A look at Zomato and Swiggy’s food delivery revenue games in light of potentially slow growth

There’s little doubt that Blinkit has become a rocketship for Zomato

But this Sunday, we wanted to focus on how Zomato became Zomato in the first place. That means food delivery and here, there’s been some discussion about food delivery in India hitting a wall.

The point being made is that outside of the metros and cities, growth for food delivery has been tepid and underwhelming. And that Zomato — and indeed Swiggy — will see slow growth in the near future as a result.

But this may be a bit of an exaggeration. In our opinion, it’s not that Zomato and Swiggy are hitting a wall, but it’s just that the road ahead is not paved. The question is can their existing businesses continue to hold good while they wait.

We’ll look at the food delivery revenue games in light of potentially slow growth, after a look at these stories from our newsroom this week:

- Blinkit Takes Off: After a watershed FY24, Zomato’s quick commerce platform seems to have turned around its story with a huge spike in revenue and a massive market opportunity

- Crypto’s Revival Story: After a decline in 2022 due to three black swan events, Indian crypto startups are now stepping up from recovery to growth phase. What explains this swing in the crypto fortunes?

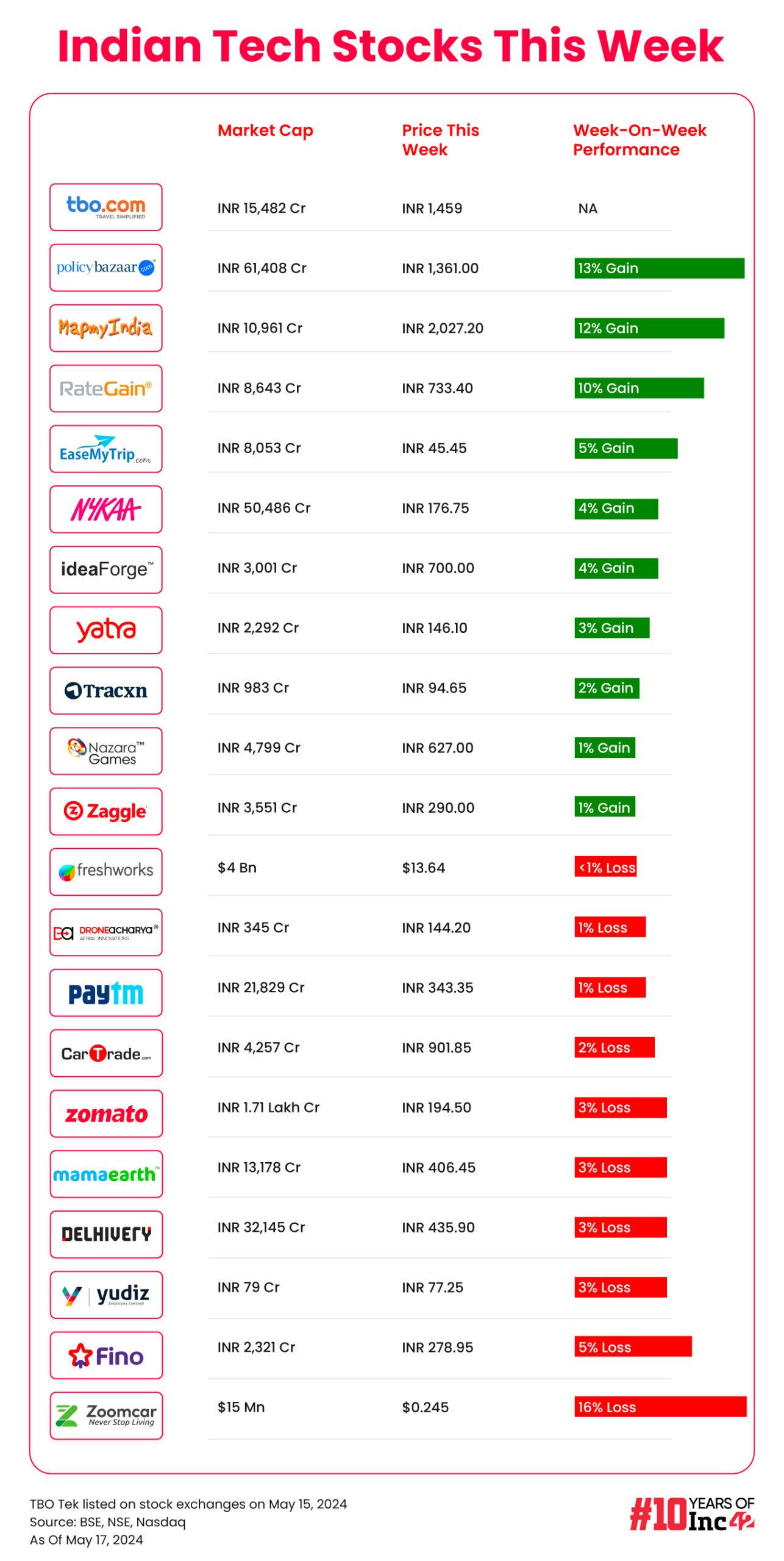

- IPO Season In Full Swing: it’s the season of Indian startup IPOs once again. Coworking startup Awfis’ public offering is all set for the coming week, following the bumper listing for TBO Tek and great response to Go Digit’s IPO.

Quick Commerce Vs Food Delivery

First, we need to understand why food delivery has seemingly taken a backseat. The answer is closer to home for Zomato and Swiggy than one might expect. It’s quick commerce.

Blinkit, Zepto and Swiggy Instamart have essentially replaced food delivery in the minds of many consumers.

Incidentally, the quick commerce growth has come in the same cities and regions where food delivery has dominated. The overlapping of these two models definitely seems to have had a worse impact on food delivery. After all, an average consumer is more likely to buy groceries twice a week than order in from Swiggy or Zomato twice a week. While food delivery is still considered discretionary spending, groceries are certainly not.

Plus quick commerce use-cases have widened in the past few quarters, making it more indispensable than food delivery in many cases.

