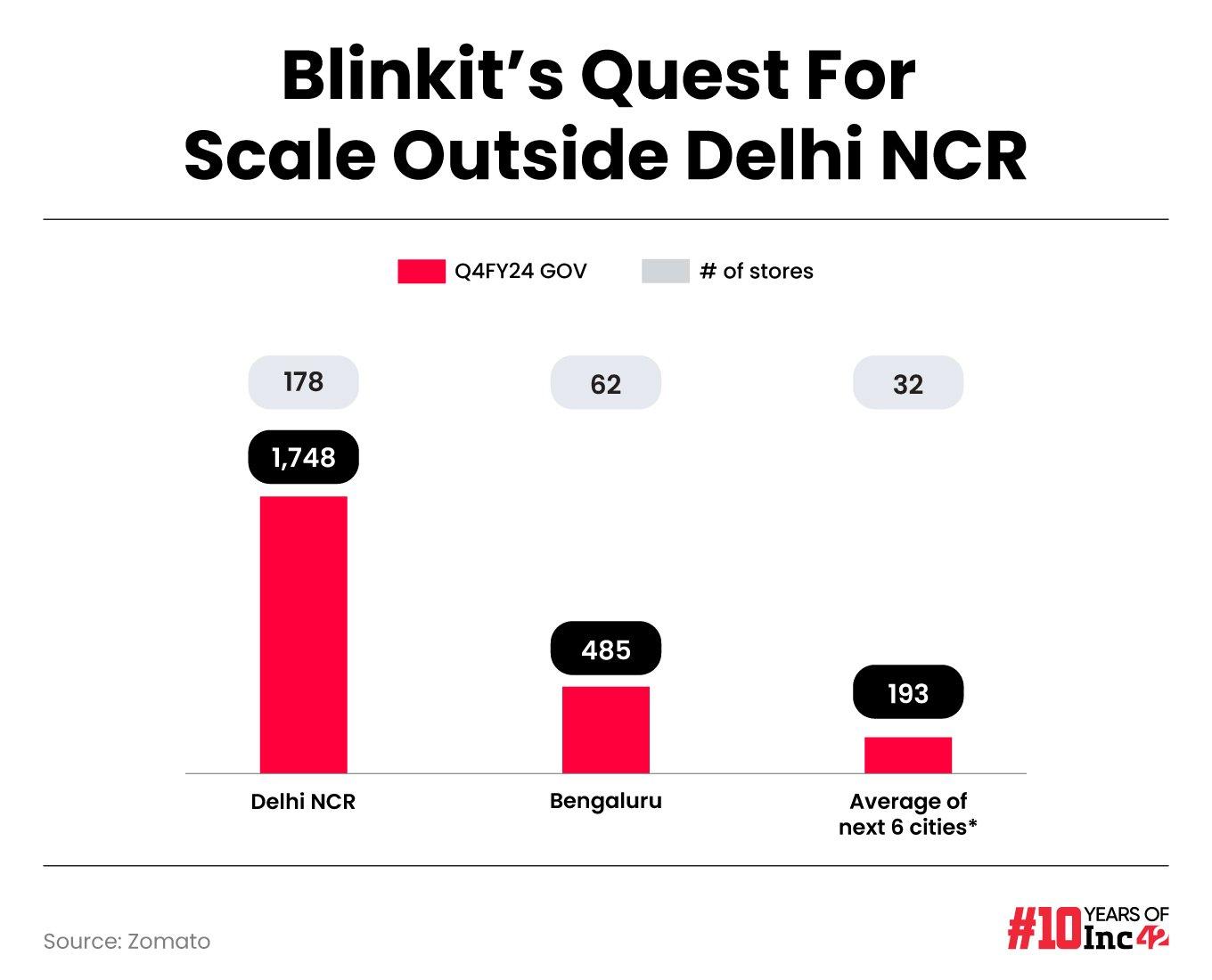

A majority or 80% of the new stores in Q4 FY24 were opened in the top eight cities for the platform, with Delhi NCR seeing the most investments in terms of store expansion. Delhi NCR is also the biggest contributor to Blinkit’s GOV and revenue, and well ahead of the other 25 cities that Blinkit currently has a presence in.

The addition of new stores allows the platform to reach more customers and be more consistent in terms of the product, irrespective of the location the customer is ordering from — this is linked to the baseline service expectations for quick commerce, as Dhindsa further explained in the letter.

The GOV for Bengaluru, Blinkit’s second largest market, is less than 30% of Delhi NCR’s GOV. The company said that it will look to get Bengaluru and other large cities such as Mumbai and Hyderabad to the same penetration levels as Delhi NCR, both in terms of store footprint and GOV.

Bengaluru, Blinkit’s next big target, is incidentally the home ground for Zomato rival Swiggy. Now, as Blinkit gears up to fight Swiggy Instamart on its home turf, it will certainly add an interesting dimension to this rivalry.

In the ongoing quarter (Q1 FY25), Blinkit is looking to add another 100 stores and reach a base of 1,000 stores by the end of FY25. Despite the planned store expansion spree, Blinkit said its overall adjusted EBITDA is likely to hover around breakeven for the next few quarters.

