Elevation Capital's Mayank Khanduja prefers to look ahead at the potential opportunity for Indian startups rather than get bogged down by the current economic downturn that's plaguing the tech ecosystem

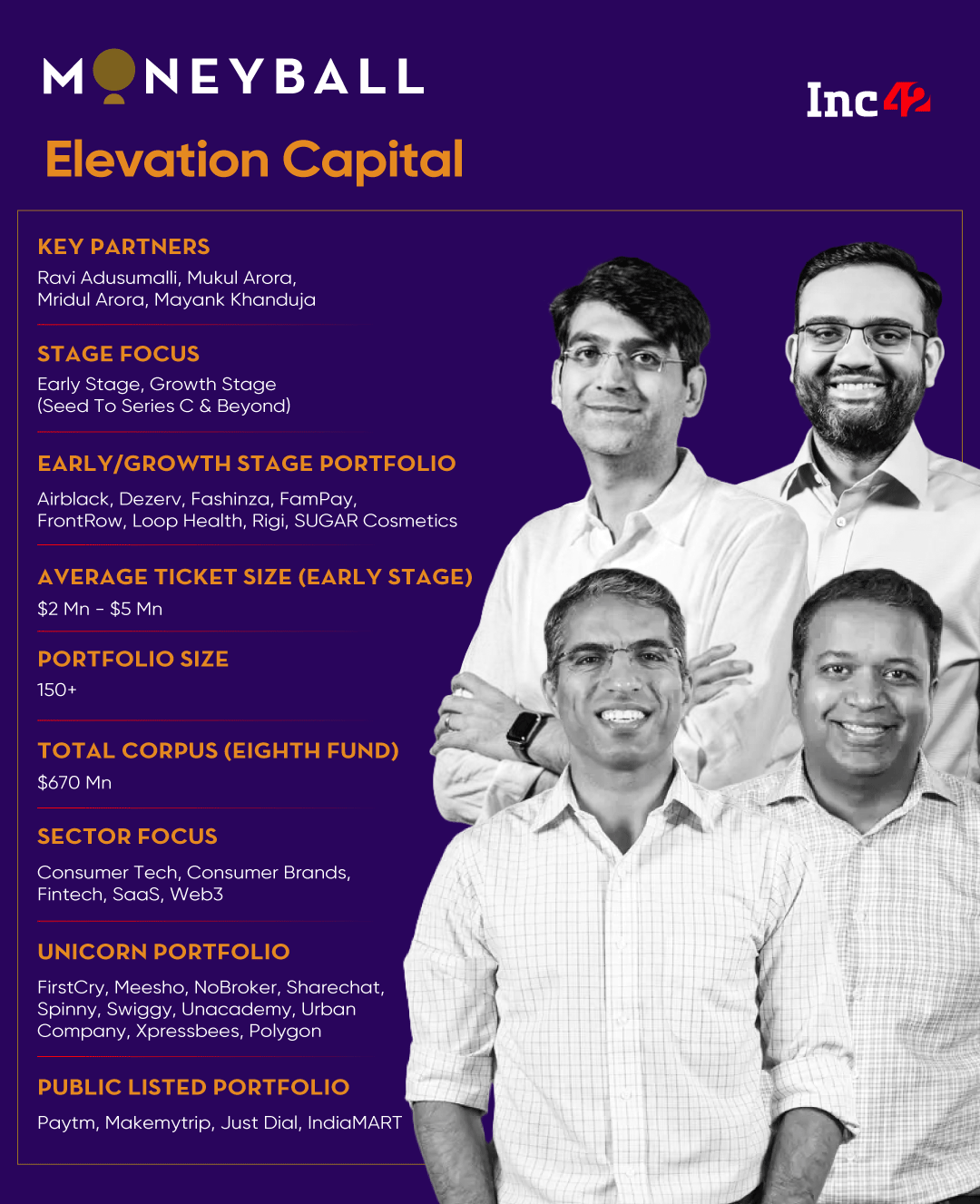

Elevation Capital raised its eighth fund for the Indian market with a massive corpus of $670 Mn in April 2022 and has backed the likes of Rigi, Bluelearn and Fashinza this year

Khanduja says that besides the emerging models around direct monetisation, the biggest positive of a downtun is that founders now know what it's like to build in a downturn

“We are all-in on India,” says Elevation Capital

But for Mayank Khanduja, a partner at Elevation Capital since 2020 and a key member of the VC fund since 2011, this sentiment is not about encapsulating the year that was 2022, but rather about looking ahead to how the Indian startups are poised to capitalise on the tech and economic opportunity in the next few years.