In its Q4 FY24 results, Zomato revealed that quarter-on-quarter the food delivery business saw a decline in gross order value (GOV). This was expected because even in the previous fiscal year, Zomato’s Q4 GOV declined compared to Q3, which accounts for the peak business day of New Year’s Eve.

The near-instant availability of ready-to-eat products, coffee, salads and other grocery staples on Blinkit, Swiggy and Zepto has definitely grabbed a share of the consumer’s wallet in the past year.

As a result, Zomato’s food delivery gross order value grew 28% year-on-year (YoY) and declined 0.6% quarter-on-quarter (QoQ), whereas quick commerce GOV almost doubled on a YoY basis and saw a sharp 14% sequential jump.

Swiggy, which is expected to record revenue of over INR 10K Cr in FY24 as per sources, is also seeing greater acceleration on the quick commerce front. In fact, one could even say that quick commerce is changing how these companies are viewing delivery too.

Take for instance, Zomato’s large order food delivery fleet. This can easily be extended for larger orders on Blinkit, a trend that’s already gathering momentum. So in many ways, quick commerce is becoming the new face of delivery startups.

One could even imagine these as small Blinkit kiosks with a fixed inventory of the most purchased products or seasonal products, ready to go to the customer as soon as they place the order. Not too far fetched for Zomato or Blinkit, given recent experiments on both platforms.

Platform Fees Play Their Part

Despite a decline in orders, Zomato has managed to add to its profits significantly in Q4 FY24. Net profit grew 26.8% to INR 175 Cr in the quarter and the company attributed this primarily to higher average order value, improvement in take rate and ad monetisation, introduction of platform fee and cost efficiencies. “Together, these factors more than compensated for the lower customer delivery fee on account of the free delivery benefit on Gold orders”

It’s interesting that Zomato name-drops Gold here because as we see some benefits under Gold have been unbundled by the platform.

Zomato’s priority delivery service is one example of a Gold feature that’s been ported out for the wider consumer base. Of course, Zomato charges a platform fee per order as well, regardless of whether the consumer is a Gold subscriber or not. Depending on the restaurant, there may be a handling fee or a packaging charge as well.