New Categories Pay Off

One of the reasons for the EBITDA improvements is the higher average order value and improvements on the unit economics front in terms of delivery fees, platform fees and other miscellaneous charges.

Zomato is also looking to broaden the focus area for Blinkit by adding more brands across new categories, in a bid to compete with ecommerce marketplaces like Amazon and Flipkart. Already, Blinkit is delivering products such as Apple iPhones, Sony PlayStation 5 consoles, electronic accessories and home appliances such as air coolers in a matter of minutes.

Blinkit is also selling gold coins, sunglasses, everyday apparel and kitchen appliances these days. In fact, the recently launched Zomato large order delivery fleet is perfectly suited for delivering such large products and packages in the future.

With 40% growth in the number of stores in FY24, Blinkit is now able to offer a wider selection of products to most of its users, Dhindsa added.

Besides this, the platform is looking to enable fast-growing direct-to-consumer (D2C) brands by building its own supply chain to directly source products as well as manage stock from new-age brands.

While quick commerce has become a major sales channel for D2C brands, the path is not exactly easy for newer brands. Blinkit is looking to enable these brands by leasing warehouses to increase their distribution footprint in key markets.

It’s not just Blinkit that has moved in this direction — Swiggy recently integrated Swiggy Mall into Instamart. However, Swiggy Mall, in terms of availability, is currently restricted to Bengaluru – its biggest market.

Blinkit, on the other hand, is looking at category expansion in most of its top markets, in addition to Delhi NCR.

Take, for instance, the recent introduction of air coolers on Blinkit, coinciding with summers in India. Besides Delhi NCR, Blinkit customers in Bengaluru and Hyderabad could also order the appliance and get it within 10-15 minutes. So Blinkit is jumping in with both feet when it comes to new categories, and it’s clearly making a difference in the number of daily orders as well as the average order value.

Service Reliability Makes A Difference

“In our case, we obsess about making our service reliable. Our investments (intellectual and financial) in the business are over-indexed to making our service more and more reliable. Reliability means a) availability of products at all times and b) quick and predictable delivery times,” Blinkit CEO Dhindsa said in the ‘Shareholders’ Letter’.

It’s hard to quantify reliability of a service, but Dhindsa went out on to list some of the operational parameters that are vital for quick commerce, and Blinkit seems to have passed the litmus test here.

The average delivery time for Blinkit was 12.5 minutes in the month of March 2024. Close to 75% of the orders were delivered within a two-minute window of the promised delivery times, while item fulfilment was higher than 99%, Dhindsa claimed.

“We believe that a business built on the back of great service quality is much tougher (and hence more defensible) than just offering lower prices (usually through unsustainable subsidies),” the CEO added.

But that does not mean that Blinkit is completely turning away from discounting. While some categories do have heavy discounts, the company is countering this with improvements on the unit economics front.

Blinkit’s Unit Economics Leaps

Dhindsa pointed out that the Blinkit’s “high quality of service results in higher customer willingness to pay us a delivery fee thereby leading to better economics.”

Blinkit added an INR 2 handing fee for every order, just like Zomato’s platform fees. This has undoubtedly led to improvements in the bottom line for the platform.

For context, the GOV-to-revenue ratio improved to nearly 20% in Q4 FY24, compared to around 17% in Q4 FY23. Besides, Blinkit’s adjusted EBITDA loss improved to INR 37 Cr in the March quarter from INR 89 Cr in the preceding quarter and INR 203 Cr a year ago.

These might seem like marginal improvements, but with scale, they can snowball into major contributors to Zomato’s overall profitability

Further, Dhindsa claimed that almost 100% of Blinkit’s orders in March 2024 had a “non-zero delivery fee with an average delivery fee per order of INR 20 (not including new customers).

What’s Next For Zomato’s Quick Commerce Bet?

One potential soft spot for Blinkit could be its weaker presence beyond Delhi NCR. The company has admitted that it needs to increase the penetration of its stores in Bengaluru, Mumbai and Hyderabad among other cities in its network.

Zepto is said to be inching forward in terms of market share and has the ability to raise fresh funds to expand rapidly. Swiggy is looking at an IPO in the next year or so, and is said to be in talks to raise fresh funding before the potential public listing. On the other hand, Blinkit can rely on some of Zomato’s cash reserves of over INR 12K Cr, for its growth push.

“In addition to scaling up the existing store network and use cases, we will be adding more use cases so that the Blinkit platform is even more useful in the everyday lives of our customers,” the CEO stated in the letter.

It will be interesting to see what these new additions will be — we have seen the company indicate that it might be venturing into home repair and other handyman services which would overlap with Urban Company. But this has not yet come to fruition.

Besides this, quick commerce rivals have experimented with delivery of packaged food and beverages, including Zepto Cafe and Swiggy Instacafe. While Blinkit has not yet revealed its plans in this regard, it will be interesting to see where the quick commerce platform goes in the year ahead.

There’s little doubt that FY24 has proven Blinkit’s potential to a large extent, but now it has to show that these improvements were not a flash in the pan.

Ad-lite browsing experience

Ad-lite browsing experience