Of course, that opportunity comes with a caveat because while the scale of most Indian startups — particularly consumer-focussed startups — is huge, the consumer spending has slowed down quite a bit over the past couple of years.

For instance, market analytics company Fitch Solutions forecasts household spending in India to grow by a further 7.1% through 2023, which is down from the 10.1% growth in spending recorded in 2022. Consumer confidence is yet to return to pre-Covid levels and spending on big ticket items will likely be deferred for the next couple of fiscals, Fitch added.

Though the outlook might be bleak for now, it is the bright future that Khanduja and Elevation Capital are bullish about.

“We are at about $2,500 GDP per capita right now [$2250] and we’re getting closer to $3,000 rather than receding. At some point in time in the next few years, consumers will have a huge amount of disposable income and that is when discretionary spending will go up,” Khanduja told Inc42 in a recent interaction for the Inc42 Moneyball series.

As someone who watches over a portfolio ranging from content-led businesses, creator economy startups and social media companies born out of India — Sharechat, Loop Health, Airblack, Nobroker, Playsimple Games, Rigi, Turnip, Treebo among others — Khanduja has a ringside view of how this potential for discretionary spending growth will lift startups.

Earlier this year, Elevation Capital saw a part exit from XpressBees by selling a portion of its stake to Malaysian sovereign fund Khazanah for $40 Mn, besides investing in Rigi, Fashinza and Bluelearn.

Khanduja’s feeling is that the fortunes of consumer businesses are about to grow manifold because India is not even close to reaching that potential. And like most VCs, Khanduja and Elevation are not trapped in status quo thinking. The VC raised its eighth fund for the Indian market with a massive corpus of $670 Mn in April 2022.

The fund’s vision is beyond 2023, which shows why it led some of the biggest rounds in 2022, such as Country Delight’s INR 498 Cr (about $65 Mn) Series D fundraise and social commerce startup CityMall’s $75 Mn Series C. Without overlooking the current churn, Khanduja prefers to see how the slowdown has changed the Indian ecosystem for the better.

Edited excerpts…

Inc42: Elevation Capital has been a mainstay in the Indian startup ecosystem for more than a decade, currently in its eighth fund. Not many have seen the journey that you have. How would you say things have changed in the past couple of years with the market going up and down?

Mayank Khanduja: The biggest change is that new startups and particularly founders are seeing from the get-go what a down market looks like. And I mean it from the point of view of the last 16-18 months.

It’s easy to get bogged down that deal flow is slower but for investors the biggest takeaway is that founders now know that those days of free money just being thrown at them may take a long time to come back, if at all. So startups are looking to build a lot more prudently and this is not just about first-time founders. Even those in their second or third startup who may have seen the cycles know that this one is different.

In those good times (2021 and previous funding peaks), because capital was easily available, founders believed there was no downside. I think that mentality has gone away because easy capital is not coming in. So the quality of ideas, the quality of thinking has gone up, which is a great thing if you are a VC actively investing in 2023.

This fundamental shift means that even the smarted founders of an earlier vintage are going to frugal ways. The frugality sentiment is deeply rooted now.

Inc42: That seems obvious but it also curtails some of the expectations around growth right?

Mayank Khanduja: I can of course speak about our [Elevation Capital] portfolio and we are seeing that across stages – late or growth or early — founders realise the need to figure out a way to monetise smartly. They need to figure out the customer LTV, CAC and unit economics, even for mature products. Or the question of balancing capital and scale to break even.

Those are conversations that are happening fairly early in the journey which is great. But you also don’t want those things to become a part of a company very early. Because otherwise how will the company grow, right? So even if there are some investments that may not be profitable right now, there needs to be a path or a visibility for profitability. This has to be crystal clear and it cannot be pushed to the back burner like one might when capital is flowing in freely.

Inc42: Coming to the Elevation Capital portfolio and the startups you look into (see above), the monetisation models have proven to be very fickle. How do you see the content or creator space catching up with the times? For instance, do you think a slow monetisation model such as Sharechat would raise funds in 2023?