More recently, there’s a surge fee, which has cropped up recently, particularly during peak lunch hours, where we have seen delivery fees as high as 5X a regular order. The fact is that food delivery as a service is much dearer for the average consumer than it was a year ago, and many might argue that it’s a worse experience than takeaways in some cities.

It will be interesting to see where Swiggy stands on these metrics when its FY24 numbers are released. With the Bengaluru-based delivery giant expected to hit the stock markets to take on Zomato later this year, analysts predict that both businesses will be more or less on par in terms of the revenue breakdown and unit economics.

Like its old rival, Swiggy has also relied on platform fees to increase its take rate from every order. Last year, cofounder and CEO Sriharsha Majety mentioned that the company is profitable on the food delivery front after excluding some one-time costs. But we do know that the company stands in losses as of December 2023.

Where Will Growth Come From?

So in light of the discussion of food delivery hitting a wall even as Zomato’s revenue has grown, it could be argued that perhaps the more affluent Indians who continue to use Zomato frequently are not averse to paying a little more.

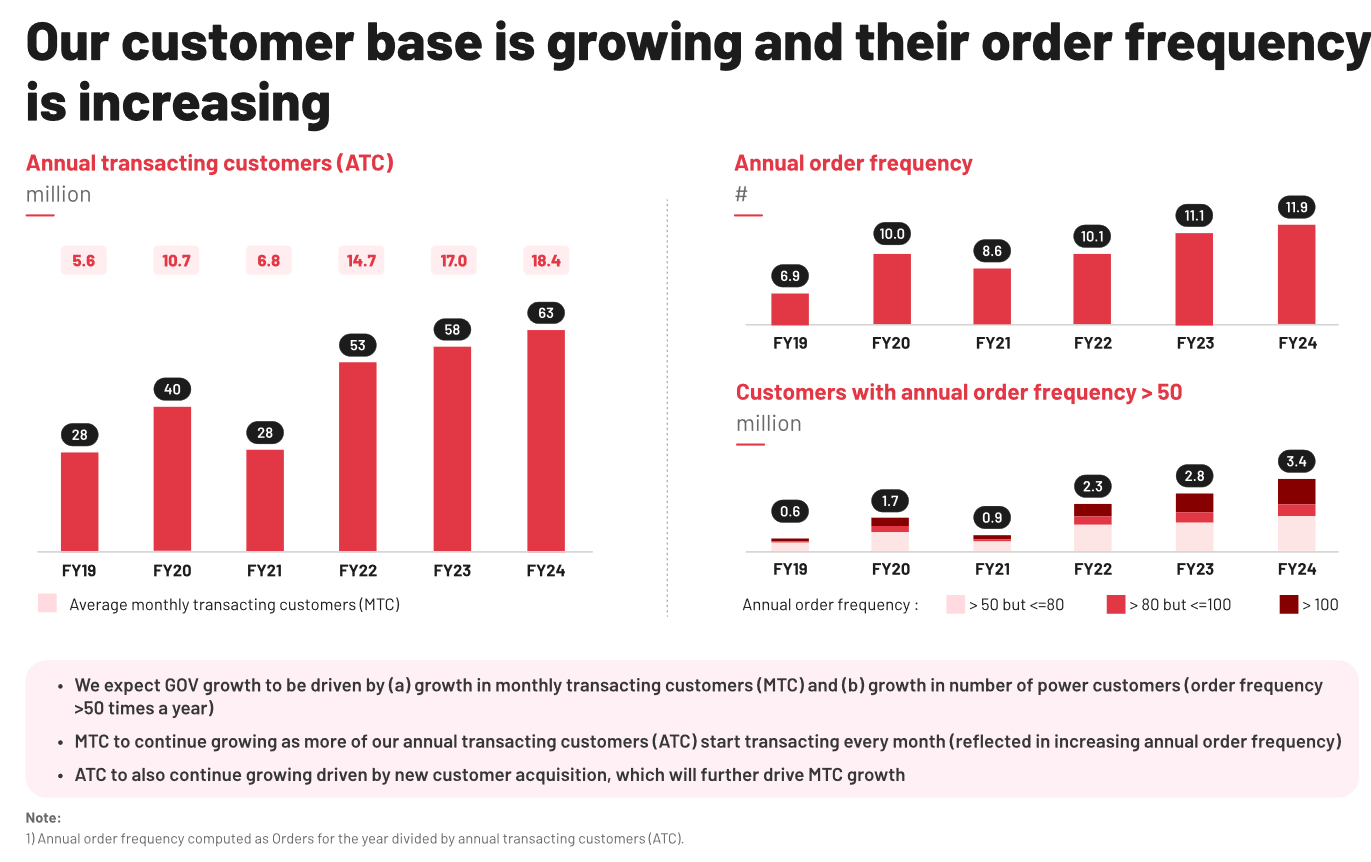

Zomato says that its monthly transacting customers (MTC) have grown in line with the overall growth in volumes at around 20%.

“We expect that as the business GOV continues to grow 20%+ (which we have guided on), that will likely be a combination of some AOV increase and order volume increase,” Zomato CFO Akshant Goyal claimed in an analyst call this week, adding that most of this growth is going to come from new customers joining the MTC base.

Beyond consumers, revenue growth for food delivery is also highly dependent on the growth in the restaurant business as well. Last quarter, Goyal told analysts that among new restaurants “a large chunk of what we are seeing as new restaurants today are cloud kitchens, at least on our platform”.

This makes sense given that the restaurant space has become highly competitive due to recent capital accumulation by some large players through public listings. This has pushed some of the newer entrants or brands out of retail spaces and into the territory of cloud kitchens. The lack of talent is another recent pain point for the retail restaurant industry.

Cloud kitchens are more important for Zomato because a lot of their spending goes to ads on platforms such as Zomato and Swiggy. Overall, Zomato has added 33% more monthly transacting restaurants in the past year. Creating an ad platform that works is critical for Swiggy and Zomato to keep its flywheel running and attract more restaurant partners.

Swiggy And Zomato’s Parallel Lives

When we talk about food delivery, the challenges and the opportunities are as applicable for Swiggy as they are for Zomato. Even though Zomato and Swiggy seem to be such strong rivals, the companies move in parallel tracks more or less. Zomato all but admitted that in the earnings call with analysts after the Q4 FY24 results.

When asked whether revenue growth for food delivery will come from the consumer side through more fees or restaurant side through ads, CFO Goyal insisted the company does not approach the business in a binary way.

“We think of it more in terms of optimising absolute profits in the business while providing the best experience to customers. And to be able to do that, these answers on economics keep changing. So, there is also an element of competition here and what they are doing and so on.”

The CFO clarified that Zomato doesn’t have a target on each of these line items such as take rates from consumers or ad sales. The goal is about meeting the margins targets.

In the FY24 annual presentation, the company boldly says, “investments in category creation now largely behind us” and talks about the progress in profitability, claiming that EBITDA margins on food delivery would remain around 4%-5% of the GOV in the medium term from the current 3.3%.

It’s taken nearly a decade for Zomato to get to the position where it can talk about margins not just notionally but actually have the numbers to back it.

Growth might be relatively slow compared to previous years, but in a market that is trending towards saturation, the winner is often the one that ekes out the most profit. Now it’s Swiggy’s turn to show its cards.