Mayank Khanduja: The biggest thing that has changed since ShareChat was launched way back in 2015 is not internet penetration or even the data usage. I feel that the biggest positive change is that monetisation pools have become very real.

Customers are willing to pay more money today than 2021 (when liquidity was at its highest) to consume content and startups don’t need to rely just on ad dollars. Anyway, ad revenue was never stable, so we feel that with ad dollars receding the direct monetisation emphasis has resulted in some interesting plays. And that’s how startups are catching up.

Microtransactions and direct payments from customers is a very real opportunity. Now coming to Sharechat. What the company has proven to the world is that you can build a very large revenue business in purely social media content from India. Earlier the question was can one even build revenue from this segment? But Sharechat has proven that it can also happen at scale, you can build a domain.

Now that is why the [monetisation] journey is shorter for many startups. Since we have seen some of the outcome from a revenue POV and how it could play out, the monetisation efforts have started happening a lot earlier for startups that have followed in the content space. So it’s just a better situation for these businesses.

Inc42: Surely, we’ll start seeing signs of subscription or microtransaction fatigue here too, potentially leading to consolidation? What is your view on building moats to protect monetisation from such attrition?

Mayank Khanduja: I always maintain that I like to back a customer-curious founder. I’m looking for someone who has spent a lot of time with their potential customers and they understand a few things. This is what gives them a right-to-win as many might say.

These are the founders who will get the user dollars — not everyone will get user money. The customer-curious founder figures out the current pain point through unique insights or understanding the contours of the problems and solutions that will be 10x better than existing alternatives.

At Elevation Capital, we believe that founders cannot answer these questions in isolation. Obviously we work with them, but they also should have spent a lot of time talking to potential customers or consumers. They should have done a lot of interviews with them. It would be great if the founder belongs to that customer group themselves in some form or shape, because then it is a very personal problem and it can be dealt with more intimately. Essentially, a founder has to put themselves in the shoes of the customer.

They will know something about the customer that I didn’t know before I met them and I walked out of that meeting, having learned something new, and that’s what we love to do at Elevation.

Inc42: Within your portfolio, how have startups adapted to the current market conditions, especially the ones that need to push for growth at all times?

Mayank Khanduja: Large majority of our portfolio companies had raised significant capital during 2020-2021 and yet, a lot of them decided to cut back on their burn when the capital markets indicated that it is time to build frugally.

Companies like Nobroker, Sharechat, Meesho, Urban Company, Sri Mandir and others ramped up their revenue trajectory significantly while controlling their costs. For example, Sri Mandir has started monetizing significantly even at their current scale, something which content businesses never did. This has made these businesses look even more attractive.

Inc42: When it comes to revenue projections and TAM sizing, are VCs taking a more sceptical view in 2023 as compared to 2020/2021?

Mayank Khanduja: Elevation Capital continues to remain bullish on India and believes that the TAM for a lot of these businesses will grow much faster than being projected. India is at the $2500-3000 GDP per capita range and after this level, the surplus in the hands of the users grows rapidly. This leads to even faster growth in consumption and investments creating a virtuous cycle. And as the country grows, tech businesses will capture disproportionate share of the incremental market share and market cap being created. Thus we believe India will see many more $5 Bn-$10 Bn companies coming out over the next 10 years.

Inc42: One of the key USPs for Elevation Capital has been the support that its portfolio companies get, from what we have heard in conversations with the founders. What are some of the processes or frameworks that Elevation has put in place in the past couple of years?

Mayank Khanduja: We have invested significantly over the last few years to build a distinctive platform for our portfolio companies wherein we bring in the best functional experts to them. We have a strong suite of specialists across talent, finance, legal, marketing, tech, corporate development and PR that work closely with our portfolio companies. Besides this, we have a strong network of experts across functions that we bring to them as and when the need arises through our platform called Elevation Stairway. And lastly we have a partnerships in place with all major SaaS and service providers to get the best deals and attention to our portfolio companies.

We believe that the founders should focus on building the best businesses and it is our duty as investors to not just give them capital but the best people support along with way. We as a fund pride ourselves in working in the trenches with our portfolio companies to help them achieve product market fit and market leadership.

Ad-lite browsing experience

Ad-lite browsing experience