Sunday Roundup: Tech Stocks, Startup Funding & More

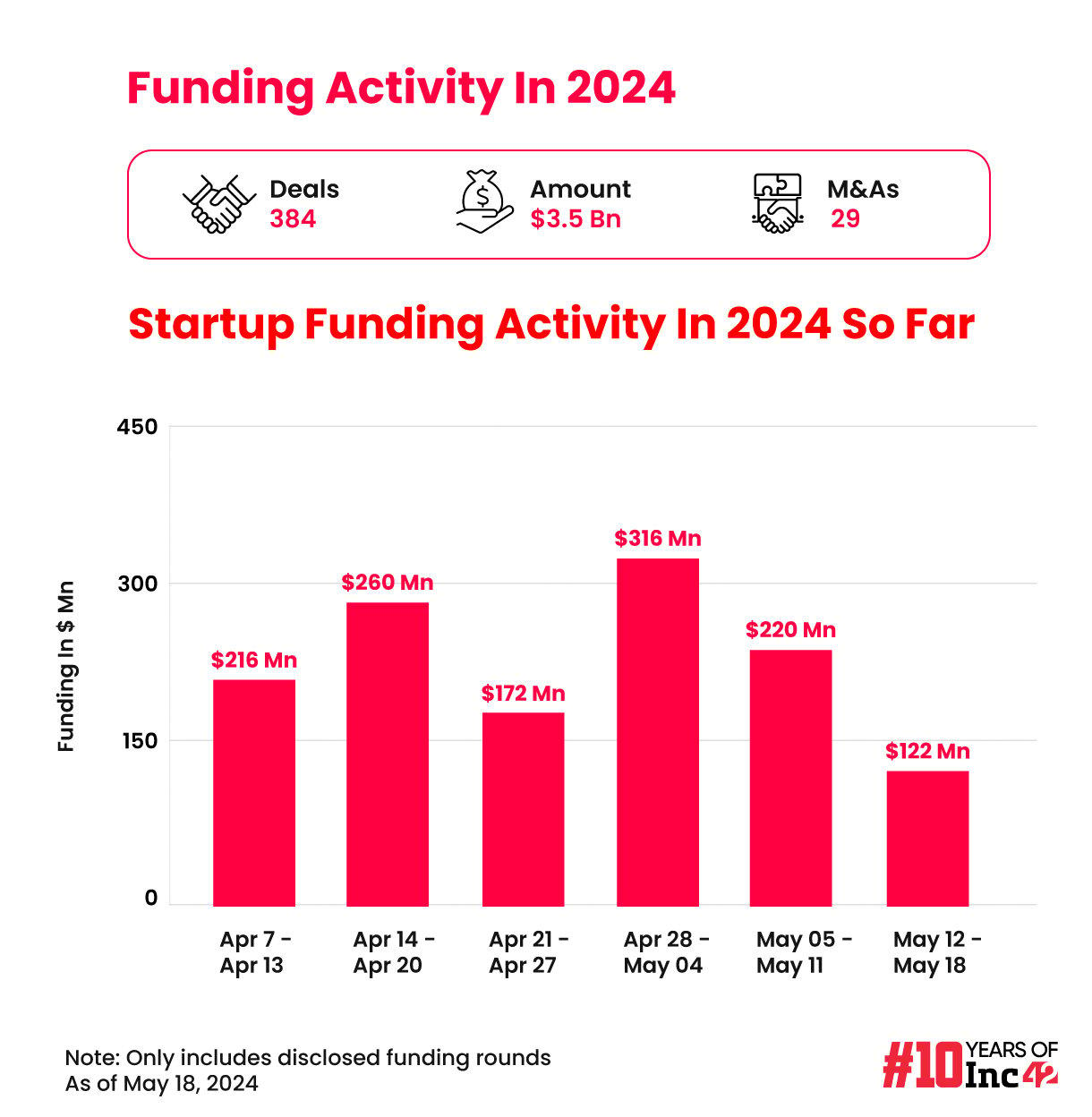

- Startup Funding Drops: Indian startups raised $121.8 Mn across 21 deals this past week, nearly half of what was seen in the week-ago period, and well below the recent weekly average tally

- Delhivery’s New Plans: Delhivery is looking to expand into drone manufacturing and freight air transportation services; after reporting EBITDA profitability in in FY24

- OYO One Step Closer: SoftBank-backed OYO is reportedly preparing to refile the draft papers for its potential IPO as the company is close to finalising its debt refinancing plans

- Zoho Enters The Game: Zoho is reportedly looking to enter the semiconductor space and is seeking approval to get incentives under the PLI scheme for a $700 Mn chip fabrication plant

Ad-lite browsing experience

Ad-lite browsing experience